- number of pips

- lot size used

- currency pair

- deposit currency

Why do you need GER30 pip calculator?

You can calculate the value for a number of GER30 pips. And that means for example if you have 100 pips as a stop loss or take profit set, then you can calculate how much that will be in terms of a currency you select.

How to use the GER30 pip calculator?

Inside the GER30 calculator you have several fields you need to fill with the data. And those are the number of pips, GER30 symbol, deposit currency and lot size. At the end you click the button Calculate and you get the value of GER30 pip.

In this article I will show you all details you need to know about GER30 pip calculator and what you can get with using it, why you should use it to speed up the process of calculating pip value and how to use it so you do not get confused when looking at pip calculator.

Read more: What is Pip Calculator

Contents

GER30 Pip Calculator Example

The best way to explain how the GER30 calculator works is to show an example. I will make a few examples so you can see the difference in calculations.

NOTE: Very Important

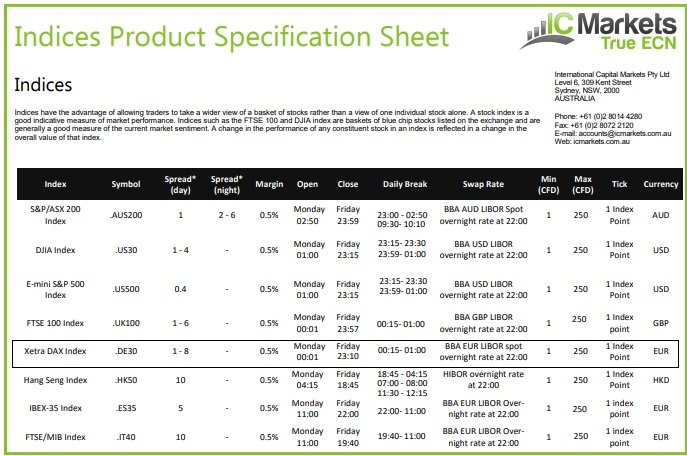

When trading GER30 or Indice like S&P500 it is important to know what is the contract size on trading platform.

What contract size means?

In Forex when you check the contract size it says that one standard lot is 100,000 units of base currency. So, the contract size for 1.0 lot is 100,000.

In Indices like GER30 the broker will define what the contract size will be on the trading platform. So, they can define a contract size of 1.0 in MT4 not to be 100,000 units, but for example:

- 1.0 = 100 units or

- 1.0 = 1.00 units

So, when you make calculation of a pip value on GER30 or any other Indice where 1.0 is not equal to 100,000 units then you need to pay attention to this.

Let’s say a broker defines that the contract size is 1 unit. That would mean that 1 standard lot if you are trading in MT4 this would be

Volume = 1.0 = 1 unit

inside trading platform.

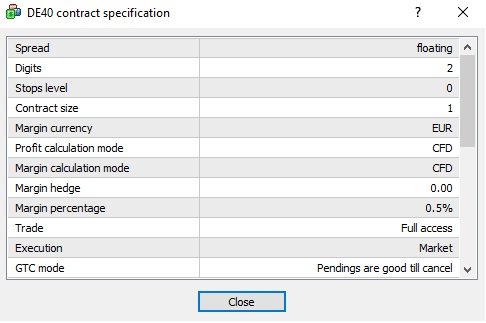

Second way how to define what is your broker contract size for the GER30 is to go into the trading platform, MT4 or MT5, and then find the symbol under the Market Watch window with symbols list.

Click the right mouse button on the GER30 and select Specification. This will open new window where all details for GER30 symbol will be.

You can see what is the Contract size and what is minimal volume available for trading.

For the GER30 the contract size is 1 which means 1 unit for a volume of 1.00.

This means 1 standard lot inside the MT4 will be 1 unit of a base currency and that is GER30.

- Number of pips: 1

- Instrument: GER30

- Lot size: 1.00 (100,000 units)

- Deposit currency: GER30

- GER30 pip size: 0.01

Second example is when you have GER30 currency pair with USD as a deposit currency and contract size is 100,000 units:

- Number of pips: 1

- Instrument: GER30

- Lot size: 1.00 (100,000 units)

- Deposit currency: USD

- GER30 pip size: 0.01

You can see that here you have examples where one contract is equal to 100,000 units, and not to 1 unit like IC markets broker has defined.

Here is an example how this would look with IC markets:

- Number of pips: 1

- Instrument: GER30

- Lot size: 1.00 (1 unit)

- Deposit currency: USD

- GER30 pip size: 0.01

How to Calculate Pips for GER30

To calculate pips for GER30 you need to use following formula which defines the pip value:

For deposit currency which is equal to base currency, GER30 :

Pip value = (Pip / Current market price) x Lot size

For deposit currency which is equal to quote currency, USD:

Pip value = Pip x lot size

GER30 Pip Value

Now with the formula you have you need to use the first formula where the deposit currency is GER30 .

Pip Value for Base Currency

For deposit currency which is equal to base currency, GER30 , pip value will be equal to:

Pip value = (Pip / Current market price) x Lot size

Here are other data you need:

- Number of pips: 1

- Instrument: GER30 = 13,058.60

- Lot size: 1.00 (100,000 units)

- Deposit currency: GER30

- GER30 pip size: 0.01

Now, when you put all the data in the formula you get:

Pip value = (Pip / Current market price) x Lot size

Pip value = (0.01 / 13,058.60) x 100,000

Pip value = (7.65e-5) x 100,000

Pip value(GER30) = 7.65

What you can see here is that the value of a pip in GER30 is equal to 7.65. But, the problem here is that your account deposit currency cannot be in GER30 . That means you cannot open a trading account with GER30 by investing GER30 as a currency.

To avoid this you would open a trading account with USD as a deposit currency. In that case you would use following calculation.

Pip Value for Quote Currency

For deposit currency which is equal to quote currency, USD, pip value will be equal to:

Pip value = Pip x Lot size

Here are other data you need:

- Number of pips: 1

- Instrument: GER30 = 13,058.60

- Lot size: 1.00 (100,000 units)

- Deposit currency: USD

- GER30 pip size: 0.01

Now, when you put all the data in the formula you get:

Pip value = Pip x Lot size

Pip value = 0.01 x 100,000

Pip value = $1,000

No matter what is current market price, if your quote currency (GER30 /USD), in this case is USD is equal to account deposit currency and that is USD, the value of a GER30 pip will be equal to $1000.

And the condition is to use standard lot size, 100,000 units of base currency or 1.00 Lot.

Pip Value for Third Currency

Third case is when you have a GER30 symbol, but the deposit currency is EUR. Which is not GER30 or USD.

This case requires that you make more calculations. If you use the GER30 calculator then the whole calculation is done by the pip calculator.

But, if you want to do it manually, then you need to use the following process.

First:

- decide in which currency you will calculate the pip value. Will that be GER30 or USD

Let’s use USD. The reason why to use USD is because we will ned EUR/USD pair price from the market to calculate GER30 pip value in EUR.

If we would use GER30 then we would need to find the GER30 in EUR price which is not available online easily. Or we would need to make more calculation to get GER30 pip value in EUR. And to do that it would make a lot of confusion for you.

The formula for the pip value will be:

- Number of pips: 1

- Instrument: GER30 = 13058.60

- Lot size: 1.00 (100,000 units)

- Deposit currency: USD

- GER30 pip size: 0.01

Now, when you put all the data in the formula you get:

Pip value = Pip x Lot size

Pip value = 0.01 x 100,000

Pip value = $1,000

Second:

Now, you need to use the EUR/USD currency pair so you can extract EUR pip value from it.

Current market price for the EUR/USD = 1.09112. Which gives us EUR = 1.09112 USD.

This is the same as 1 EUR = 1.09112 USD.

So, the formula would be:

Pip value (EUR) = Pip value (USD) x (1/ EURUSD)

Pip value (EUR) = 1000 x (1 / 1.09112)

Pip value (EUR) = 1000 x 0.91649

Pip value (EUR) = 916.49

Pip Value for IC Markets Case

For deposit currency which is equal to quote currency, USD, pip value will be equal to:

Pip value = Pip x Lot size

Here are other data you need:

- Number of pips: 1

- Instrument: GER30 = 13058.60

- Lot size: 1.00 (1 unit)

- Deposit currency: USD

- GER30 pip size: 0.01

Now, when you put all the data in the formula you get:

Pip value = Pip x Lot size

Pip value = 0.01 x 1

Pip value = $0.01

No matter what is current market price, if your quote currency (GER30/USD), in this case is USD is equal to account deposit currency and that is USD, the value of a GER30 pip will be equal to $0.01.

And the condition is to use standard lot size, 1 unit of base currency or 1.00 Lot.

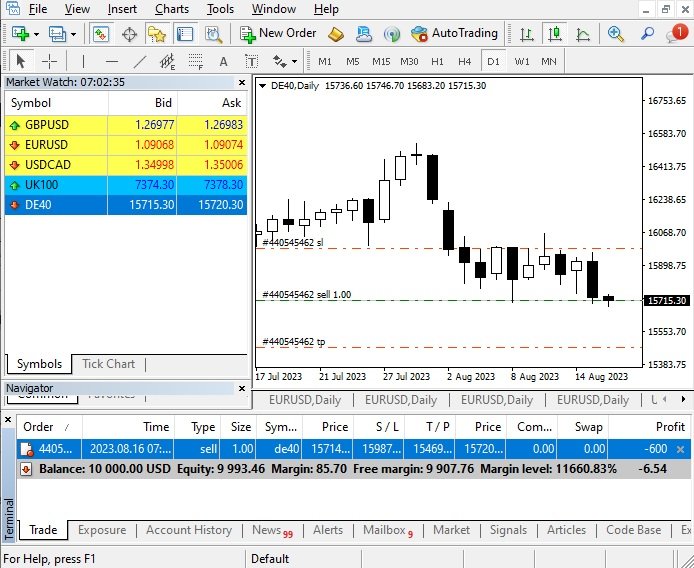

Here are all details about the open order:

- Currency pair: GER30

- Deposit currency: USD

- Lot size or Volume: 1.0

- Entry price: 15714.00

- Current market price: 15720.00

- Pip difference between entry and current price: 600 pips

So, I have open sell order where the current profit is 600 pips.

In the image you can see that the current loss is equal to $6.54.

Let’s calculate GER30 pip value for this example.

Here are other data you need:

- Number of pips: 1

- Instrument: GER30 = 15720.00

- Lot size: 1.00 (1 unit)

- Deposit currency: USD

- GER30 pip size: 0.01

Now, when you put all the data in the formula you get:

Pip value = Pip x Lot size

Pip value = 0.01 x 1

Pip value = $0.01

Pip profit or loss is equal to:

Pip profit/loss = $0.01 x 600 pips

Pip profit/loss = $6.00

Because my trade has profit 6000 pips this would be -$6.00 of profit.

This is the way how you calculate GER30 pip profit in case of IC markets with 1 unit of standard lot where contract size is 1 unit.

Have in mind that we here have a -$6.54 and not -$6.00.

The reason is that in the calculation you use US dollar.

But, in the specification sheet GE40(and GE30) indice is calculated in EUR. That means the price you see on the chart is in the EUR.

To calculate the price in the US dollar you need EURUSD price which is currently 1.09131.

So, the calculation of the GE40(GE30) in US dollars would be:

Pip value = Pip x Lot size x EURUSD

Pip profit/loss = $0.01 x 600 pips x 1.09131

Pip profit/loss = $6.54

How Do You Calculate GER30 Pip Profits?

With the above calculated you can calculate GER30, pip profit.

Let’s say you have an open SELL order on the market with the GER30 = 13,057.10.

And you want to close the trade at GER30 = 13,050.10.

The price difference in pips is:

Pips = |Entry price – Exit price|

Pips = |13,057.10 – 13,050.10|

Pips = 7.00 = 700 pips

You can see the difference is 700 pips between open and close price.

Pay attention to this when you make manual calculation.

Now, the profit for 700 pips is:

Profit = Pip value x Pips

Profit = $0.01 x 700

Profit = $7.00

If you want to use USD as a deposit currency then:

Profit = Pip value x Pips x EURUSD

Profit = 0.01 x 700 x 1.09131

Profit = 7.64 EUR

0 Comments