What is Forex Spot, Futures or Option market. Which one to use and what is the difference between them?

You can invest or speculate on Forex market in several different ways. Those are:

- Currency Futures

- Currency Options

- Forex Spot

Contents

What is Forex Spot Market

In trading on Forex market, spot refers to the price of the currency pair at the time you see it on the trading platform.You can visualize it like “price at the spot“. It is called also as the cash market.

You will encounter someone says that settlement for spot market takes 2 days for most currencies. Settlement means that currencies change their owner. 2 days is referred to brokers and financial institutions not for us small individuals who trade over broker.

Because of Forex brokers, who are market makers, settlement for us traders does not last two days because brokers take both sides of the trade. This way, our trades and our account balance is updated instantly when we open and close order.

On the Forex spot market currency pair is traded immediately by current market price. There is no waiting time for exchange price until contract expires. Trade is executed in milliseconds and trading is very simple and fast. Forex spot trading session is 24/5 which means five days in a week.

Forex Spot Market Execution

Here are several execution types on the Forex spot market:

- Instant execution – when you want to open order sometime it can happen that you trade does not go through. Instead you get re quote from trading platform to open a trade with another price. In this type of market execution you can set a slippage or maximum price deviation. This means if your order does not open at specific price, order will be open until it is in limits set by slippage.

- Market execution – this means your order will be open when you open a trade at desired price and there will be no re quote. But price on trade that is open can be different from one you see in window if market volatility is to fast.

For you, most of the time, market execution is better because you do not want that trading platform rejects your request when you try to open a trade. Rejection happens when price is highly volatile and broker trading platform cannot execute it immediately but it asks you to try again(re quote).

But market execution can be harmful for your account when you open a trade on highly volatile market and then movement of the price goes against you.

In this case every trader would like that he had received “re quote” from trading platform because he would not be on the wrong side of the market direction.

Currency Futures

Currency futures is Forex future contract, financial instrument, with which you exchange one currency for another in the future at specific date if trader does not close his position earlier.

You can trade futures in two ways which depends on exchange you are dealing with. There is a floor trading and electronic trading.

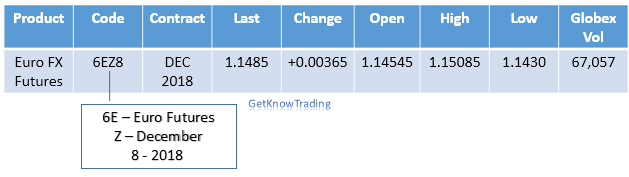

Futures contract have contracts codes that defines which product is used followed by character for month and year of expiration. Contract code combination varies from platform to platform.

When currency future trade is open, price is determined at that time. Price on the currency futures can change as the spot market price change. It is not mandatory that currency futures price change immediately with spot market because spot market price can vary a lot and to avoid short term movement it does not follow those changes.

Sometime daily price limit can be set which means that price of the contract will not change more then limit. If limit is set to $10 price change of the contract will not go beyond this value.

Forex Futures Example

As example of futures trade imagine this:

If you buy Euro Forex future on the US exchange at $1.37 it means that you agree to buy euro at the end when contract expire. Price that you will pay will be 125,000 euros at $1.37.

Why you need to pay 125,000 EUR? It is because 1 Euro Forex future on the Chicago Mercantile Exchange (CME) is 125,000 euro. For example, Gold contract unit, GC, is 100 troy unces or oil contract unit is 1,000 barrels of oil.

If you want to exit earlier instead waiting contract to end you can close position. With this move you will lose or make money depending on the price difference between current price compared with price when contract was open.

To calculate how much you would get or lose you can multiply difference with contract unit which is 125,000. If the exit price is 1.38 then you need to multiply 0.01 x 125,000 which gives you gain of $1250. If price has drop 0.01 then you would lose $1250.

Futures Margin

In order to stay in a trade if market moves against you, you need to have available margin. Margin is amount of money you need to have on account before trade is open so dealer can cover loses at the end of the day when settlement is done.

Dealer will contact you to increase margin in cases when necessary or he will close trade whatever price is.

Here is a list of some currencies offered by CME:

- EUR – The Euro to US Dollar currency future

- GBP – The British Pound to US Dollar currency future

- CHF – The Swiss Franc to US Dollar currency future

- AUD – The Australian Dollar to US Dollar currency future

- CAD – The Canadian Dollar to US Dollar currency future

Currency futures is centralized and regulated market so if you look for that kind of currency market you are at the correct place. For any specific rules on futures market check on exchange website for detail information.

Fore more details about difference between Spot and Forex market you can check here.

Currency Options

Currency option is similar to currency futures, contract with which you can buy or sell certain currency, but without obligation, on specified date at a defined exchange rate.

When buyer wants to purchase option it is known as a Put Option. When he wants to sell a currency option it is known as a Call Option.

Here is a list of terms used in currency options:

- Exercise -Option buyer notifies the seller that they intend to comply to the options Forex contract

- Expiration date – the last date for option to exercised

- Delivery date – the date when the currencies will be exchanged if the option is exercised

- Call Option – right to purchase a currency pair at exchange rate on agreed time in the future

- Put Option – right to sell a currency pair at exchange rate on agreed time in the future

- Premium – cost involved in purchasing an option

- Strike price – The rate at which currencies will be exchanged

Conclusion

As a conclusion I would like to emphasize that Forex spot market makes most of daily trading on the Forex market and it is widely used Forex product among Forex participants. That is the reason you are here.

Because of high volatility, trade execution speed, liquidity and simplicity high number of the traders loves it.

FREE WORKSHOP

For beginners who does not know how and where to start with trading

In the workshop I will tell you

what steps to do in order

to transform yourself into a trader

0 Comments