Volatility 50 Pip Calculator is a Forex calculator that calculates the value of a pip for synthetic indices called Volatility 50 Indice or Volatility 50 index.

The Volatility 50 calculator requires these values in order to calculate pip value:

- Volume

- Contract size

- Tick size

Additionally you can enter the entry price, stop loss and take profit to calculate stop loss difference and take profit difference.

If you are a trader that wants to calculate the risk on each trade you can enter here order details and calculate how much you would lose and make profit if you trade Volatility 50 index. This will help you define correct entry and exit levels according risk management.

Contents

- 1 Volatility 50 Pip Calculator

- 2 What is a Pip and Why is it Important in Trading?

- 3 Understanding the Pip Value for Volatility 50 Index

- 4 How to Calculate Pip Value for Volatility 50 Index

- 5 Example Pip Calculations for Volatility 50 Index

- 6 Tips for Improving Your Volatility 50 Index Trading with Pip Calculation

- 7 Conclusion: Mastering Pip Calculation for Successful Volatility 50 Index Trading

Volatility 50 Pip Calculator

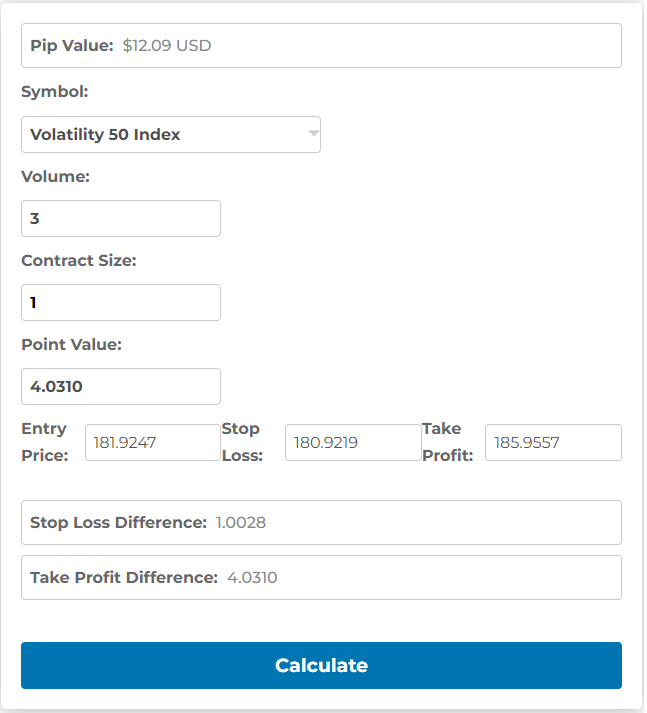

At the beginning of the page you have a Volatility 50 pip calculator where the symbol is defined. You have drop down menu to select the symbol which will automatically populate following values:

- Contract size

- it is defined as 1

- Point Value

- it is defined as 0.0001

These predefined values are for Deriv broker. It is a broker that has a majority of synthetic indices for trading.

What is a Pip and Why is it Important in Trading?

When you trade the Volatility 50 index you need to calculate the stop loss and take profit. That way you will know how much you can lose or make per trade.

In order to calculate stop loss and take profit for Volatility 50 you need to know how much pips you want to set stop loss and take profit.

For example if you put:

- Stop Loss = 50 pips

- Take Profit = 150 pips

you need to know how much money that would be.

Now, to calculate how much money would be stop loss and take profit you need to know how much is 1 pip.

When you know how much is 1 pip for Volatility 50 you can easily calculate stop loss and take profit:

- Stop Loss = 50 pips x 1 Pip value

- Take Profit = 150 pips x 1 Pip value

Let me explain to you the pip value for Volatility 50 index.

Understanding the Pip Value for Volatility 50 Index

Volatility 50 index pip value is determined by a few variables. Those variables are:

- Volume

- Contract size

- Point value

The formula for the pip value is following:

Pip value = point value × volume × contract size

You enter these three values and you get the pip value for Volatility 50.

But, if you do not want to manually calculate pip value then you can use the Volatility 50 pip calculator that will do this for you.

You need to enter the:

- Symbol – pick the symbol you want to use in calculation

- Volume – enter the volume. This is a lot size that can be from 0.01 up to some value. Have in mind that minimum and maximum value is defined by the broker

- Contract size – this represents the number of units and it can be different for each of symbols you use. This can be from 1 up to some value. This value is defined by the broker

- Point Value – this is the pip on the trading platform you use. The pip can be defined as 0.01 or 1.00. This is also defined by the broker you are using

Now let’s go and see how to calculate pip value for the Volatility 50 index.

Volatility 50 Index

Pip value details- Contract size: 1

- Volume min.: 3

- Volume max.: 1000

- Point value: 0.0001

- Pip value: $0.0001

How to Calculate Pip Value for Volatility 50 Index

Calculate pip value for volatility 50 index by using this formula:

Pip value = point value × volume × contract size

or you can use a pip calculator.

You can see that the formula requires three values and those values are defined by the broker you are using.

Contract size represents the number of units and usually this is set to 1 for synthetic indices.

Volume or lot size is defined by the broker and it has minimum value and maximum value. When you calculate 1 pip value you set this to 1 which is one standard lot.

And point value is the value of a one pip on the chart for the price. If the price is shown as 1234.234 and point value is defined as 0.0001 then price change from 1234.0234 to 1234.0235 is change by 1 pip:

Price change= |1234.0234 – 1234.0235|

Price change= |0.0001|

Example Pip Calculations for Volatility 50 Index

Let’s make one example for the Volatility 50 index.

I will use a synthetic pip calculator to calculate the stop loss and take profit for one order.

These are values from the trading platform:

- Contract size: 1

- Volume: 3.0

- Point value: 0.0001

- Entry price: 181.9247

- Stop loss: 180.9219

- Take profit: 185.9557

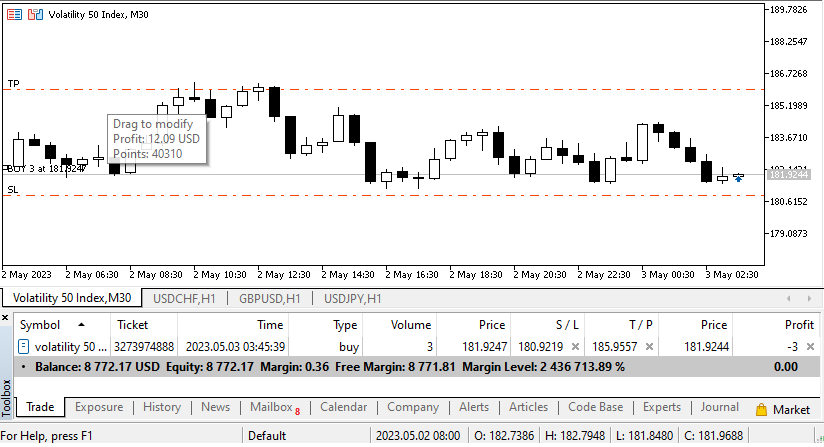

Take a look at the image below where you can see the metatrader 5 trading platform. I have open order in MT5 and defined stop loss and take profit.

With all these values defined now I will use a synthetic pip calculator and enter these values.

Remember to set Symbol to Volatility 50 index.

Insert:

- entry price

- stop loss price and

- take profit price

Then click Calculate to get the price difference for stop loss and take profit.

When you copy that value click Calculate and you will get the stop loss value in U.S. dollars.

This way you know how much the stop loss will be equal to.

If you go to the MT5 and hover your mouse over the stop loss level you will see that the stop loss is equal to the value calculated by the volatility 50 pip calculator.

Copy take profit difference and put it into the Point Value field and click Calculate.

With the take profit calculated you can check it is the same as inside MT5 on open order.

You can see that these values are the same. The Volatility 50 pip calculator has calculated values for stop loss and take profit.

Tips for Improving Your Volatility 50 Index Trading with Pip Calculation

Tips you can use in trading with synthetic indices are:

- before opening an order in the trading platform define stop loss and take profit to calculate price difference

- use GetKnowTrading calculator so you do not need to use additional calculator to calculate the price difference for stop loss and take profit

- Change volume inside Volatility 50 pip calculator to get different pip value

Conclusion: Mastering Pip Calculation for Successful Volatility 50 Index Trading

You can see that Volatility 50 pip calculator is a great tool to calculate pip value for volatility 50 index.

You simply enter volume, contract, point value and order details like entry price, stop loss and take profit levels to get all what you need in trading.

You will know what is stop loss and take profit in U.S. dollars so you can already know what will be the cost and the profit on that trade.

If you are beginner in trading and you need to download trading platform you can check these tutorials:

0 Comments