Forex rebate calculator is a calculator in Forex trading which calculates how much money you can get back as a cashback from your trading activity.

Each trade you open costs some spread that brokers charge for their service. Small portion of that spread is returned back to you as a rebate or cashback.

Contents

What is a Forex Rebate Calculator?

You can use the rebate or cashback service over a third party company. That company is the middleman between you and your broker who returns you money back on each trade you open.

You know that each time you open an order you pay a spread cost. If your trade is positive or negative you will pay spread cost.

That means if you have positive trade or losing trade you can get money back if you use rebate service.

Cashback Calculator

The money you can get back is a rebate or cashback service who gives a portion of the money earned back to you.

Have in mind that the cashback calculator gives you an approximate value which depends on the rebate service provider.

And, the money you get back is not money you earn, but it is money you lower the cost of each trade you open.

Below you will see an example how rebate is calculated and how to use a Forex rebate calculator.

How to Use the Forex Rebate Calculator?

To define the rebate amount that you can get back, you need to define the pip value of the currency pair traded or instrument or symbol.

In the rebate calculator select the instrument and then deposit currency.

Then define the rebate per lot in pips or in currency. This allows the calculator to calculate the pip value in two different ways.

For example the cashback can be $1 per each traded lot or 1 pip per each trade.

Then one of the most important variables is the lot size or volume. Define what lot size you are using in your trade.

Click Calculate and you will get the value in the account currency.

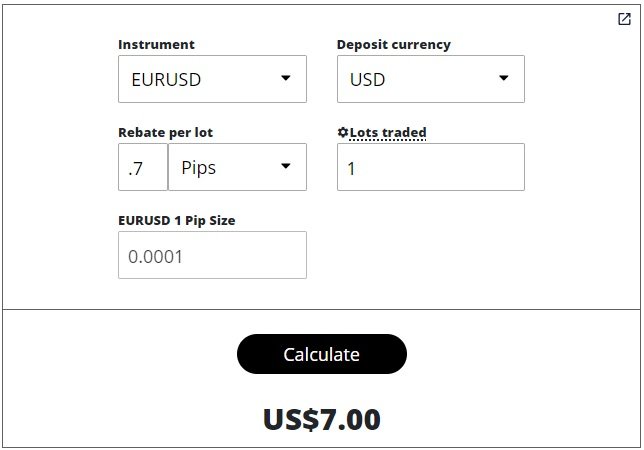

In this example you can see that I have used EURUSD currency pair with USD as a deposit currency.

I have defined that the rebate per 1 lot is 0.7 pips.

When you calculate the value of a one pip you get that for 1 lot you get $7.00 back on that trade.

Read more: Calculate Pip Value

How to Calculate Rebate

In the example from above you can see that I have:

- EURUSD

- 0.7 pips per lot

- Lot size = 1 lot

When you calculate pip value for EURUSD for 1 lot you get that 1 pip in EURUSD for 1 lot = $10.

So, if you have cashback defined as 0.7 pips per lot you get this:

0.7 pips/lot x $10/lot = $7

So, you end up with a $7 rebate for 1 lot traded.

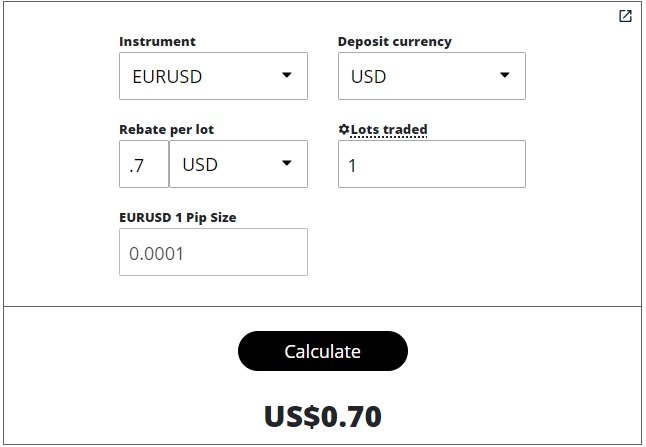

Let’s make another example where I will use USD as a rebate per lot.

In this example I have:

- EURUSD

- 0.7 USD per lot rebate

- Lot size = 1 Lot

Now I need to calculate the pip value for EURUSD. For 1 lot in EURUSD 1 pip is equal to $10.

If I have 0.7 USD per lot rebate that means I would get $0.7 if I trade 1 lot.

0.7 USD/lot x 1 lot = 0.7 USD = $0.7

Conclusion

You can see that rebates in forex are a great way to reduce the cost of trading. Rebate in Forex is not making money, but returning the cost the broker has taken from you when you open an order.

But, this way you can use a Forex rebate calculator to calculate how much you would get back as a cashback for your trading activity.

Check with the rebate providet what is the rebate amount per traded lot so you can see what will be the return on your trading activity.

0 Comments