Supply and demand strategy in trading represents using the area around support and resistance levels where the price bounces because of liquidity or sellers and buyers waiting to enter into or exit from the market.

Demand means buyers’ intention to buy a security in the market. Supply means sellers’ intention to sell a security in the market.

Simple as this:

Supply = Selling

Demand = Buying

If you learn how supply and demand in Forex works you will have a much easier path understanding how to trade and becoming profitable. The reason is understanding how the price of a certain currency pair moves in the current moment and how it will move in the future.

Supply and demand when used properly can be highly profitable and why it is the most popular Forex trading system among traders.

This strategy is the basis of all other strategies. You can build any other strategy by using supply and demand techniques. Because it shows the basic position of buyers and sellers on the market.

This is also the basic strategy I am using without indicators. But on this website you will find more strategies including this one as a basic.

Contents

- 1 Definition of Supply and Demand

- 2 What is Supply and Demand in Forex?

- 3 How Supply & Demand Works?

- 4 Supply and Demand Analysis in Forex

- 5 What is a Supply Zone?

- 6 What is a Demand Zone?

- 7 Supply and Demand Trading Strategy in Forex

- 8 Types of Supply and Demand Patterns

- 9 Difference Between Forex Supply/Demand and Support/Resistance?

- 10 Supply and Demand Forex Pros and Cons

- 11 General Rules to Follow

- 12 A Real Example of Supply and Demand in Forex

- 13 Conclusion

Definition of Supply and Demand

Supply and demand are two forces that drive the market, that drive the price in one direction or in another in the Forex market or any other market. We can say in any market because the logic behind supply and demand is the same everywhere.

In the case of the Forex market you can understand supply as the force that is moving the price down and demand as the force that is moving the price price up.

A supply zone forms before a downtrend and a demand zone forms before an uptrend.

If the number of sellers and buyers are the same then the price will stay where it is and the market will range. Meaning, it will not move up or down.

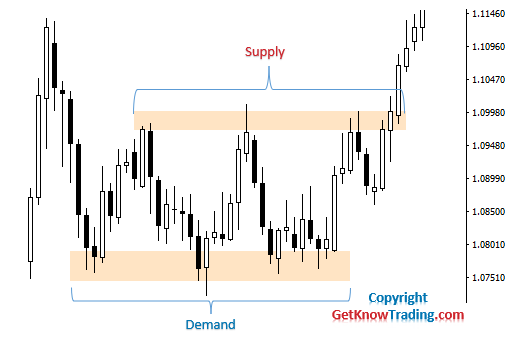

Here is an image where you can see how those zones look on the chart. On the upper side you have sellers that create supply zones and push the price down.

Below you have a demand zone where buyers are pushing the price up.

And when you have price stuck between these two zones the price will bounce and it will create a range area.

Supply definition in Forex represents the amount of sellers who are willing to sell the currency. If there are many sellers willing to sell currency then the supply will be high.

In the case of EUR/USD pair, many sellers define the supply area on the chart for a certain price. If there is no one who is willing to pay the price which is current on the market then the price will go down.

Demand definition in Forex represents the amount of buyers who are willing to buy the currency. If there are many buyers willing to buy the currency then the demand will be high.

In the case of EUR/USD pair many buyers define the demand area on the chart for the certain price. If there are many buyers who are willing to pay the price which is currently on the market then the price will move up.

What is Supply and Demand in Forex?

In the Forex market you have companies, investors and other participants who need foreign currencies in order to make a job in foreign countries.

For example, a US company that has a subsidiary in Europe needs Euros to pay their employees. That can be Tesla that has a factory in Europe and Tesla needs Euros to pay the employees in their domestic currency.

Now, exchange rates are the prices of foreign currencies, in our case, Euro, which is used in the European market. There are many factors that influence the exchange rate of Euro compared to other currencies. Those are import/export of goods, inflation, interest rates, GDP.

Lets say European GDP changes in a way that it falls in value.

If the GDP falls in Europe, Europe will import less from foreign countries because buying power decreases. If GDP grows they will import more because their buying power is stronger.

Another example is if the U.S. goes into a recession then GDP will fall and the U.S. would import less from Europe. Consequently, the demand for European Euro decreases and the U.S. dollar falls in value compared to European Euro. That means the Euro increases in value.

Supply and demand in Forex are terms used to describe price status in the markets and how the buyers and sellers are behaving.

Supply in Forex represents the sellers who are selling the currency.

Demand in Forex represents the buyers who are buying the currency.

How Supply & Demand Works?

Any market in the world works like this:

- when demand is higher than supply, the price will move up

- when demand is equal to supply, the price goes sideways

- when the supply is higher than demand, the price goes down

This market behaviour explained Richard Wyckoff in his analysis where he showed this connection between supply and demand with price movement.

Short story is that the markets moves in phases called:

- Accumulation

- time period when the price creates demand zone

- Markup

- time when the market is moving up from the demand zone

- Distribution

- time period when the price creates supply zone

- Markdown

- time when the market is moving down from the supply zone

As you can see in the chart there are small price zones when the market is moving up and when it is moving down.

In the uptrend those are small accumulation zones and in the case of downtrend those are small distribution zones.

Supply and Demand Analysis in Forex

Supply and demand analysis in Forex defines buyers and sellers willing to sell or buy certain currency pairs. If there are buyers and sellers in the market then there will be supply and demand.

If there are no sellers or buyers then the supply and demand will not exist. And that is because the Forex market is a place where buyers and sellers meet to conduct the business.

Supply and Demand Analysis in the Past

If you want to make the supply and demand analysis then you start analyzing the past of a certain currency pair.

Supply or demand in the past has a high chance to repeat again in the present or in the future. And that is because human psychology, sellers and buyers, works like that.

They tend to repeat the same scenario over and over. And if there is evidence that something happened in the past at a certain price there is a high chance something will happen again.

If the price of EUR/USD pair at $1.12000 price had support or resistance then you can expect the price will find support and resistance again at the same price.

Using this information buyers and sellers form supply and demand zones which have an impact on the price of a currency pair.

Steps to Identify Supply and Demand Zones

- define current market price from where you will start searching supply and demand zones

- start looking in the past on the chart

- find big black or white candles

- find the start of these big candles

- create rectangle around the start of these candles

- beware of strong and weak signals

Doing the steps above you will create a zone around price which will determine supply or demand zone.

Supply and Demand Base

Price range is a combination of many smaller candles which represents a consolidation of a price or what I call a range.

This can be the price range of supply or demand, but the analogy is the same. The price is inside a rectangle forming a base of the supply and demand.

Single Candlestick

When you find a big candle after one candle that one candle will represent the supply or demand zone.

One candlestick is enough because at some prices the market has strong moves which defines the area with high supply and demand.

Sometimes you will find Pin bars or engulfing candles as supply or demand zones because they are patterns that indicate the market will make a move.

Find Weak and Strong Signals

Try to spend some time finding the strongest signals that will indicate a good supply and demand trade setups.

Here is a list of signs you can take to determine strong supply and demand zones:

- Look for narrow price range

- this means look for healthy price range where the candles do not h ave long wicks, and the range does not lasts for too long

- Beware of candle numbers

- Too many candles in the price range can mean the zone will not act as it should. It can happen the supply or demand zone do not have a breakout with long candle which will not be a good trading opportunity

- Breakout candle

- wait for the breakout with long candle which will represent strong move from big players

- New supply/demand zone

- when the breakout occurs look for the retest that has not been formed earlier on the same place and on the same zone. If the zone is tested more times it will have less significance because it will lose it meaning of a retest

- Fake brakeout

- this is know as a stop hunting where big players catch stop loss on the false breakout

- breakout happens, but the price reverse back in the supply/demand zone and then moves in the opposite direction

What is a Supply Zone?

Supply zone on the chart is the area where the price starts downtrend. It is a place where the price finds many sellers who push the price down. It is also called a distribution zone.

Supply zone is also an area where the buyers exit the trades because of locking their profits or changing the trading strategy.

Maybe it is easier to understand if you see this example.

Let’s assume the price of $100 per basket of apples is a supply area on the market.

And you are one of the apple sellers. Your goal is to sell as many apples as possible with the highest price possible. So, if there is a competition on the market you will check their price and maybe lower the price slightly to attract the buyers.

That means you will, as an apple seller, lower the price by one dollar and then again one dollar because many sellers are lowering their price in order to sell their apples.

Supply of apples is high and market conditions force the price to fall down.

How to Identify Supply Zones on Chart

Just to recall what the supply zone is.

Supply zone is an area where the price finds many sellers and the price starts to fall down. Base currency in a currency pair starts to lose its value against quote currency.

In the case of EUR/USD with price $1.12000 the price will start to fall down, below $1.12000. For example $1.11900.

Supply zones can be identified from many sides. It can happen if you have a ranging market. That is when the price is moving inside range.

And when the supply exceeds demand you will break below.

Sometimes you can have prices rising and then stalling for some time. The time period when the price stalls can form a supply zone which will return the price down.

So, in any case the supply zone will be defined as an area where the price breaks below current price on the chart.

What is a Demand Zone?

Demand zone on the chart is the area where the price starts uptrend. It is a place where the price finds many buyers who push the price up. It is also called an accumulation zone.

Demand zone is also an area where the sellers exit the trades because of locking their profits or changing the trading strategy.

Lets see an example for easier understanding.

Assume you are the apple seller and you are the only one who sells apples on the market.

If you put the apple price to $1 you expect to sell as many apples as possible to make money.

Now, if many buyers come to the market and want to buy apples you will be able to increase the price of the apples because there is large demand.

For example, one buyer comes to the market and buys 10 apples for $10. Then a second buyer comes and buys 10 apples for $10.

You see the selling is moving fine and many more buyers come to you to buy the apples so you decide to increase the price per apple.

You set the price to $1.1.

Now, the third buyer will pay $11 for 10 apples.

As this scenario continues where more and more buyers come to you , the price eventually increases several dollars.

Now imagine that many buyers come in a short period of time. And they want to buy many apples when the price is at $1 per apple.

That large amount of buyers makes a demand zone for the apples at $1 per apple. That is how the demand zone is formed in any market.

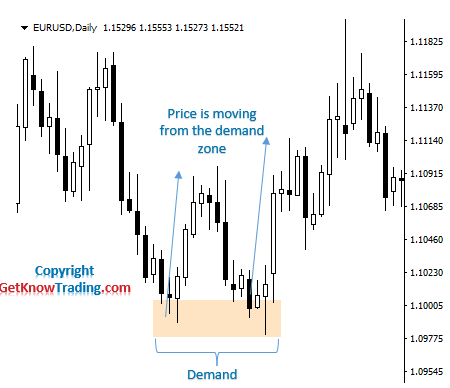

How to Identify Demand Zones on Chart

Identifying the demand zone on the chart starts with looking when the price was breaking above price range.

Since the supply and demand analysis says to look in the past then you should take a look when the break from range has happened.

Break is defined as a large candle breaking up from a range area after the price has stayed inside the range for some time. Large candle represents the buyer’s demand for the price.

High demand was formed which eventually forced a break above from a range.

That demand area or demand zone will likely happen again in the future so you can take that area as a possible demand zone when the price comes to that price zone.

Supply and Demand Trading Strategy in Forex

There are three important things when trading supply and demand zones.

That is:

- Entry level

- Stop loss level

- Profit targets

Supply and Demand Entry Level

Your goal is to find a supply zone so you can enter with a sell order. That way you will sell at the higher price which will lower possible loss if the price goes against you.

Entry level is at the break out point. That means when the price breaks up or down it will be a place where to enter.

Break from the supply or demand zone is a confirmation that there is an imbalance between buyers and sellers and it is an opportunity to make money on that imbalance.

Now, you cannot catch when the break out will happen so you cannot enter right on the break out.

Instead, you wait with a pending order expecting the price will come back to the breakout point and will continue in the direction of the breakout.

Stop Loss Level

Stop loss level in case of supply or demand zone breakout will be below or above range area.

It is above or below because you expect the price will hardly move in the opposite direction. And that is because when the price was in the range area it could not break in the direction of stop loss, but it broke in the opposite direction.

Profit target

To define where to exit when trading supply and demand zones in Forex you need to have supply and demand zones drawn on the chart.

All zones from the past must be on the chart, at least one above and one below the current supply and demand zone.

So, if the break is above the zone, then your profit target is on the entry of the next zone on the chart.

If the break is below the current zone, then your profit target is on the next zone on the chart which is below the current zone.

Second way is to leave the trade open until a new zone appears. And you would exit if the break from that zone is against your open trade direction.

Trading Strategies

Here is a list of a few strategies you can use in trading supply/demand zones.

Range Trading Strategy

Supply and demand zones are the range area of a price. That means the price is moving in a range between two prices.

If the range lasts for a longer period of time you can use that range as a potential way of trading.

It means you can prepare to sell the currency pair at the top of that range and buy it on the bottom of that range.

Your stop loss level in case of selling would be above range area and take profit close to bottom of a range area.

That way you are taking the opportunity of the price bounce inside the range area.

In case of buying a currency pair you will buy at the bottom and close the trade at the price close to the top of the range area. Stop loss would be below range area.

Breakout Strategy

When the price makes a range of supply or demand you can bet that it will break eventually to the upper or lower side.

WHen that break occurs you will pay attention and wait for the price to return back to the supply/demand zone.

When that happens you will try to enter the trade in the direction of a breakout. The return of the price acts as a confirmation for the price the breakout is valid and the previous supply or demand zone now acts as a support or resistance for the price.

Types of Supply and Demand Patterns

As said earlier there are small zones in the uptrend in the downtrend.

Small zones of accumulation in the uptrend or distribution zones in the downtrend can form some kind of pattern.

Just like candlestick patterns or chart patterns you have supply and demand patterns. When the market moves up or down you will have reversal patterns that will be the start of the trend change. They are called supply and demand reversal patterns.

Then you will have patterns that will tell you the trend will continue. They are called supply and demand continuation patterns.

They are easy to understand so let me explain them.

S&D Reversal Patterns

Supply and demand reversal patterns are:

- Drop-Base-Rally is bullish reversal pattern

- Rally-Base-Drop is bearish reversal pattern

S&D Continuation Patterns

Supply and demand continuation patterns are:

- Rally-Base-Rally is bullish continuation pattern

- Drop-Base-Rally is bearish continuation pattern

Difference Between Forex Supply/Demand and Support/Resistance?

There is a small difference between support and resistance lines and supply and demand zones.

Support and resistance lines are simple lines with one price on the chart. You draw them as a horizontal line and depending where the current price is you will have that line as a support or resistance.

If the current price is below the horizontal line then the line will represent resistance for the price when the price approaches the horizontal line.

If the price is above the horizontal line then the line will represent support for the price when the price comes close to the horizontal line.

Supply and demand zones are not drawn as a horizontal line, but as a horizontal area which covers a wider area around a certain price.

And that is because supply or demand include much more different prices of certain pairs. It includes prices which can be different from 2 pips up to several pips or even 10 or 20 pips.

The range of a supply and demand zone depends on the time frame you are looking at.

Supply and Demand Forex Pros and Cons

Positive part of the supply and demand zone is that they are easy to detect on the chart. With some time practicing or mentoring you can understand how supply and demand works.

Anothe rpart is that you can open pending orders and leave your PC without watching the chart all the time. Will the price come to your entry level or not?

The third part is that the trading supply and demand is not hard and it can be understood with logic. You can easily understand what it means when there is too much supply and when there is too much demand. And what will happen afterwards.

Cons

For some traders it can be hard to understand the logic behind supply and demand in the markets. Maybe you will need more time to understand.

So, it depends on the trader and how determined he is to understand this trading concept.

Another thing to watch is trading supply and demand on its own. There are other things that are good to include in trading supply and demand. Those are candlestick patterns, channels and other trading techniques who could help increase the success of this strategy.

So, try to include more trading techniques in the trading supply and demand zone.

General Rules to Follow

- Always use higher time frame

- higher time frames, like H4 and daily, give better overview where the supply and demand zones are

- You will have much better and more reliable supply and demand zones with higher time frames

- Make a rectangle on the chart to mark the supply and demand zone which will give you a better view of the zones on the chart. Use different color to easily make the difference between chart background and supply/demand zones

- Find the strong price moves of the supply and demand zone

- when you find strong candles forming after the breakout of the supply/demand zones you will confirm that the zone is supply/demand zone

- large players, like banks and institutional traders, like to make money on these moves from supply/demand zone and that will be confirmation for you to pay attention to these zones

- having several breakouts from the same zone gives significance to that zone and you can expect the same scenario will happen in the future

- If the price stays inside the range of a price and has long wicks on the upper and bottom side it can mean a bad supply and demand zone. Find narrow supply and demand zone with strong candles breakout

- The number of Base candles indicates the strength of the zone. More base candles, the weaker a zone will be. On the other hand, the fewer number of base candles the stronger the zone will be.

- Beware of bull trap and bear trap

- false breakout from the supply and demand zone with large wicks are stop loss hunting from the institutional traders who catch small traders with tight stop loss

- try to widen the stop loss range, but with good risk to reward ratio

- Large candle at the breakout

- one of the most important things in the supply and demand trading strategy is to watch strong candle breaking the zone

- strong candle means strong imbalance between supply and demand

- the stronger the breakout the better the demand or supply zone

- zone with strong breakout will have future potential of being a good entry point as a supply or demand zone because of left interest which was not filled at the first breakout

- Zone is new

- if the supply or demand zone is created for the first time then it means it will have potential more than old ones

- old zone was broken in the past and if tested several times it will lose its strength because old orders become filled and zone becomes weak

- zone tested several times will lose its value and it should be avoided in trading

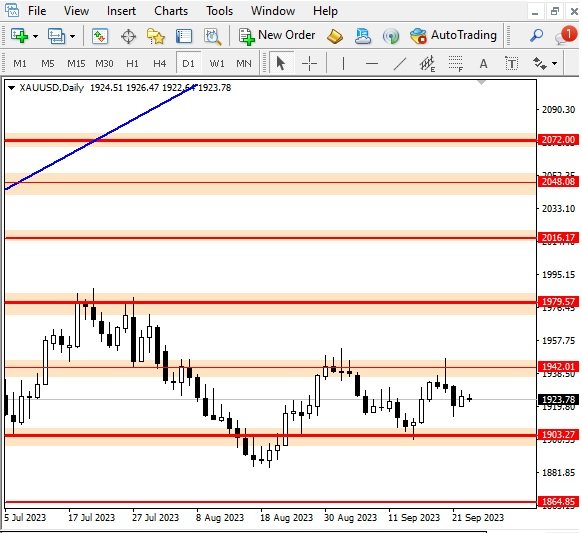

A Real Example of Supply and Demand in Forex

In this section I will show you how supply and demand are formed on the chart and how to stop them and trade them.

Earlier I have explained the supply is when you have a lot of sellers on the market who want to sell the currency pair.

That means the price is meant to move down.

When you have high demand that means you have a lot of buyers and the price is meant to move higher.

Now, when you have a balance between supply and demand, meaning there is a similar amount of sellers and buyers, the price will move in a range. That means it will not move up or down significantly.

It can move a little down and then return back up. And move like that for some time.

When imbalance between supply and demand happens the price will move outside of the price range. The price will break outside of the price range.

If the supply is stronger then the price will move down from the price range. There are more sellers than buyers so the price starts to decline.

In this case you can see how supply and demand zones are formed on the chart and the price is bouncing from them.

When the price comes to the supply or demand zone it bounces by creating a Pin bar and then moves in the opposite direction.

When the price bounces between these two price levels you can see it makes a range I have mentioned earlier. This means price cannot find enough strength, meaning sellers or buyers are not strong enough to push the price in their direction.

The chart also has red lines that represent horizontal support and resistance lines. The supply and demand zones are created around them.

If you want to learn more about demand zones and how to create them you can join the trading community.

Conclusion

If you are a beginner in trading or you need to learn a trading strategy the supply and demand is a must. It is a foundation of trading analysis because it has no indicators, but pure technical tools like support and resistance lines with a zone around them.

0 Comments