Free margin as one of Forex trading basics is crucial thing you need to know. You need to know what is and how does it change, so you can make a trading plan accordingly.

If you do not watch your free margin level you can expect that you will not be able to open the trade when you want.

Free margin have direct impact on your trading and your trading results, so it is advisable to learn all about it.

Contents

What Does Free Margin Mean in Forex

Meaning of Free Margin in Forex is the the amount of margin that you can use to spent on the other orders.

If you have already read what is margin in Forex, then you know that margin is fixed amount your broker takes from you. That amount you cannot use to make a trade, but you use the amount that has left to open the trades.

The amount you have when you remove margin that is used by your broker is the free margin you will use to open orders.

If you spent all the free margin amount it will mean that you cannot open any new orders. That limit will be removed if you increase your balance by investing more money or by having profitable trades that are currently open.

If that is to abstract to you to understand then read further and I will explain to you all what you need to know.

What is a Free Margin in Forex

Free margin refers to the rest of the amount left after the used margin is deducted from the equity.

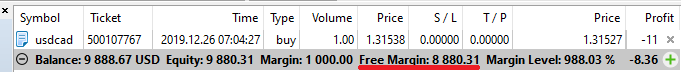

Here is an example from the image below where I have one open position with $9,888.67 balance.

How to Calculate Free Margin in Forex

How to calculate free margin in Forex is done through some math. You can calculate free margin just by looking on the Metatrader 4 trading platform and make calculation in your head or by allowing trading platform to do that for you.

You need to take two numbers to calculate free margin in Forex. I have made simple example to show you how to do it.

Used margin is $1,000 and rest of the money is free margin to open new position.

Free margin = equity – margin on open positions

Free margin = $9,880.31 – $1,000

Free margin = $8,880.31

Free margin represents the amount of money that is free to use for new positions. If I want to open new trade, one part of free margin amount would be used to set aside as a margin.

When I open new trade, margin will increase from $1,000 by certain amount that is defined by the margin percentage requirement.

Second Trade for Free Margin Example

Here is another trade where I have open the trade to demonstrate you how does the margin and free margin change when the new order is open.

I have open another trade with 1.00 lot and here is how free margin is calculated.

After I have open new position my Free Margin is decreased by $1,000. That is the amount my Margin is increased, from $1,000 to $2,000.

Now I am left with $7,874.23 for new trades if I decide to open them.

Free margin = equity – margin on open positions

Free margin = $9,874.23 – $2,000

Free margin = $7,874.23

Free Margin is Floating Value

Have in mind, and that is shown on examples, that free margin is floating. Meaning, the amount varies as the trade results varies.

If my trades are profitable then my equity will increase. When the equity increases then the free margin will increase.

That means I can open more trades because I have free amount of money for more margin.

When the trades are losing ones my free margin will decrease because the equity will decrease. That will leave less space for me to open new trades.

Here is FREE PDF for Margin with live examples where I show you how free margin changes when the trade is profitable and when the trade is losing one. There you will see examples how to calculate free margin in Forex.

Try not to spent all free margin on open trades because if your trades become losing ones you will soon get margin call.

Conclusion

Free margin in Forex is important topic to understand. How the free margin is calculated is also important thing to know.

Without knowing basics about free margin in Forex you can bet that you will lower your trading results. By knowing and understanding free margin you will be able to plan future trades you plan to open.

When the free margin is spent you will be closed automatically by your broker because of margin call.

Free margin is used to allow you to open new trades when you already have some trades open. Your job is to make free margin large enough to sustain your trading.

If you have losing trades, your free margin will decrease which will leave less space for new trades. When your trades are profitable you will increase free margin which will allow you to open more new trades.

0 Comments