Leverage in Forex is the third part of the three main parts in Forex trading basic knowledge.

Pip and Lot size or Volume are the first and the second part.

I am sure you as a beginner or experienced trader have been in a position that you do not know what is leverage and how does the leverage works.

I was in that situation were I know that the leverage is something that comes with Forex trading but did not know what for.

When you open trading account you always select which leverage you want to have. I always have selected the largest possible.

I assume you did it also like me. The higher leverage the better.

Well, if you did not know what is leverage and which one to use I have made this post just for you.

I have struggled to understand what is leverage in Forex and how should I use and select leverage. Now I am showing it to you.

I have used real examples on trading accounts with different leverage just to explain it to you in a way that is clear and easily understandable. You will see in real situation how leverage impacts the trading result.

That way you will see why it is important that you know what is leverage in Forex. Which leverage in Forex is the best for you so you can be profitable trader. How to reduce the risk in Forex trading by selecting appropriate leverage.

And at the end you can download free PDF with important facts about the leverage which you should remember.

Contents

What is Leverage in Forex

Leverage in Forex is borrowed money from the broker. It is virtual money that allows you to trade higher volumes on each trade.

It is virtual money because that money you cannot withdraw like the money you have physically invested on your trading account.

The leverage always exceeds the amount you have on your trading account. Meaning, if you have $1,000 on your account you will borrow at least several times more than that amount(1:2, 1:3 or more).

The reason why you want to borrow more than you have is, if you want to have borrowed money you will not borrow less than you have because you want to have more.

The Leverage in Forex is a tool that trader can use to increase the value of a pip and to increase the profit or loss on each trade.

Well, the loss should be avoided because you want to be profitable when trading Forex.

How much money you can borrow from your broker it depends on the broker. Each broker have its own offers and rules for trading.

Forex broker offer many leverages and one of the typical ones are leverage 1:100. The ratio 1:100 means you will borrow $100,000 from the broker if you have $1,000 on you account.

Each broker can have certain rules for each leverage. For example broker can request that you have $1,000 for leverage 1:100. For amount of $500 you can have leverage 1:400.

These offers are different from broker to broker.

Logic Behind the Leverage in Forex

The leverage does not give you more money to trade with but it just have impact on the speed at which you can profit or lose money on your trading account.

By the speed I mean having larger leverage you increase your ability to open larger lot size or Volume which then increase the speed of gain or loss on your trading account.

Larger lot size will give you more money by each pip when the markets moves in your direction. See here how to calculate the pip value.

As a conclusion why leverage, lot size and pip are the three main parts of the trading you can remember this:

- Leverage in trading increase the possibility to use higher lot size

- Higher lot size increase the value of each pip

- With higher pip value the pip you win or lose will increase or decrease account balance

What is Leverage Ratio

The leverage ratio represents how much money the trader will get to control on the Forex after he deposit initial money on the trading account.

Minimum margin required for the trader is 1:100 = 1%. This means trader must have at least 1% of the total value of trade available as cash in the trading account.

If the trader wants to trade whole standard lot which is 100,000 units he needs to have $1,000 on his account if he have 1:100 leverage.

1:50 leverage requires margin 1:50 = 2% of the total value of trade available as cash.

In case of equities where leverage is 2:1 or futures 15:1, trader does not have so much opportunities as in Forex trading. The difference between those markets and Forex is that in Forex market volatility is pretty high.

The higher volatility the better chance to enter and exit the trade. That way the Forex trader have more opportunities to earn more money.

Why Does the Broker Offers Higher Leverage in Trading

What do you think why the broker offers higher leverage?

If you have read few sentences above you will see that higher leverage in trading increase the pip value.

Broker earns money through the spread by each trade you open. If you lose or win that trade, broker does not bother with it because he took the money through spread.

If you trade many times and with larger leverage, the spread that is on each trading pair gives the broker more money. They want you to have larger leverage so they can get more money when you open order.

They want that you trade more and more, so in order to push you to trade more they offer you more profit by each pip move through larger leverage.

If you are not experienced and you are greedy, you will accept higher leverage with your hands wide open. But at the end, broker wins on the long run because you will for sure lose money with bad decisions impacted by greed and over trading.

Be smart, and avoid this problem.

How Leverage Works in the Forex Trading

Imagine that you open order with the Volume = 0.01. That means you open trade with the micro lot size.

Each pip will worth $0.1 in case you trade EUR/USD on USD trading account. If you have another currency as deposit currency on your trading account then the value of 1 pip will be different.

If you have a trading plan to earn more money by trading you can calculate how many pips you need if you want to profit $10.

You need 100 pips which is doable but you must find the correct trading pair and predict the right direction of the price.

When you do that then you will earn $10 but that is not a lot.

Maybe you want to earn more?

How Does the Leverage Works?

If you are trading by the pip and the leverage is 1:1, meaning no leverage, you would need a lot of time to earn money.

Why?

If you have invested $1,000 to trade with, you could open only micro or nano lot size which is 0.01 or 0.001. Micro lot size gives you $0.1 on each pip move and nano lot gives you $0.01 on each pip move.

For many traders that amount is not enough so they go for higher lot size. Higher lot size gives more money per pip.

In case of standard lot you would need $100,000 to buy one standard contract of EUR/USD.

Volume = 1.00

One lot allows you to earn $10 by each pip move in case of EUR/USD trading pair and if USD is your trading account currency.

If you do not invest $100,000 you cannot open 1 lot. To make that possible broker offers you leverage.

If you can invest $1,000 you would need 1:100 leverage to get $100,000 for trading with 1 lot. If broker gives you 1:100 leverage you will control $100,000 because 100 x $1,000 = $100,000.

When you have 1:100 leverage you can open 1 standard lot and by each pip move you will earn $10. That is already acceptable but be warned that on your $1,000 account balance you need 100 pip move to wipe the entire balance.

How?

Well, if you open order with lot size = 1.00, each pip will bring you $10. If the trade moves against you by 10 pips you will lose 10 pip x $10 = $100.

Move by 100 pips gives you 100 pip x $10 = $1,000, which is the entire account balance. Move by 100 pips on some pairs like GBP/JPY trading pair is common thing that can happen in 1 minute.

Imagine to lose $1000 in one minute. Yes, that is possible and happens all the time. Some traders lose more than that in few seconds.

But imagine that the trade goes in your favor. $1,000 of profit in just few seconds.

You see that the leverage can be good if the trade moves in your favor, but if it moves against you, you will not survive too long in the market.

Double edged sword

To prevent that from happening you need to select the correct leverage and limit yourself of selecting wrong lot size .

What is the Best Leverage in Forex Trading

Do define which leverage is the best I need to divide traders in few groups. That way I can explain which trader needs which leverage.

The groups are:

- Beginner

- do not know anything about trading and leverage

- They start from 1:20 up to 1:50

- Experienced

- knows how to trade but do not understand what is leverage and how the leverage impacts on the trading

- Usual leverage is 1:100

- Professional

- knows all about trading and leverage. Leverage can be from 1:50 up to 1:500

- Scalper and day trader

- use as high leverage as possible. From 1:50 up to 1:500

- Position trader

- low leverage or none at all. If they use leverage then it is from 1:5 up to 1:20

One rule that traders could use is to define the time how long the trade will be open.

If the trade will be open for longer period the leverage should be smaller. When the market makes larger moves you do not want to be stopped out if the market moves against you. That could happen if you have high leverage.

If the trade will be open for few minutes or seconds the leverage can be higher. The trader is aiming to extract few pips from the market and with higher leverage each pip can bring a lot of money.

What Leverage Suits Newbies Best

When the beginner enters into the Forex trading he does not know anything about the leverage in Forex.

He understands that he needs to select one leverage size when he wants to open the trading account. The common leverage that he uses is 1:100 because he read somewhere that the leverage 1:100 is standard one that everybody use.

When he starts trading he does not pay attention to the leverage because he have the trading account and he is trading. That is all what he wanted to have.

The problem happens right at the start.

He opens the trade with large lot size and he sees that he can earn money very fast. The amount on the trading account changes very fast when the price changes. Very fast money is the thing he was looking for.

But the only problem is when the market goes against him. He lose too much money very fast.

Now he would like to stay in the market for longer period of time. He do not know what to do and by reducing the lot size he is not satisfied because each pip move gives small amount of profit.

This problem remains for very long time until the trader finds out that the leverage have impact on the trading results.

In many cases traders do not come to the conclusion that the leverage have impact on the trading results and eventually the trader gives up from the Forex trading.

Smaller Leverage

To prevent that from happening trader as a beginner should have small leverage. Small leverage will limit the maximum lot size he can open.

When the lot size is limited the trader cannot open the trade where 1 pip will have large value. The value of 1 pip will be smaller and the trader will not lose too much if the trade is losing one.

That way the trader will stay in the game for longer period of time. Being in the game he can make more profitable trades than losing ones and become profitable trader.

The leverage that is suitable for beginners is 1:20 – 1:50.

Read further and I will explain why smaller leverage is better for protection of the trading account.

The Risks of High Leverage

The risk of high leverage comes through lot size. The higher lot size you use on any trade it will maximize the chance to lose a lot of money if the market moves against you.

By increasing lot size you increase the pip value. That is visible through the examples I have shown above but also on the examples further in this post.

The pip can worth $10 if high lot size is selected. If the trade goes against you by 100 pips you will lose $1,000.

If you do not have $100,000 large account, $1,000 is huge loss. With that high lot size you are risking to lose all what you have on your account. And that happen very fast if you trade highly volatile pair.

Leverage is the first step where you define the risk you will have on your trading account.

If the leverage is high you are giving a chance to yourself to open large lot size. Consequently you are increasing possible risk on your trades.

If the leverage is small you are reducing a chance to open large lot size and reducing the risk you will have on your trading account.

Second step how you can define your risk is through lot size. Large lot size will increase the risk you are taking by each trade.

What Can I Do To Minimize Risk When Trading With Leverage

To minimize the risk with high leverage you should never open the maximum lot size where your entire account balance is at risk.

- You need to open smaller volume where the loss, the loss you plan to accept if the trade is losing one, will not make too much damage to your account balance

- Each trade you open should have Stop Loss level

- Use Trailing Stop

- Use leverage minimum as possible

- Understand the margin level to avoid margin call

How is Forex Leverage Calculated

To calculate the leverage use the formula:

Leverage = 1 / Margin = 100 / Margin percentage

Margin is the term I will explain in the next post on this blog but here is small introduction.

The margin is defined by the broker. It is value of few percent of your total account balance.

The margin is the amount moved aside so you do not lose everything if the trade goes against you. It is the amount of money that is required as a deposit in order to open and maintain a leveraged trading position.

If the trade goes against you, broker will close your position when the balance reaches margin level. This is called Margin Call.

That way you are protected from losing all of your money on your trading account and from going into negative balance.

If I use margin level = 0.02(2%) and put that in the above formula I will get

Leverage = 1 / 0.02 = 100 / 2 = 50

Forex Leverage Example

In this part I will show you how does it looks like when you have three different leverage on the trading account.

I have open three demo account on the Metatrader 4 trading platform.

All three have the same deposit, $1,000 so it is easier to understand where is the difference.

Without Leverage

The first one does not have any leverage. The deposit is used to open the trade.

To open a trade I need to select desired lot size. First I will select micro lot size which is 0.01. Then, the 1 pip move will give me $0.1.

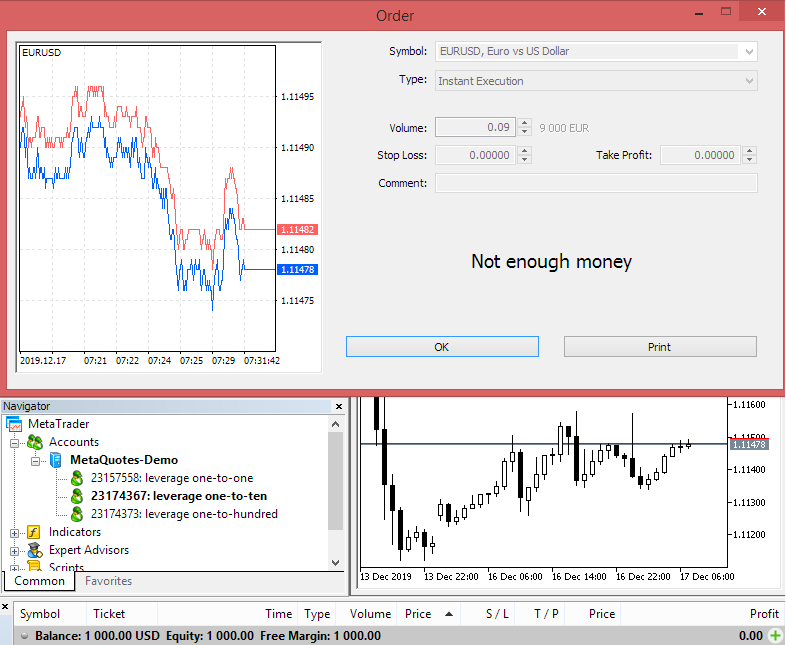

When I open Metratrader 4 window for new trade I must select Volume = 0.01.

When I do that I get message that I do not have money. The reason I cannot open the trade is that I do not have enough money to open micro lot .

1 micro lot is equal to 1,000 units of base currency.

I have deposited $1,000 that is equal to 1 micro lot and there is no space for margin. To open new trade I need to decrease lot size, below 0.01 or I need to deposit more money.

Lower lot size is nano lot which is equal to 0.001. Nano lot is not offered by the broker I am trading with so I cannot open new order.

Only what I can do is to deposit more money or increase leverage.

I will increase leverage to 1:10 so you can see what happens.

Leverage 1:10

Now I have account with $1,000 deposit and leverage 1:10. That means I control $10,000.

I will try to open new trade with 1 mini lot size because I control $10,000 which is equal to mini lot(mini lot is equal to 10,000 units of base currency).

On the image above you see that I have set Volume = 0.10.

On the left side under “Navigator” window you see that I have account “23174367 – leverage one-to-ten”.

When I click on the “Sell” button this is what I get.

I get the message saying “Not enough money”. The reason is in the margin and deposit amount.

Problem is that I want to open high volume and there is no room for margin requirement. To solve this problem I can lower volume or I can deposit more money.

I will lower Volume and try again.

Even I have decreased volume to 0.09 I cannot open new trade. Same message again saying that I do not have enough money.

Leverage 1:10 – Margin and Volume

Let’s decrease volume for one more step.

Volume = 0.08 is ok and I can open new trade.

New order is open and I can track the progress when the price changes.

Whenever I earn or lose 1 pip I will get or lose $0.80. In this example I am in loss for -0.5 pips or 5 pipettes which is equal to $-0.40.

When the trade comes to 1 pip difference, you can see what is the current status.

In this case I am in loss for 1 pip. My account balance is lower for $0.80.

For $1,000 deposit that is small loss.

If the loss increases to 100 pips I would lose $80 which is 8% of $1,000 deposit. That is acceptable but it is better to cut the loss around 2-3%.

Now take a look what happens when you have higher leverage, 1:100.

Leverage 1:100

In this case I have 1:100 leverage with $1,000 deposit which means I control $100,000.

This means I can open higher lot size or Volume in Metatrader 4. By increasing the lot size or Volume I increase the value of 1 pip. The value of a pip will be $10,00 for 1 lot(Volume = 1.00) or $20,00 for 2 lots (Volume = 2.00).

Let’s see how does that looks like in real example.

As a first step I want to open new order with Volume = 2.00. That means I want to open two standard lots.

I get the message that I do not have enough money.

Two standard lots means I want to control $200,000 which I do not have. I would need to have at least 1:200 leverage or more.

I will decrease Volume to 1.00 and see what happens.

You can see that next to the Volume is stated I will open 1 lot that is equal to 100,000 EUR.

When I try to open new order I get the new message.

Same message as before saying I do not have enough money. The reason is that I do not have enough money for margin.

I can decrease Volume a little bit more or deposit more money.

Leverage 1:100 – Margin and Volume

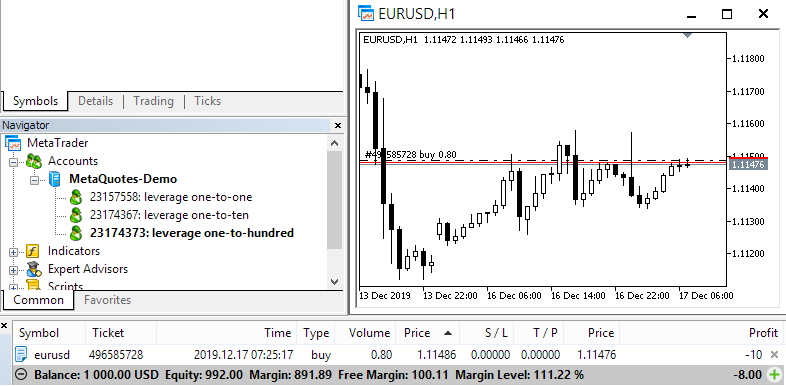

I will decrease the Volume to 0.80.

At the Volume = 0.80 I have new order open and new row is shown under the chart.

The row contains all necessary data about the order. What is my current balance, Margin level, Margin and Free Margin, price at which I have open the trade, current price, and current profit.

When the price moves for 1 pip I am in loss for $8.00 which is ten times more than in the previous example where I had 1:10 leverage.

Imagine if the price moves by 100 pips. I would have -$800 which is 80% of my account balance.

This would not happen because I would get margin call. My order would be stopped out when my loss reaches -$100.

The reason is in Free Margin that says 100.11. This is protection for you not to lose all what you have on your account.

What is Different Compared to the Previous Example?

In the example with leverage 1:100 and in the example with 1:10 leverage, I have change in the price by 1 pip. Deposit amount is the same.

Difference is in the leverage and in the Volume or lot size.

In the example where the leverage is 1:10 I can open only maximum Volume = 0.08.

In the example where the leverage is 1:100 I can open maximum Volume = 0.80.

The leverage 1:100 is 10x larger than 1:10 leverage and you get the chance to open 10x higher lot size. My gain or loss is multiplied by ten times. But that also gives you chance to expose your trading account to more risk.

Have in mind that in the case of 1:100 leverage you can decrease Volume to the same volume as in the case of 1:10 leverage. With leverage 1:100 you can select Volume = 0.08 so the pip value is $0.80.

The leverage allows you to open larger Volume or lot size which means you can increase the pip value but it is not mandatory. That means also that you can speed up your gains and losses.

The leverage is a tool you can use if you are experienced and you understand how the leverage works.

Read again and understand these examples so you can make a correct decision when selecting the leverage on your account.

The Bottom Line

The leverage in Forex is a great tool when used properly. That is when the leverage is not used as a tool to get rich quickly or to destroy complete account balance.

If you use the leverage with proper management you can be successful and profitable in Forex trading.

Here are some facts about the leverage:

- Leverage is the borrowing money from a broker

- Leverage is the tool that allows you to manage more money than you can invest by your own. It gives you a chance to earn a lot with small investment

- If you use the leverage wisely you can increase account balance in very short time. That way you can have second income for your monthly budget

- In order to use leverage, Forex broker require a minimum deposit that is called the margin

- Leverage varies from 1:10 up to 1:500 or more

If you download FREE PDF file you will find real examples with different leverage on the Metatrader 4 trading platform. I have used very simple situation so you can see what leverage means in live examples.

0 Comments