What is margin in Forex is a very important question when the Leveraged trading is used. I have explained what is leverage in previous post if you are not familiar with the Leverage.

If you need to learn more about other basic terms you should read Forex trading basics.

Margin in Forex is used always when the trade is open through Metatrader 4 trading platform or any other trading platform on leveraged account.

The trading platform consist of few margin levels that are calculated automatically.

They are:

- Margin

- Margin level

- Free Margin

The margin amount broker use to open the trade on the Interbank market. He does not use only your margin but also margin from other traders and with large margin he puts the trades on the Interbank market.

In this post I will explain all the terms related to the Margin. I will show you examples so you understand how to read the Margin details.

Knowing how to read the margin details is important because margin have impact on your trading.

Even though margin is not easily understandable just by looking into the numbers in the trading platform I will show you the math behind the numbers.

If you want to open a trade or few trades, you need to know will you be able to open them. Margin will give you answer can you open them and how much of them.

After reading this post you will see why is important to know what is Free Margin or Margin level in Forex and how they impact on the decision can you or you cannot open new trade.

Contents

How to Calculate Margin in Forex

To calculate margin in Forex you should use the following formula:

Margin Requirement = ([BASE Currency / Account Currency] x Units) / Leverage

I will take one example and show you how to calculate margin in Forex.

Margin Requirement = ([1USD / 1USD] x 100,000) / 100 = 1,000

The calculation is done by the metatrader trading platform. You do not need to bother with the calculation but it is good to know if you want to know how to calculate the margin in Forex.

Manual calculation is useful if you want to know earlier how much of money your broker will set aside as collateral. The rest will be free as a free margin for new orders.

Why You Need Margin in Forex

Why would you need Margin in Forex?

In order to open leveraged trade where you control more money than you have invested on your account, you need to have margin.

Margin is a piece of money you have invested that is set aside by the broker just as a collateral.

The broker use the margin when you open a trade. The amount the broker use as a collateral depends on the trade size. When you increase your trade size or open more trades at the same time, the margin amount increases.

Typical margin requirements and the corresponding leverage are listed below:

| MARGIN REQUIRED | MAXIMUM LEVERAGE |

|---|---|

| 5.0% | 1:2 |

| 3.33% | 1:30 |

| 2.0% | 1:50 |

| 0.5% | 1:200 |

What is a Free Margin in Forex

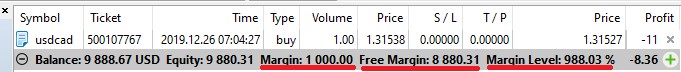

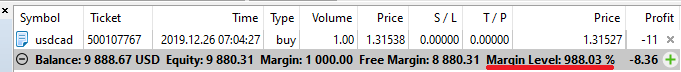

Here is an example from the image below where I have two open positions with $9,888.67 balance.

Free margin refers to the amount that is left after your margin is deducted from the “Equity”. Pay attention that the free margin is not fixed value like Margin.

Free margin change the value as your “Profit” changes. If you have negative Profit then your free margin will decrease.

What is Margin Level in Forex

Margin level in Forex tells the trader how much of their funds are available for new trades.

The lower the margin level, the lower the amount of cash available to trade and this is where an account could be open to a margin call.

How to Calculate Margin Level in Forex

If you want to know how to calculate margin level in Forex you should use the following formula:

Margin level = (equity / margin) x 100%

In the example from the image we have margin equal to 1,000. If I put this value into the formula I will get:

Margin level = (9,880.31 / 1,000) x 100% = 988.03%

To calculate margin level you have seen that the margin depends on:

- leverage used on the trading account

- lot size used

The margin level depends also on used leverage and lot size, but it also depends on the numbers of the trades currently open.

If you open several orders your margin will increase which will decrease the margin level.

The example with two open orders shows that the margin level is decreased and it is half of the previous margin level where I had only one trade open.

When the margin level comes to near 100% you will not be able to open more position. That means you will soon get margin call if the market moves against you.

Margin level on 100% means that you have spent all free margin and there is no space to sustain more loss on your account.

Without free margin the next thing that can happen is close some open positions and free some space for free margin or close all positions and start again with new trades.

What is a Margin Call in Forex

Margin call in Forex is the term used when the broker start to close your open position because you do not have any free margin left to sustain your losing trades.

It is a way how broker protects the margin secure.

In the example above you can see that I have $7,874.23 of free margin. That amount is used to sustain my open trades. If the trades become losing ones my free margin will decrease.

When the free margin is wiped out with my open trades then the broker will try to protect my margin. My margin in the example above is $2,000.

Broker will try to close one open position to lower the required margin.

If that happens and my second trade is closed then I would have $1,000 as a margin, and free margin would get $1,000. This would leave me more space for one left position.

If the last trade continue to decline and I spent the rest of free margin, the $1,000 I got when the second trade is closed, the broker would initiate again the margin call.

The margin call would close my open position and I would be left with $1,000 on my account. Those $1,000 on my account would be returned from margin to open new trades.

Next time when I open new order I will have smaller margin but I will also open the trade with smaller lot size. That is because my account size with $1,000 is not enough for larger lot size.

You need to do your best to avoid getting margin call.

The Difference Between Forex Margin and Leverage

The formula for margin calculation shows the connection between leverage and margin.

Margin Requirement = ([BASE Currency / Account Currency] x Units) / Leverage

Here are few examples of margin with different leverage so you can understand where the connection is.

Example 1:

- Leverage = 1:10

- account currency = USD

- base currency = USD

- Units = 1 standard lot, 100,000 units

Margin Requirement = ([BASE Currency / Account Currency] x Units) / Leverage

Margin Requirement = (1USD/1USD] x 100,000) / 10 = 10,000

Example 2:

- Leverage = 1:100

- account currency = USD

- base currency = USD

- Units = 1 standard lot, 100,000 units

Margin Requirement = ([BASE Currency / Account Currency] x Units) / Leverage

Margin Requirement = (1USD/1USD] x 100,000) / 100 = 1,000

Margin Impact on Leverage

The conclusion is that the higher leverage requires lower margin.

Have in mind that the margin is the amount which will be left on your account if you get margin call.

If you want to be left with more money after the margin call is activated then you should plan to have larger margin. That means you need to select lower leverage on your trading account.

Conclusion

Margin is the topic you need to know when trading on the Forex. As you can see the trading platform have 3 margin levels that shows you the money you can use when you open the trade.

It means that the margin cannot be left out because it impacts on your trading results.

Here are three important facts you need to remember:

- Margin

- the amount broker use as collateral

- Free margin

- level that tells you how much money you have free for new orders or current order if the market moves in wrong direction

- Margin level

- level in percentage that tells you how much of free margin you have left for new orders

- Margin is close connected to the leverage

I know that it is much easier to understand through examples so I have made PDF with real examples.

The FREE PDF for margin contains example:

- when I have orders with different lot size and how the margin works in that case. How much margin do you have and how it changes when the market change direction in your favor or when it goes against you

- when I change the leverage on the account and how the margin changes

- how the free margin behaves when the market moves in my favor and when the market moves against me

- what is good to do when you are close to margin call

- how to prevent getting margin call on your trading account

0 Comments