If you are using sell stop order in Forex then you are one of the proffesionals in trading.

If not, then you should learn what is sell stop order so you can take advantage of it in your trading.

It is a tool that will help you minimize entry mistakes and it will offer you more precise entry trades.

Contents

What is Stop Order

There are two stop Forex orders types, buy and sell. Buy or sell stop order have logic in a way that current price on the market must first reach that level in the direction, buy(bull) or sell(bear) and then order will be triggered.

That means when you want to use Buy Stop order market price must move in bull direction(long – UP) from current position and when price reaches certain level you have defined, a level at which you have set pending buy stop order then order will be triggered.

When you want to use Sell Stop order market price must move in bear direction(short – DOWN) from current position and when price reaches certain level you have defined, a level at which you have set pending sell order then order will be triggered.

Let me explain this on the examples. It will be easier to understand.

What is a Sell Stop in Forex

As explained above, stop order is when you wait for the price to reach a certain price level and then continues moving in that direction.

Sell stop order in Forex is the case when you have price falling down or rising up. The price of a base currency is losing value or gaining value.

It is not mandatory that the price moves down or up for a sell stop.

On one level you expect the price will continue moving in the same direction. You expect that the price will continue and it will move DOWN.

The change will be from bullish sentiment to bearish sentiment or if the price is already in bearish sentiment it will continue to stay like that.

On the level where you expect the price will continue to move down you open the sell stop order and wait for the price to come. When the price reach that level it will automatically activate and you will have open order. There is no need to sit in front of your computer or smartphone and wait for the price to activate the sell stop order.

Everything will be done automatically.

If you shut down your PC or smartphone your sell stop order will still be activated. The reason is that your order is sent to the broker server and your sell stop order details, like entry level, stop loss and take profit level are saved on the server.

Those data are not saved on your PC or smartphone so there is no worry they will be cancelled once you turn off your PC or smartphone.

Sell Stop Order Stop Loss

Sell stop order can have other details set like stop loss and profit level. Stop loss is very important because you do not want to have sell stop order activated without stop loss.

If the trade becomes a losing trade you want to cut your loss and have the sell stop order closed.

If you do not set a stop loss you can expect that the price will not continue moving in the same direction and you can lose your money. Without stop loss the only level that can close your order is margin call.

Margin call will be activated when your account balance loses the majority of the money. That is not something you want to happen to you.

Sell Stop Order Profit Level

Profit level is also good to set because if you are not following the market when your sell stop is activated you can expect that the order will close when the price reach target level.

Without a profit level set, it can happen that the market continues moving in the right direction and reaches your target level, but it does not close because you did not set take profit level. Then the market can change the direction and reach your stop loss level.

That is the case you do not want to happen. The case when your order is profitable and then close as losing one.

To avoid that you should always set a profit level so you make money instead losing money.

How to Open Sell Stop Order

On the image below I have made one example to simplify whole process of Sell Stop order.

Think in this way when you want to explain to yourself how Sell Stop order works.

If you want to Sell EUR/USD currency pair in the future at the price that is lower than current market price(example – 1.12778) you will activate Sell Stop order. Meaning, you expect that market will move in bear(DOWN) direction when EUR/USD price reaches level 1.12110.

This way you expect by your trading strategy that pair must come to 1.12110 level and then price will continue to move down. If price does not reach that level you do not expect that it will continue to fall and your trade will not be activated.

How to Open Sell Stop Order in Metatrader 4 – Example

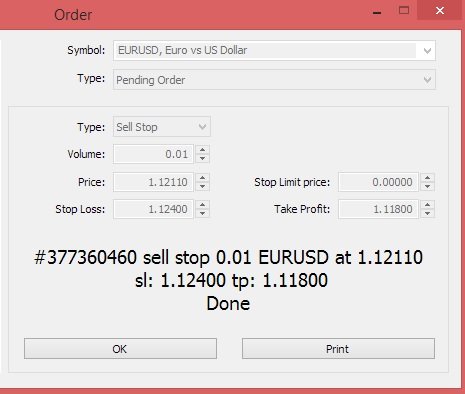

Now let’s see how does it looks like when you want to open sell stop order in Metatrader 4 trading platform.

You need to select new order on the Metatrader 4 and order window will open. Here you need to select:

- Order Type

- Pending Order

- Type

- Sell Stop

- Volume

- which lot size do you want to open

- Price

- at which price order will open

- Stop Loss

- at which price your order will close if order becomes losing trade

- pay attention that stop loss must be above price you have set to open sell stop order

- Take Profit

- at which price your order will close if order becomes profitable one

- pay attention that take profit must be under price you have set to open sell stop order

Those are main conditions you need to fulfill before you can open order. When you have entered correct data you will have “Place” button available to select. If some of the data is not correct you will not be able to select “Place” button which is helpful.

Why?

It says to you that there is error in entered data.

Sell Stop Order Example

Mostly error is in Price or Stop Loss/Take Profit levels because traders cannot understand how to enter correct values for Sell Stop order.

When you entered correct data and activated “Place” button you will get confirmation message as image below. It says to you that you have placed sell stop order at specific price with SL(Stop Loss) and TP(Take Profit) levels.

You need to confirm message by pressing “OK” button.

When you take a look into chart you will see your sell stop order. There is three lines on the chart indicating your sell stop price, stop loss and take profit levels.

As you can see my sell stop price(1.12110) is under current market price(1.12801), my stop loss(1.12400) is above sell stop price and take profit price(1.11800) is under sell stop price.

I am expecting that price after it hits my sell stop order at 1.12110 it will continue to fall DOWN and when it hits 1.11800 order will close and I will earn money.

Know that you can close your order whenever you want. You do not need to wait for take profit level or the price hits your stop loss.

If you are watching the market live and you see that the market could reverse or change the direction earlier than you thought at the first time, you just open the order window and close it.

That way you react earlier if you see possible problems and take the profit before it hits your stop loss or you can prevent bigger loss if the trade becomes losing trade.

Sell Stop in Forex – Expiration Date

As you can see at the beginning of opening a sell stop order in Forex you have the possibility to set an expiration date.

That is the setting that will close your order if your order does not open up to that date.

For example, if today is 01.02. and I set the expiration date to 15.02. the trading platform will close my order if the price does not reach my entry level.

This is useful for you because you can cancel the sell stop order if the price does not play as you thought it could.

Your strategy for sell stop order can be valid for a day or few days. And to prevent some problems in the future after your strategy is no more valid you use the expiration date to close pending sell stop orders.

Conclusion

Sell stop order in Forex is a very good tool to have.

You can use sell stop whenever you think that there is a level the price must first pass and then you expect it will continue moving in that direction.

Sell stop order have other details like stop loss and profit level which you should use each time to use the most of the sell stop order.

One of the strategies you can use to set sell stop order is to place them on the breakout. Breakout is when the price breaks one level and it continues moving in the break out direction.

That level will give more chances to sell stop order being a profitable trade.

0 Comments