Bid and Ask price in Forex market are two prices you see on the chart in the Forex trading platform. Bid and Ask price represents the price you will enter into trade when you open buy or sell order.

When you open a buy order you will pay the Ask price which is higher than Bid price.

When you want to open a sell order you will pay the Bid price which is lower than Ask price.

What is important is that you need to understand that you as a trader buy or sell Forex currency pair from the market maker or a Forex broker who is acting as a market maker.

So, when you see Bid and Ask price you need to understand is the Bid price for you or is it for the market maker.

And, is the Ask price for you or it is for the market maker.

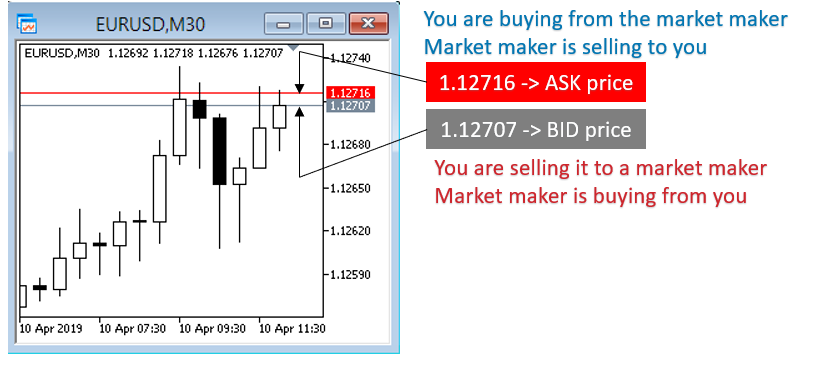

Below you have an image where you can see that when you buy at Ask price at the same time that means market maker is selling to you.

And when you sell at Bid price at the same time that means the market maker is buying from you.

You always end up with a “bad” price which is the cost you pay. This will be explained further in this lesson.

Contents

How to Understand Bid and Ask Price

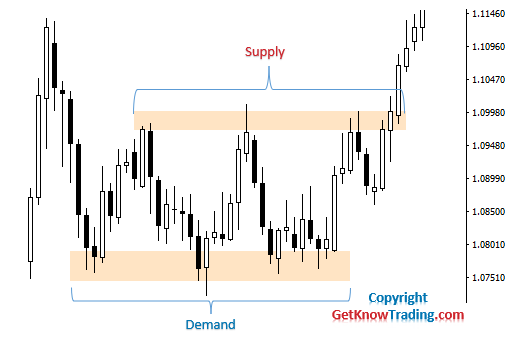

Bid and Ask price are determined by the market. They are defined by the participants on the Forex market or any other market.

Both prices will move up or down depending on the supply and demand on the market.

If the demand outperforms supply, that means the price of a bid and ask price will move up. Because the market participants are pushing the price upwards.

When there is more supply that means the price will mode down because the market participants are pushing the price down.

What Bid Price Means?

If you are a market participant, and you can become one if you start trading on the Forex market, you will sell the currency pair at the bid price.

That is the price someone is willing to buy from you that currency.

If the broker as a market maker is on the opposite side of a trade then they will offer you a bid price as a price they are willing to buy the currency pair you wish to sell.

How is Bid Price Calculated?

The bid price is calculated by subtracting the Ask price with spread.

Bid price = Ask price – Spread

In case where the Ask price is 1.12716 and spread is 0.9 pips then the Bid price will be:

Bid price = 1.12716 – 9(pipette)

Bid price = 1.12707

Bid Price With Example?

For example, let’s say you want to buy a EUR/USD pair where the Ask price is 1.12716 and Bid price is 1.12707.

The price you will pay will be the Ask price because someone on the market is ready to sell you that pair for that price.

At the start you will be in minus for the spread which is the difference between bid and ask price.

So, you need to wait until the Bid price(1.12707) reaches your entry price which was the Ask price(1.12716).

When that happens you will be at 0. No profit and no loss.

If the price continues to move up you will make money.

But, what or who will move the price up so you make money?

Lets say your friend comes to the market and wants to buy the EUR/USD pair. There is someone who is willing to sell the EUR/USD pair at 1.12717.

So, your friend buys the EUR/USD pair. And the price of EUR/USD increases for the spread amount and that is 0.9 pips or 9 pipette.

Now you have Bid price at 1.12716 and Ask price at 1.12725.

If you sell now you will make no money because the Bid price is at the price which is equal to you being at zero. No loss.

But, if you wait for some time and more buyers come to the market and they push the price higher you can exit from the trade with profit.

So, it all depends on the supply and demand on the market.

What Does Ask Price Means?

Ask price means what is the price someone is willing to sell the currency pair to you. And that means the price you want to buy the currency pair at.

If the broker is a market maker he will offer you the Ask price he is willing to sell you the currency pair.

How is the Ask Price Calculated?

The Ask price is calculated by adding the spread to the Bid price.

Ask price = Bid price + Spread

In case where the Bid price is 1.12707 and spread is 0.9 pips then the Ask price will be:

Ask price = 1.12707 + 9(pipette)

Ask price = 1.12716

Ask Price With Example?

For example let’s say you want to sell EUR/USD pairs where Bid price is 1.12707 and Ask price is 1.12716.

The price you will pay will be Bid price because someone on the market is ready to buy from you that pair for that price.

At the start you will be in minus for the spread which is the difference between bid and ask price.

So, you need to wait until the Ask price(1.12716) reaches your entry price which is Bid price(1.12707).

When that happens you will be at 0. No profit and no loss.

If the price continues to move down you will make money.

But, what or who will move the price down so you make money?

Lets say your friend comes to the market and wants to sell the EUR/USD pair. There is someone who is willing to buy the EUR/USD pair at 1.12707.

So, your friend sells the EUR/USD pair. And the price of EUR/USD declines for the spread amount and that is 0.9 pips or 9 pipette.

Now you have an Ask price at 1.12707 and Bid price at 1.12698.

If you buy now you will make no money because the Ask price is at the price which is equal to you being at zero. No loss.

But, if you wait for some time and more sellers come to the market and they push the price lower you can exit from the trade with profit.

So, it all depends on the supply and demand on the market.

What Is the Difference Between a Bid Price and an Ask Price?

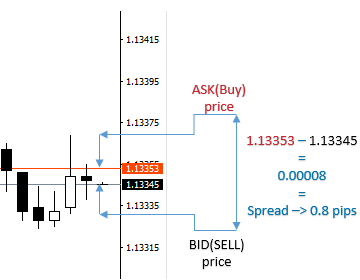

Simply said the difference between bid and ask price is spread. It is the cost you pay to the maker or broker.

The difference between bid and ask price is fluctuating all the time so the spread can vary. But in some cases brokers offer you a fixed spread where the difference between bid and ask price stays all the time the same.

Usually there is variable spread which depends on the market conditions.

If the market experiences news related to the currency that will have an impact on the spread.

The difference between bid and ask price will increase which will make trading more expensive.

If that happens you should wait until the price returns back to normal and the difference between bid and ask returns to acceptable value.

Who Benefits from the Bid-Ask Spread?

Then only one who has benefited from the Bid-Ask spread is the market maker. That means the broker you are trading with.

If the spread is wider the broker will make more money on each trade you open. So they are trying to widen the spread as much as possible.

But, they need to be careful because if the spread is too large then the traders will avoid trading that currency pair. Because the cost of the spread is too expensive.

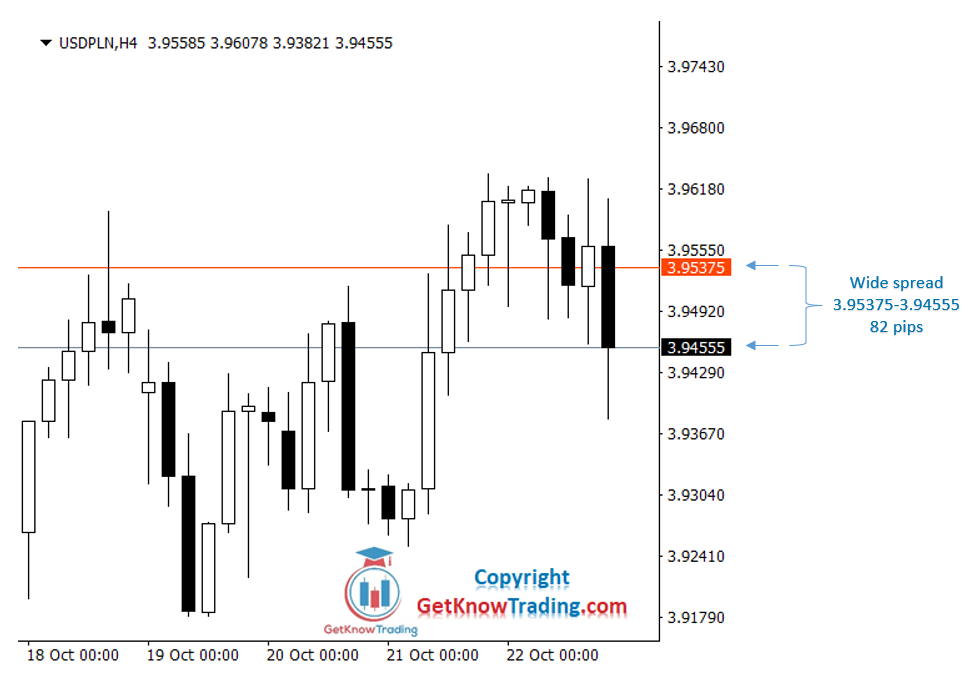

Below is an image with high spread which makes the pair expensive for trading.

The broker tends to lower the spread as much as possible to attract more traders who are willing to trade and with more traders they will make more money.

More trading at the end will cover small spreads where they make more money.

Bid-Ask Spread Costs

Here is an example of how they make money.

Usual spread is around 1 pip on EUR/USD. If you open 1 standard lot which means 1 pip equals to $10.00 the broker will make $10 per each trade.

1 standard lot = $10/1 pip

If you open 10 trades per day the broker will make $10 per each trade.

10 trades = 10 pips x $10.00 = $100

The broker makes $100 from you just allowing you to open a trade.

If you increase the spread to 2 pips then the broker will make 2x time more. And that is $200 on 10 trades you open.

Your job is to find a broker that has an acceptable spread cost and that means less than 1 pip which will make trading less expensive.

The other way to lower the spread cost is to find and select currency pair that is traded often because they have the lowest spread. Those are currency pairs that are more liquid.

What Does It Mean When the Bid and Ask Are Close Together?

Bid and Ask price close together means lower spread and lower cost for trading.

But, one more thing is good to know when the Bid and Ask price are close together or wide.

In case when the bid and ask price are close it means the currency pair is liquid and it is easy to get out from a trade.

Below you have an example of EUR/USD currency pair where the bid and ask price are close. The difference is only 0.9 pips which is great.

When you enter into the trade you can expect the price will move and if it moves in your direction you will make money. You will not need to wait days until the price reaches your entry price.

And the cost of 0.9 pips on one standard lot is only $9.

1 standard lot = $10/pip

0.9 pips x $10 = $9

In other scenarios when the bid and ask price are wide it can happen you cannot get out from a trade.

That is when the price does not move enough to reach the desired price when selling or buying.

In the example below you see the price of bid and ask price is wide and it has 82 pips of spread.

Imagine how to get out of that trade if you open an order. You would need to wait a long time until the price reaches your entry price and then wait until it moves in your direction.

That is why it is important to have the currency pair with bid and ask price close together.

The cost you would pay to enter into a trade on this pair would be:

1 standard lot = $10/pip

82 pips x $10 = $820

Not such a smart idea to trade this pair.

Should I Buy at Bid or Ask Price?

Should you buy at bid or ask price is not open for discussion because the market defines the entry price.

You buy at the Ask price which is defined by the market. If the price does not fit your requirements then you can wait until the price falls down to the price you are willing to pay.

The same is for selling at bid price. You can sell at Ask price which is determined by the market.

If the Bid price is not acceptable for you then you can wait until the price rises in value and then you sell at the higher bid price.

What is Best Bid and Best Ask?

If you wonder what is the best bid and what is the best ask price then it all depends on you.

If you are satisfied with the price you see on the chart then those are best bid and ask prices.

But, there is one more thing you can use to filter and get the best bid and ask price.

If you want to buy at the Ask price you should wait until the price of a currency pair falls down. That way you will enter into the trade with the best possible price and where you expect the price to rise in value.

If you want to sell at the bid price then you should wait until the price of a currency pair rises in value. Then you can open a sell order at the top of the market where you expect the price will fall down.

Conclusion

At the end what is good to know about bid and ask price is that they define what price you will pay if you want to buy or sell a currency pair.

The one whom you are trading with is the market maker, broker or other participants on the market. If they are willing to buy or sell currency pairs from you then you will make a trade.

Your goal is to find the currency pair with lowest spread and that means with the lowest difference between bid and ask price.

That way you will lower the cost you pay on each trade.

This article is part of the large tutorial about Forex order types.

0 Comments