Synthetic indices Lot Size Calculator is a calculator in Forex that gives you a value of a lot you open with a trade defined by you with the acceptable risk and trading account size.

Read more: What is Lot Size

This means you can define how much money you are willing to risk per trade. And to do that you define risk which is the number of pips also known as Stop Loss.

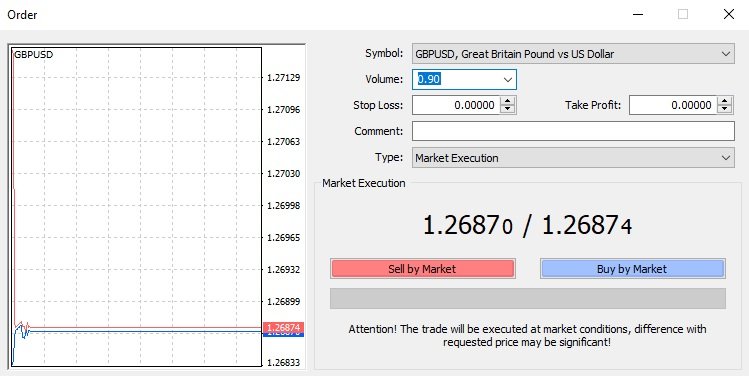

This calculator helps you easily define what volume or position size you need to enter into the window for Volume when you want to open new trade.

And what is the best it automatically populates contract size and pip size for Deriv symbols. That means you have Deriv lot size calculator.

Read more: Forex for Beginners

Contents

Synthetic Indices Lot Size Calculator

Lot size calculator have several fields that needs to be entered in order to calculate lot size:

- Instrument

- Deposit Currency

- Stop Loss

- in pips or in money

- Account Balance

- Risk per trade

These fields you need to enter to calculate lot size.

When you do that you get the result as:

- Lot size

- the lot size you need to enter into the Volume field inside new order window

- Units (trade size)

- number of units of base currency. For Forex currency pairs you have 100,000 units for 1 lot

- For Deriv broker you have symbols automatically populated with contract size and pip size

- Money at Risk

- How much money you are risking with the lot size calculated

Deriv Position Size Calculator

Synthetic indices position size is also called lot size because position or lot is the same. Lot defines how many units of base currency you will use and position tells you how large the volume you will use.

When you use volume and number of units into the calculation it is the same variable we are talking about.

So when calculating the lot size of a trade you are calculating position size.

How to Use Synthetic Indices Lot Size Calculator

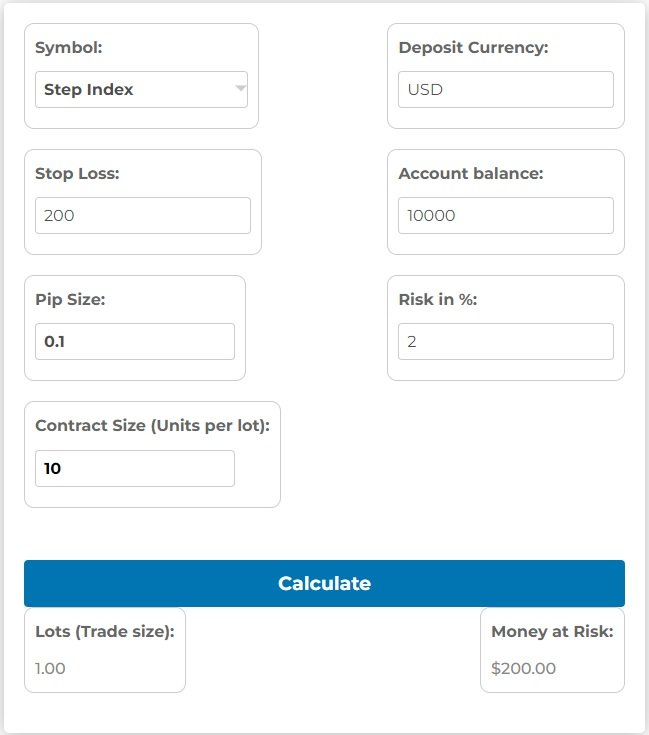

In the example above you can see that I have defined all variables inside lot size calculator:

- Instrument: Step Index

- Deposit Currency: USD

- Stop Loss (pips): 200

- Account Balance: 10,000

- Step Index 1 Pip Size: 0.1

- Risk: 2%

- Contract size(Units per Lot): 10

These are variables that you need to define:

- Instrument: Step Index

- Deposit Currency: USD

- Stop Loss (pips): 200

- Account Balance: 10,000

- Risk: 2%

The Step Index 1 pip size and contract size is already defined by the Forex instrument.

Read more: Calculate Pip Value

Calculate Deriv Step Index Lot Size

The Synthetic indieces Lot size calculator takes these values and first calculates the Lot size needed to be used in order to get risk to 2%.

Risk = 2% out of $10,000 = $200

Stop Loss = 200 pips

Pip value = $1 per 1 lot

Stop Loss in $ = 200 pips x $1 = $200 per 1 lot

Read more: Step Index Pip Value Calculator

Now, we have a $200 stop loss if we use 1 lot.

This is how we have lot size calculated in this example.

Calculate Units (trade size)

When you have Lot size = 0.1 this is easily converted to the number of units.

1 Lot = 10 units of base currency.

0.1 lot = 1

And this is how we got the number of units for the 0.1 lot.

Conclusion

Synthetic Indices Lot size calculator or Position size calculator are the same calculators in Forex trading.

Lot size calculator gives you needed lot size to open an order defined by the risk and stop loss level. As an additional result you get what is the lot size in the number of units and what is money at risk.

This is one of the best tools in trading you will need because proper risk management is very crucial in trading.

Learning Forex basics terms is very important to understand the basics so you do not end up making mistakes at the very first beginning.

0 Comments