This post will cover pip range in Forex market where I will explain what is pip range and what is pip range on different time frames and on trading sessions.

Pip range is an important topic because the pip in Forex trading basics is the main point you need to know in order to make money.

How much pips a certain Forex currency pair moves daily or on another time frame is important. If you know what is pip range on different time frames you will know when to trade to extract the most from the Forex market.

Contents

What is Pip Range in Forex

Pip range in Forex is the number of pips in a certain time frame. That means how much pips the currency pair changes in a specific time frame.

First of all you need to know what is pip in Forex in order to know what pip range is. The pip is the smallest change in the price of a currency pair.

When you see a tick change on the Forex trading platform that tick can be a change by one pip. I say it can be a pip, because there is a smaller point than a pip in the price change and that is the pipette. The pipette is 1/10 of a pip.

Now, when you know what is a Pip you can follow further on

Example of a Pip Range in Forex

The range of a pip in Forex defines how much pips was the difference between maximum and minimum price of a currency pair.

Maximum price – Minimum Price = Pip Range

So, for example if the price of the EUR/USD currency pair had a maximum of 1.1234 and the minimum was 1.1224, then we have a difference of:

1.1234 – 1.1224 = 0.0010

The difference is 10 pips. We can say that the range is 10 pips.

But, one problem here is that we do not know in which time frame is the difference.

The difference of 10 pips can be in one minute. In one minute the price of a currency pair can change a lot.

When you want to say what is the pip range of a certain currency pair you need to say in which time frame.

The pip range in Forex is connected to time frame or there is no meaning saying number of pips.

Meaning of Pip Range in Forex

As I have shown you, the pip range in Forex means the difference between maximum and minimum in certain periods of time.

Pip range means how much the currency pair price changes in one minute or in one day.

The pip range is very important for traders because traders can know if it is worthy to trade the currency pair.

That means the pip range of that currency pair allows the trader to make money. Making money on the Forex market is done with a number of pips. Each pip in the right direction gives a certain amount of money to the trader.

If the currency pair has a large pip range that means the trader can make a lot of money. If the pip range is 100 pips per day, the trader can make $100 if the pip value is equal to $1.00 and if the trader predicts the correct direction of the price.

Daily Pip Range in Forex

The pip range and the time frame plays a role for the trader that trades on the daily basis.

That means, if the trader trades only once per day and a few times per week, for him it is important to know what the daily pip range is.

If he knows that the currency pair is moving 100 pips per day he can put the stop loss around 100 pips. That means, the pip range helps him to know that the price probably will not hit the stop loss on that day.

Why?

Because usually the price moves 100 pips per day. So it can happen that the price will move less than 100 pip on a certain day and his stop loss will not be hit if he does not predict the correct direction.

Daily pip range in Forex helps traders to define whether they trade that currency pair or not.

Daily traders look for the pairs that have good pip range because large numbers of pips in a day can offer them a nice opportunity to make money.

If the daily pip range is low, and that is from 5-20, there will be no so many opportunities. If you enter into the trade in the middle of a range of 5-20 pips, that means you enter around 10-15 pips from the open price.

The spread you will pay to enter into the trade can make your trade lose trade. If the spread is 5 pips that means you will need to wait several days for the price change in order to get even on that trade.

But when the pip range of a currency pair is 50-100 in a day then you can enter into the trade with 5 pips spread. You know that the price moves up or down for at least 50 pips and you can make money.

Four Hour Pip Range

Four hour pip range in Forex is usually used by the intraday traders. Intraday traders look for the opportunities on smaller time frames.

They are looking for the pip range that is around 20-50 pips. That amount of pips in a four hour time frame gives them a nice chance to make money.

Some currency pairs have more than 50 pips in a four hour time frame and those are pairs that are pretty volatile in Forex.

Pip ranges on smaller time frames, like four hour or less, varies from 10-60 pips. That depends on the currency pair where major currency pairs have a nice pip range and minor pairs have smaller pip range.

You will see exotic currency pairs that have large pip ranges because of their volatility. Those pairs usually have large spread which makes them less attractive, but still possible to trade and make money.

Trading Session Pip Range in Forex

The pip range depends on the Forex market structure. If there are many participants you can expect more volatility.

When there is a high level of volatility the price will change its value very often because many traders are trading the pair.

With high volatility there is a larger pip range on the currency pair. The amount of traders that are active on the market depends on the time in day.

While the Forex trading session is open five day in a week and 24h per day you have certain periods of time in a day when you have traders from the Asian and Europe trading the market.

There are times when European traders are trading and when U.S. traders are active.

Those times are overlap periods. Overlap periods are when two trading sessions overlap. That means we have London trading sessions and New York trading sessions active.

At that time the pip range in Forex increases because many traders are active. During overlap time you can have a much larger pip range than in time when there is only one trading session active.

Pip Range Example During Session Overlap

For example, on Asian sessions you will have less volatility than during on overlap between Asian and European sessions.

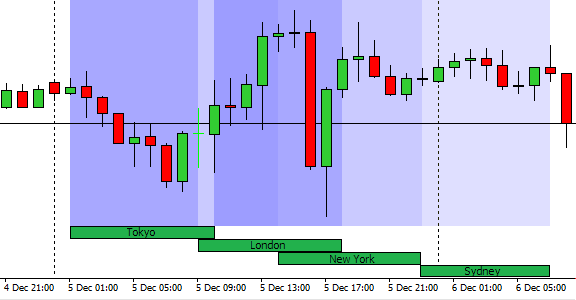

Take a look at the image above. The image shows what are the times when each trading session is active.

Now, take a look how the pip range on EURJPY currency pair increases when we have overlap between Asian and European trading session.

Image below shows the pip range, and that is the amount of pips between maximum and minimum price, during 02:00h – 04:00h increases because of overlap between European and Asian session.

Pip range has increased from 13 pips up to 21 pips. It is not a large increase, but it is an increase.

If you take a look at other sessions, the pip range increases even more.

During time from 14:00h – 18:00h we have increased in pip range from 22 pips up to 29 pips. Increase is because of overlap between sessions.

How to Calculate Pip Range in Forex

There are two ways to calculate pip range in Forex. First way is having a trading indicator which you activate on the trading platform and indicator list pip range in a specific time frame.

Second way is manual where you can take the desired time frame and see what is maximum and what is the minimum price of the currency pair.

You calculate the difference between maximum and minimum of the price and the result is the number of pips or pip range.

Here is an example on how to manually calculate pip range.

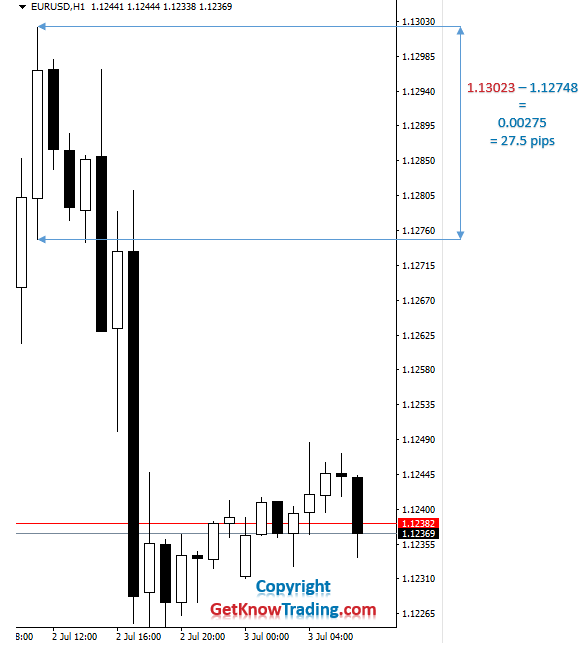

Image below shows you EUR/USD currency pair on H1, one hour, time frame.

I have picked one candle and read the maximum and minimum price. The difference between those two prices is the pip range. The range in which price has moved in one hour time frame.

The example above was a pip range for one candle. If you want to have a pip range on average for several candles the image belows shows how to do it.

I have taken four candles and read the minimum and maximum price. Then I calculated the pip range for each.

Average Pip Range

The average pip range for those four candles is calculated as the average value between four values.

In this case the average pip range is 16.12 pips.

Average pip range means that you can expect the price will move on four candles in a row for 16.12 pips.

This is a simple example and to get a more precise average pip range you need to extract a lot of data from the chart to get the best results.

If you want to have an average pip range for a specific time frame, you need to use many candles in that time frame and see what the average pip range is.

If you want to have an average pip range in trading sessions, for example London session, you need to calculate many London session candles and see what is pip range for each session. Then calculate average by standard mathematical formula.

Conclusion

As a conclusion we can say that the pip range depends on the time when the trading is active. The difference between maximum and minimum price of a currency pair is defined as pip range in Forex.

Pip will increase on trading session overlap and when more traders are active. Major pairs will have larger pip range than minors because they have more traders. More traders are active on major pairs because it is more attractive to trade.

The pip range is useful information to know in order to focus and trade the pair to make more money.

Pairs with small pip range will not offer too many opportunities so it is smart to follow pairs with higher pip range.

Read more about how big the Pip Range is for trading pair:

Read more:

- EUR/USD Volatility – Pip Range Analysis

- GBP/JPY Pip Range Analysis – Account Widow Maker

- GBP/USD Pip Range Analysis – Cable Connection

- EUR/GBP Pip Range Analysis – Forex Under the See Level

- EUR/JPY Pip Range Analysis – Euro Japan Samurai

- EUR/CHF Analysis-The Biggest Crash in the Forex History

- USD/CAD Pip Range Analysis – Oil UP Pair DOWN

- USD/JPY Pip Range Analysis – Ninja Pair

- USD/CHF Pip Range Analysis – Swissie

- AUD/USD Pip Range Analysis

- AUD/JPY Pip Range Analysis

- NZD/USD Pip Range Analysis

- What is Meaning of XAU in Forex

- What is Meaning of CFD in Forex

- What is GU in Forex

- What is GJ in Forex

0 Comments