Forex trading for beginners is tutorial where you are guided step by step to become a Forex trader with trading platform, trading account, trading basics that are crucial for a beginner.

Contents

- 1 Step #1 – Forex For Beginners

- 2 Step #2 – What are Forex Currency Pairs

- 3 Step #3 – Forex Trading Platform Guide

- 4 Step #4 – What are Forex Basics

- 5 Step #5 – Which Forex Order Types Exists

- 6 Technical Analysis in Forex Trading for Beginners

- 7 Forex Trading Broker

- 8 How to Start Forex Trading as a Beginner

- 9 Trading Websites for Beginners

- 10 Forex Trading Questions

- 11 Trading Podcasts for Beginners

- 12 Forex Signals for Beginners

- 13 Risk Management in Forex

- 14 Forex Trading Plan for Beginners

- 15 Trading Tools

- 16 Famous Traders

This trading tutorial is the ultimate guide of your journey to start trading on the Forex as a beginner.

Here you will learn what is:

- Forex meaning

- Forex market structure

- Forex industry

- When you can trade on the Forex as a beginner

- How to start trading on the Forex market

- Tools you need to start Forex trading as a beginner

- How to become profitable beginner trader

- How much money you need to start trading on the Forex as a beginner

- How long demo trade as a beginner before going to live account

- Can you get rich by trading on the Forex

- How much money can you make trading on the Forex

- How to become successful and profitable trader

- Is Forex trading SCAM or gabmling

- What is Forex trader salary

- Trading Forex for a living

- Forex beginners needs a trading mentor

- Holy Grail trading strategy in Forex

It is important to know all about Forex so you know what is done on the Forex and what is expected from you to make money trading on the Forex.

Step #1 – Forex For Beginners

While you are here you want to know what is Forex in simple terms as possible. There are a lot of articles about Forex where authors describe Forex as a place where exchange of currencies is held.

Even that is true, for beginners in the Forex trading who want to know more about making money that information is not so important.

That is why I will skip writing in depth about Foreign Exchange Market aka Forex but I will focus more on simple terms needed for Forex trading.

But, I suggest you read the article where I explain in more details what is Forex, what is meaning of Forex, what is Forex industry, who is involved in Forex and how large Forex market is.

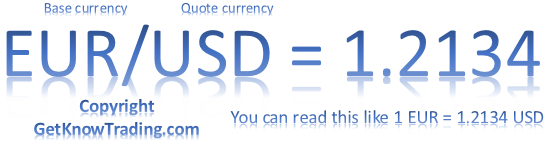

Step #2 – What are Forex Currency Pairs

If you exchange your currency in the exchange office you have your domestic currency which you will use to pay for when buying new currency.

In the exchange office you have seen currencies listed with exchange rates at which you can buy or sell certain currency.

In Forex, where you as a trader buy or sell currency, you have currency pair which consists of two currencies. That currency pair is called Forex currency pair or trading pair.

Everything in Forex is about pairs. In order to understand why Forex is all about Forex currency pairs you need to know which Forex currency pairs exist and how they are segmented.

There are Forex currency pairs that are traded more than some less known currencies. Here you can take U.S. dollar and Euro as an example.

Those two currencies are well known and when you compare them to Croatian Kuna, you will understand what I mean.

U.S. dollar and Euro are world currencies so they are called major currencies. Croatian kuna is not world know currency so it is called minor currency.

When you make Forex currency pair from two currencies you can get major and minor currency pair.

Without going too deep into explaining about currency pairs I suggest that you read article about Forex currency pairs.

There you will find out how currency pairs are made, how to read them, how they are traded, how to read value of a currency pair and which type of Forex currency pair exist.

Step #3 – Forex Trading Platform Guide

When you learn what is Forex and what you trade on the Forex the next part is to get the trading platform. Forex trading platform guide is here to show you how to download a trading platform and how to use it for trading.

You need to know how to prepare the charts, how to understand charts to analyze the market and be ready for trading.

Trading platform is the main tool you will need in trading on the Forex. All what you will learn in theory you will test on the trading platform with real situations.

To make that possible with trading platform you will need trading account. And trading account will be demo account which is free. Without need to have a broker in the early stage of your beginners trading carrer.

Then, there are tools in the trading platform which this trading guide will help you understand and teach you when to use them.

All the necessary knowledge for this beginners step I have put in the article called Forex Trading Platform.

Be ready to:

- download trading platform

- open demo account

- prepare charts for trading

- learn how to use charts

- learn how to get around trading platform

Step #4 – What are Forex Basics

When you start reading about Forex, you will encounter some Forex basic terms that will be strange or complex to understand.

At the beginning it could be complex to understand Forex basics because they are not used in your common life. If you are in financial sector then maybe you have heard some terms that are used in Forex.

In this section I will introduce you to Forex trading basics you will use whenever you start trading on the Forex.

Do know that this is one of the most important parts of knowledge you will need in trading. These are basic terms and if you do not understand them you will have hard time to move forward and be successful.

Forex basics consists of explanation of the money you pay to your broker because broker offers you access to the Forex. Money you pay to your broker can be variable amount or fixed amount. I do not want to scare you but you need to know that the amount broker charges you is small amount.

Second Forex basic thing you need to know is money you can borrow from your broker in order to make more money with small amount you invest. That money is virtual money which you cannot withdraw but you can use to increase possibility to make more than you could with your invested money.

When you borrow money from your broker to make more money, your broker take some money aside just as a protection if your trading decision do not go in the right direction. Broker also use that money as an entrance to large Interbank market where all exchange is held.

There are possibilities to make a lot of money with very little change in the price of a currency pair. The amount of money is defined by the trade input you select at the beginning of the trade. You can define that small change in the price of Forex currency pair gives you $1, $10 or $100.

Step #5 – Which Forex Order Types Exists

This is the most fun part in learning how to trade as a beginner. Because you will play with trading platform and make money or lose money.

If you want to start making money in Forex you need to know how to open and close a trade. Trade is when you decide will you buy or sell currency pair based on your strategy.

If you decide to buy a currency pair and the price goes up, you will make money. If you decide to sell a currency pair and the price goes down, you will make money.

There will be times when you think that current price will come in the future to the certain level and you want to have ready order to open when that level is reached. Those are orders in the future that are open based on certain criteria.

That kind of Forex order types are possible and can be very helpful. It means that you do not need to sit in front of your computer and wait until the price reaches that level.

You can prepare order in the trading terminal and leave your computer. When the price reach that level the order will open.

If you set level when the order must close to take the profit or when the order must close if you have made wrong prediction, that is also possible.

Technical Analysis in Forex Trading for Beginners

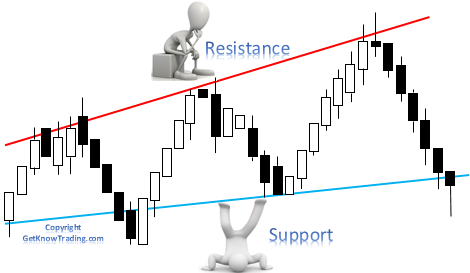

Forex trading requires certain knowledge and skills to be profitable. Those skills includes knowledge about support and resistance levels, trendlines and channels in Forex.

Support and resistance are levels where the price make a bounce, stops at or reverse at. What the price do depends on many things.

Support level will be when the price falls down and reaches level where it stalls. That means the price have hit obstacle that prevents price moving more down.

Resistance level will be when the price rises up and reaches level where it stops. That means the price have hit obstacle that prevents price moving more up.

You can learn more about support and resistance by reading articles but the best knowledge you will get while practicing.

While drawing support and resistance lines on the chart you will see what is important thing to watch to draw them best as you can.

Through time you will see which patterns occur in drawing support and resistance line which will increase your quality of drawing.

I have made examples with charts to explain to you more in details what is technical analysis and how make one. You will learn what to watch in the past that influence on the current support and resistance level.

Forex Trading Broker

This broker trading guide will show you all you need to find the best Forex broker.

You will find a list of Forex brokers I am using and which you can use in your trading.

If you are a beginner then find these brokers as a first broker you will use because they offer you low entry investment and demo account for practicing.

Here is a guide which brokers exist on the Forex market, which ones are the best and what to watch when selecting a broker you will trade with.

How to Start Forex Trading as a Beginner

If you want a simple step by step tutorial to start trading as a beginner then here is a simple video lesson. You will see what you need to start trading as a beginner on the Forex market.

You will know the main points, steps, tools, basics you need to be a Forex Trader. The article is written with a beginner trader in mind so this will be great for you if you are just starting.

Let me show you what are the steps to start trading on the Forex market.

Forex Trading for Beginners Video Tutorial

If you like to watch video more as a beginner in trading then I have prepared a video that will guide you through all steps you need to take.

You will see where to start first and that is to learn details about Forex. Same as the start in this article.

Then you will see how to download trading platform and open trading account. Without these two you cannot move forward because it is a tool you need to have.

Beginners video tutorial will show you how to prepare trading platform and chart for analyzing the currency pairs. And then which tools you can use to analyze them.

This video is the ultimate guide you will need as the start.

25 Best Forex Trading Books for Beginners

Read what experienced traders say when talking about trading on the Forex. You will see a lot of good advices, examples in trading which will help you start trading as a beginner.

There are some trading strategies you can use and learn and master them. As a beginner it is good to have someone who will show you what is needed and what is waiting for you.

Check these books and learn from the experts. You will see what are important things in trading to be more successful.

Online Forex Trading Course for Beginners

When you start it will be hard. It will be hard to understand what others say when they explain what Forex trading is and how you should trade as a beginner.

To simplify the road from beginners stage up to where you are ready for trading with tools needed there is an online course that will help you.

Online course is a straight guidance where you will be guided step by step what you need to do in order to become a Forex trader as a beginner.

If you want to use trading course at the start of trading journey then read this article which will help you find the best trading course.

Trading Websites for Beginners

Forex Beginner Blog

I want you to learn more as a beginner so you need to learn from different people. That way you can learn what others suggest about how to trade on the Forex market.

There are many trading websites and Forex beginners blogs, but also trading sites for beginners or experienced traders.

I will give you a few of them. I would suggest reading them. There you will find a lot of useful material which you can use in your trading career:

- DailyPriceAction

- here you can learn a lot about trading with simple support/resistance/trendlines and candlestick charts

- Trading With Rayner

- this is a Forex blog where you can find a lot of stuff for beginners and experienced traders

- Desire to Trade

- this one is trading site for podcasts where Etienne talks with other traders and where they share their trading advices

There are other trading sites and beginners blogs, but feel free to search on your own or let me show you one of the best you can use in your trading career.

Use FinTwit to Learn More About Forex Trading as a Beginner

FinTwit is a great FREE tool you can use in your trading carrer. It is Twitter part where many traders and investors are sharing their insights about certain symbol.

You can take their insight in your advantage and learn from them or to add more valuable information to your own trading.

If you need help using FinTwit here is an article with video hot to use FinTwit.

Forex Beginner Forum

Discussing details about Forex trading is the best when you find a great forum specially devoted to explain Forex trading for beginners.

I have to say that it is not an easy task to find one because there are a lot of them that are active and have experienced traders talking about different topics.

One of them is the Forex Factory trading forum that has lots of traders discussing beginners topics and more advanced topics. One of those topics is Non-Farm Payroll report that have huge impact on the U.S. currency and all other currencies in the world. Check the article which will explain to you what is non-farm payroll.

When I started to learn about Forex trading I could not find a useful trading guide that would help me learn more about trading.

I would suggest checking Baby Pips Forex forum for beginners. There you will find beginners in trading that seek help about basic trading terms.

You will find questions that you will have because those traders are at the same position as you.

You can ask any question that pops out and you will get an answer to it. Maybe I will answer it to you because I have an account there under GetKnowTrading.

Here is a list of forums I would suggest you visit:

- Baby Pips

- Forex Factory

- MT5 (old) – Now InvestSocial.com

- ForexForum.co

- Trade2Win.com

- ForexPeaceArmy.com

I hope this will help you connect with right minded people and help you in your trading journey.

Forex Trading Questions

During a trading career and especially at the beginning you will have lots of questions. Those questions will provide you insight into how trading looks, what you can expect.

Some of questions you will have are:

- How long demo trade until going to live account

- Can you make money by trading

- Trade Forex with 9 to 5 job

- How much money is needed to start trading

- Can you become rich trading on the Forex

These questions are normal, and I have asked myself when I have started trading and once a while I like to read those topics again.

I have gathered most asked questions you will encounter in Forex trading so once a while check the link below where I will add more and more questions answered.

And one topic that many traders are interested is a funding program where traders get funds for trading. One of such companies is FX2 funding.

Trading Podcasts for Beginners

Trading podcasts are video or radio channels where you can listen to traders speak about trading. It can be their own trading technique or someone else.

One of the most known trading podcasts for beginners is Etienne Crete podcast channel. On his channel you can be sure to find lots of podcasts with well known traders who share trading techniques for free.

Forex Trading podcasts for beginners:

Forex Signals for Beginners

When you start Forex trading as a beginner you will probably be attracted to the possibility to trade Forex signals as a beginner. Trading signals are signals where you simply copy a signal and enter it into the trading platform.

Some trading signals you pay and some are free. Those that are free are mostly not worthy because who would give you potential profitable signals for free?

Probably a few of them, but those are hard to find.

On the other hand you have trading signals you pay a certain fee per month or week. And when you pay for the trading signals you can end up losing money because no one can guarantee the signals will be profitable.

One trading signal I can suggest you take a look at are harmonic scanner signals which use the harmonic scanner to detect harmonic patterns.

It has a monthly fee, but from what I have seen it has good trading results. I did not try trading signals so I cannot vouch for the service, but you have a 7 day free trial to test on your own.

Have in mind that you need to know how to use risk management in trading any signals because you need to protect your money and maximize potential profit on each trade you open.

Risk Management in Forex

Each trade you open should have risk management included because you need to protect your money and maximize the profit on each trade.

Risk management in Forex trading as a beginner should be the main focus. Maybe at the beginning of your trading career you think this is not important. Maybe you think you need to learn how to trade first, and that is a valid opinion.

But, learning how to open a trade with calculated risk is really important.

If you learn risk management at the beginning you will see how it is easy to make more money in the long run.

Risk management includes defining acceptable risk on each trade. And the loss can be expressed as a percentage of account balance or you can define how much pips you will lose.

On the other end you need to define how much percentage you will make on each trade or how much pips you will make.

For example you can set 2% of risk on each trade you open. That means if you have $1000 account balance and open one trade you will risk:

2% of $1000 = $20

If the trade closes with stop loss you will lose $20.

If you set risk to reward ratio 1:3 that means you will make 6% if trade is profitable.

6% of $1000 = $60

Risk to reward ratio is a really important thing to watch on each trade you open. That way you can have 2 bad trades and 1 good trade you can end up in profit.

Use risk to reward ratio at 1:3 on each trade and do not risk more than 2% on each trade. Remember that one of your goals is not to lose your money.

There are different ways how to take risk into calculation when trading. And one way is to reduce risk by dividing one trade into multiple trades.

That trading strategy is called Twin Trading.

Forex Trading Plan for Beginners

Forex Trading plan for beginners sets the right trading path for you to become profitable and to lower the risk on each trade.

Trading plan represents the steps you will follow on each trade you will open.

That means you will know:

- which currency pair to trade

- how to analyze the chart

- which tools to use in analyzing

- which Forex order type to open

- how to set up stop loss and take profit

- how to manage the risk to protect your account and maximize profits

With the trading plan as a beginner you will be equipped with something that most traders do not have.

Majority traders trade without a trading plan. They simply enter into the trade now watching risk to reward ratio, now analyzing the chart, now defining stop loss.

And then they end up blowing trading accounts.

Trading plan is a must have at least with the above listed steps. Those are crucial ones, but you can add more of them if you think they will help you in trading.

As time passes and you get trading results you can come back to the trading plan and revise if there is something that must be changed to increase the profitability.

Trading Tools

In your trading career there are certain tools you need to calculate the risk and have proper money management.

One of the tools you need to have is a compound calculator. It is a tool that helps you calculate possible profit if you have a certain percentage of profit added each month.

It is hard to understand when you only read about calculators so here is an article that will help you understand that, but here is also a calculator which you can use and test.

That way you will understand what is a calculator and make a Forex compounding plan. And you can use excel to calculate CAGR formula in excel which is reverse calculation than compounding.

Famous Traders

Check which famous traders exist which you can learn from based on their life experience and results they have achieved.

Some of them are stock traders, some Forex market traders and some trade on all markets.

Forex Trading

Forex Trading Guide

1. Forex Trading for Beginners

2. What is Forex

3. How to Start Trading as a Beginner

4. Forex Beginner Course

5. Forex Trading Tools

6. Forex Trading Questions

Forex Trading Questions Overview

How Long Demo Trade Before Going Live

How to be Profitable Part-Time Trader With 9 to 5 Job

Forex Trading Mistakes - Stop Doing in Order to Succeed

How Much Money do You Need to Start Forex Trading

Can I Get Rich by Forex Trading With $100 Dollars

Do I Need 1000 Pips to Get Rich

How to Stay Consistent Forex Trader

Why Forex Traders Fail? The Root Cause?

Does Anyone Really Make Money by Trading Forex

Is it Possible to Earn a Lot of Money on Forex

Realistic Monthly Return for a Forex Trader

How Much Does the Average Forex Trader Make

Forex Trading for a Living - How Much Money do You Need

What do I Need to do to Build Wealth by Trading Forex

You Don’t Have a Trading Mentor? You are Wasting Your Time!

11 Things in Forex That Annoys You Most

Holy Grail Trading Strategy in Forex

Trade Forex With Less Than $1,000 and You Will Lose Everything

How to Be Successful Forex Trader When so Many Fail

What Really Turned My Trading Around