If you are a scalper or a trader that wants to have open order at the precise price then the instant execution in Forex is for you.

If have read about what is Forex and which Forex order types exist, then you know that there are other execution types that can be better or worse.

There are advantages in Instant execution, but you will see that there are also disadvantages when using instant execution.

Contents

What is Instant Execution in Forex

This is the order type where you open, sell or buy currency at the “Ask” or “Bid” price. It means when you press the button on the mouse your order will open at the price you see it.

It will not happen that your order ends open with another price compared to the one you wanted. This problem can happen on other order types.

As with Market execution where you have the possibility to get the order open with the price that is lower or higher than the price you wanted, here with instant execution that will not happen.

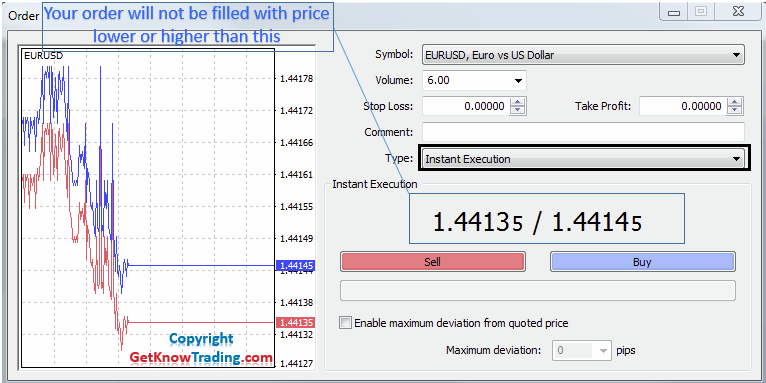

When you open a window for a new order you will have a price shown on the right side of the window.

It is a tick chart where the price changes on every tick. The price moves down or up.

The price you see on the chart is the price at which your order will be open if you decide to open order.

When you activate the buy order broker will receive your order with the requested price. If the broker can give you an order with the price you have requested you will have a new row in the Terminal window.

If the broker cannot offer you the price you have requested, you will receive a requote message.

What is Requote in Forex

Requote message is a message that a broker sends to you if he cannot fulfill your request. The price you have requested cannot be filled so you need to send another request.

Requote can happen a lot of times if the market is highly volatile. If the market is highly volatile, brokers will not be able to give you what you want.

Brokers can only send you a message to try again and maybe sometimes, if you are lucky, you will hit the buy button on the right time when the broker can fill your order.

If the market is not so volatile then there will be no problem. If you see the price on the screen as the price you want to have your order to be open, then the broker will execute your order right away. There will be no requotes because there is no problem to fulfill your request.

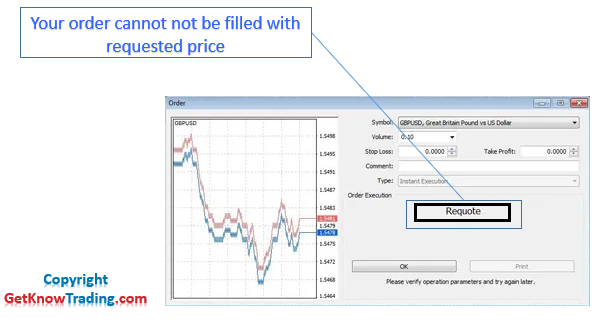

Image above shows you one example when the order you want to be open is declined by the broker trading platform.

When you press the buy or sell button and if the broker cannot fulfill your request you will receive a message “Requote”.

The message below the OK button says that you need to check your parameters and that is the price at which you want to open buy or sell order.

You need to press OK and then click the buy or sell button and hope that the broker can open an order at the price you have selected.

This process of a requote can last for a long time if the market is highly volatile.

What are the Benefits of Instant Execution in Forex

The benefit of an Instant execution in Forex is that you can have your order open on the precisely defined price.

If your trading strategy is based on the precise entry point then instant execution is very important.

If you are a scalper which means you are entering on the precise entry point and you are catching only a few pips, then the entry point is crucial.

If you miss your trade entry point for a pip or two where your profit target is 2-5 pips, then you see that a loss of a pip or two makes a big difference.

There is a big difference because if you have spread of 1 pip and your profit target is 3 pips, the difference in the open price of 1-2 pips means you are trading without profit.

All your profit is gone in the price change and on the spread you are paying to the broker. The only one who is making money will be your broker.

With precise enter on the price you want, will give you all profit you have planned to get.

Instant execution in Forex is for a precise entry and for those who are trading very fast, like scalpers.

What are the Disadvantages of Instant Execution in Forex

Disadvantages of Instant execution in Forex is shown through requotes you receive each time when the broker cannot fulfill your request.

Many requotes will block you from trading with your trading strategy.

Imagine having a broker that gives you requotes 5-10 times on 20 request from you.

You will be filled with 50% of possible trades. And if your trades would be profitable, you would lose 50% of profit.

That is not something you would want to see while trading.

My Personal Experience With Instant Execution

I know when I have used instant execution and the market was highly volatile because of the news published, I have received many requotes when the market moved in my way.

I was frustrated because of why I cannot enter into the trade when I would make money.

And I would make money very fast.

But, on the other side when I wanted to open a new order on a highly volatile market in the opposite direction than the market was moving at the time, which means I want to open a new order where I will lose money, then the broker did not send any requotes.

Everything was fine, there were no problems to fulfill my request on the highly volatile market.

As you can see, instant execution can be very tricky.

Conclusion

While instant execution has its own advantages I would not use that kind of execution in my trading.

Or I would minimize the amount of trades open with instant execution just to avoid requotes.

To decide which execution would be better than instant execution I would go for Market execution.

What is the difference between instant execution and market execution read in the article about what is market execution in Forex.

0 Comments