To understand what is Forex structure and why is so large financial market where several trillions of U.S.$ is turned each day you need to read further.

- Who are the participants that trade on the largest financial market in the world

- What is Forex market structure

Forex Market Participants

Forex market structure consist of participants like institutional investors, currency speculators and individuals, beginners in Forex trading who make a trade through Forex dealers, financial firms(who mostly are banks), insurance or similar financial firms.

Commercial, international banks that trades behind the scene, meaning it is invisible to us, individual traders, is called Interbank market.

Here is short list of the participants on the Forex market:

- Central banks and governments – most influential participants on the Forex market because of their size on the currency market

- Commercial banks – when you change currency in the bank they use that currency to exchange on the Forex market

- Hedge funds

- Brokers

- Investors/Speculators – Individuals like you and me who wants to earn some money on the market by trading currency pairs

Forex Market Structure Overview

How to imagine this system and easily understand how system works and to use that knowledge for better trading?

Forex as a system is made as decentralized system. One entity does not control whole market but it is scattered on the global network. No one can control all trades as in central system where one entity set rules and all others must follow.

In decentralized system general set rules must be followed in order to participate. Forex market structure consist of several levels where each level represent one type of the traders. Generally, all traders do same thing, trade on the market by buying and selling currencies. But difference is how they trade and what surrounding they have in their trading.

You can imagine Forex structure as a 3 level system. On the top level is Interbank market where large money centers exchange currencies between each other.

On the second level are firms known to you as broker and on the third level is small retail trader, like you and me.

Forex Market Structure – First Level

Imagine money center as yourself who owns EUR currency and your friend who owns U.S.$. You and your friend have different currencies which could be needed in the future for some operation.

If you travel to U.S. from Europe you will need to have U.S.$ to buy articles. In order to do this you will contact your friend to give you some U.S.$ but you will pay him in EUR on the price you agree with him. The price you agree on is the exchange rate.

Your friend accept your proposal and let say that he will sell U.S.$ at price

$1 = 1.4 EUR

If you are willing to accept this price you two will close the trade.

This small example of the currency exchange is a example how money centers works on the Interbank market. Additionally to this on the Interbank center there is a problem when you have high amount of participants who would like to exchange currency.

Interbank Market Exchange Problem

Problem is that due to large number of participants no one knows who have currency in amount that one needs and at which price. Similar problems appears if you want to exchange exotic currency which is rarely exchanged.

You need to find opposite side which will give you exotic currency. Side that is willing to accept your currency at rate you are willing to pay. Have in mind that on the Interbank market is not exchanged only U.S.$ or EUR but all world currencies.

So, if you need to exchange large amount of U.S.$ for EUR you would like to easily find who can give you opposite side of the trade in that amount at rate you will pay.

This problem is solved with application from EBS and Reuters. Application allows Interbank participants to see who, how many currency and at which rate is willing to make a transaction. Application serves as communication link between Interbank participants. This way app gives them the Depth of Market(DOM).

Dept of Market

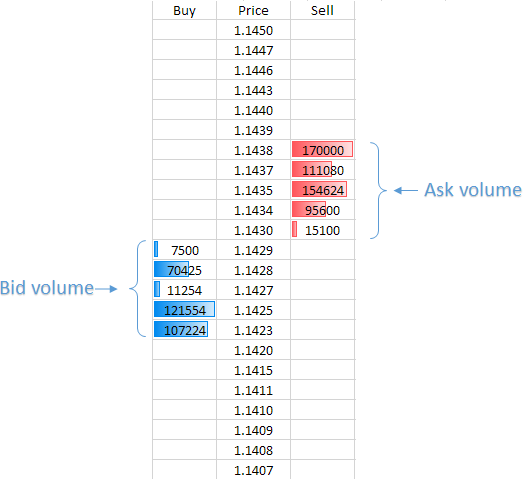

Depth of Market is a list of all possible offers, buy or sell, and someone with this information can see which price rates are available. This is also a liquidity information for traders to see how currency is easy to exchange. Depth of market is also known as order book since it contains information of pending orders.

On the picture below is a small example how that looks like on the list of pending orders. List also shows volume of Bid and Ask orders. This list becomes very helpful if you base your trading strategy on order flow where you look for possible movement of the price based on the trading volume.

Have in mind that broker you are using mostly have only a DOM of the traders who trade on their platform. They do not have whole DOM of all participants because they do not have that information from Interbank market.

On the picture below you can see what you have as a DOM on the MT4 platform that your broker allows you to see. There is no information you can use in your trading as a list of the pending orders to base your trading strategy.

With information who is willing to sell or buy some currency and at which rate gives Interbank market participants solution to problem of finding opposite side of the trade.

Major banks that are involved in the interbank market are JPMorgan, UBS, Barclays, Deutsche Bank and HSBC.

Forex Market Structure – Second Level

On the second level you will encounter brokers and banks which products you use every day. They are commercial banks who offers currency exchange.

If you understand how big companies buy and sell products on the world market then you know that they need to have foreign currencies to trade. If you do not understand how it is done then read further and you will find out.

When one company in Europe wants to buy raw materials or parts from another company in the world, let say Japan, they need to have Japanese Yen in order to make transaction.

How they will get Yen for trade. Well, they will participate on the foreign exchange market over commercial banks. Then commercial bank with access to Interbank market make exchange for companies.

Currency transactions done through this level is exchanged between banks and mostly they exchange it in low amount compared to Interbank participants.

Another example that characterizes this level is exchange you encounter everyday, one to one, you and the bank. If you want to exchange currency in the bank office you are forced to exchange currencies at rate they offer you. If you are not satisfied with exchange rate you are free to choose another bank and try to find better exchange rate.

Transaction you do in the bank office, it will be transferred internally in bank. Bank in their reserves have different currencies which they use to cover small transactions like the one above. When bank wants to exchange large amount they turn to level one, Interbank market and make exchange.

Forex Market Structure – Third Level

Third level consists of small traders(set up FinTwit traders list) who trade on the Forex market through retail broker.

There is 2 type Forex retail broker you will encounter:

- Market Makers – brokers that set their own bid and ask exchange rate

- Electronic Communications Network ECN – they use the best bid and ask available from institutions on the interbank market

Market Maker

Broker is a link for you to Interbank market where all buy and sell orders are. It is not direct link to Interbank but broker internally matches orders for you with other traders. All your losses are his profits.

Retail broker in order to participate on the Interbank market must make a deal with large bank who is willing to give him liquidity. This means bank which is willing to accept all broker orders.

Bank which is willing to accept broker orders will offer different order price compared to price which bank will get on the Interbank market. Reason for this is that bank makes profit on the spread.

So when you see spread on Forex currency pair remember that same spread is not on the Interbank market. It is smaller on the Interbank market. Also, remember when you get information from your broker that they promise you same spread all the time, it is not correct because they cannot control spread which large bank will give him.

Mostly they cover their agreement with statement that in case of news there could be slippage or spread value change. If bad scenario happens sometimes broker can leave spread as he promised but that risk he calculates into his money management.

ECN Broker

ECN broker who is also on third level but operates slightly different to retail broker use large bank provider to get access to Interbank market. Difference is that ECN acts like link for Depth of Market for third level traders like EBS and Reuters for first level.

ECN broker does not have internal order matching and does not trade against traders but they pass quotes to you directly from the bank. But remember, those quotes from bank is not Interbank quotes because bank must earn some profit on spread. So, those quotes are also different from Interbank market.

Compared to market makers price is not defined by the market maker but traders set their own price. Also ECN have tightest spread so to earn some profit ECN charge small commission for the trade you make. This way ECN is known that has small spread and commission which makes trade cheaper.

Which Broker to Choose

Have in mind that ECN broker charge commission on each trade. Additionally to this have in mind that ECN broker offer lower leverage and full lot transaction. Something that can happen during some events is that bank can withdraw their liquidity and leave broker without opposite side of the trade. Consequently trader will not be able to enter or exit their position.

Market maker can offer non standard contract size, high leverage and small account balances without charging commission on each trade.

For small traders market maker is better choice because it gives trader more approachable access to Forex market.

FREE WORKSHOP

For beginners who does not know how and where to start with trading

In the workshop I will tell you

what steps to do in order

to transform yourself into a trader

0 Comments