This post covers all about a Pip in Forex trading basics tutorial that you need to know.

Without knowing what is pip in Forex you cannot make a strategy that will be profitable.

Why?

Pip in Forex is used all the time whenever you trade because the pip is the main point in the price of a trading pair. If the price moves up or down it will move by certain amount of pips.

You will see how to calculate a pip, what is meaning of a pip in Forex and some examples in real trading cases so you can take that information and make a trading strategy.

Contents

- 1 What is Pip in Forex

- 2 U.S. Dollar and a Pip in Forex

- 3 What is Pipette in Forex

- 4 How Much is a Pip in Forex

- 5 How to Calculate a Pip in Forex

- 6 How to Calculate a Pip Value in Your Account Denomination

- 7 How to Calculate a Pip for USD Trading Pairs

- 8 How to Calculate a Pip when Your Account Currency is Quoted as a Base Currency

- 9 How Much is a Pip in NZD Account

- 10 How Much is a Pip in EUR Account

- 11 How to Calculate a Pip Value That is Not in Your Account Denomination

- 12 Conclusion

What is Pip in Forex

Pip in Forex is term used very often in Forex trading. Knowledge about the pip will help you to understand trading strategies and to calculate values of a pip.

By now you have seen Metatrader 4 trading platform and Forex currency pairs where the price of the trading pair is changing. If you did not see or you still do not have Metatrader 4 trading platform please check the instructions how to download Metatrader 4.

The example below shows the price of the trading pair, which is 1.28416. The price have 5 decimal places which means that the last value is pipette.

Last number at the end represents number of pipettes and the number on the 4th decimal place is the pip.

The pip contains 10 pipettes. So, the below image shows me 1.6 pips which means I have 1 pip and 6 pipettes which is equal to 16 pipettes.

Each trader use the amount of pips gained or lost in a trade to express the amount of money he have gain or lost.

But the pip is not the only thing you will use as a trader because you need few more things to calculate the amount of a pip in your account currency.

Read further and I will show you how to calculate the pip value on different trading account currency.

What is Pip in Forex Definition

Meaning of a pip in Forex is about price that moves up or down. The change of the price is expressed with the small unit that is called a Pip.

Pip definition say that the term “pip” is from Percentage-In-Point or Price Interest Point. Which ever pip definition is correct we will use the name Pip because it is most used term in the Forex trading.

Meaning of a pip is smallest change in the price of a currency in Forex trading. If you see that a currency changes the value by 1 cent(example U.S. dollar), in Forex trading the change will be defined by the pip which is 100 times less than a cent.

U.S. Dollar and a Pip in Forex

Each currency in a world have several levels which you can express the value with. I will take U.S. dollar because it is the easiest one to explain.

U.S. dollar have the smallest unit called the cent. 1 U.S. dollar have 100 cents.

When the dollar value changes, the smallest value that changes is 1 cent.

So, for example, if the 1 Euro is worth 1.10$ U.S. dollar (or 110 cents) and when the price of the U.S. dollar changes it will change by few cents.

The price will change up or down by one or more cents(1.11$ = 111 cents or 10.9$ = 109 cents).

In the Forex, the small change in the trading pair price is called a Pip.

The pip change can be from 1 Pip to several hundreds Pips. The range between start price and end price is called Pip range. Each trading pair you will see have different Pip range and each pair has average Pip range in certain period of time.

For example, you can watch one day period and in that period you will see average daily pip range.

Pip in Forex – Metatrader 4 Example

If I take the above example where the 1 Euro = 1.10$ and put it into Metatrader 4 trading platform the price will be shown as, 1 Euro = 1.1000$.

We have added 2 more zeroes(0) because the price on Metatrader 4 is shown with 4 decimal places and Forex market shows the change in the price that is 100 times smaller than 1 cent. That means change in a U.S. $ will be 1/100 of a cent or 0.01 cents.

When the price change it will not change by 1 cent but it will change by 0.0001.

That small change is called a pip.

Pip in Forex can be expressed in a different way. Instead writing the pip as 0.0001 you can express it as 1 pip. Amount of 0.0002 is equal to 2 pips.

In case of U.S. dollar that small change in the price, a pip, needs to change 100 pips(0.0100) in order to make a 1 cent change in the value of U.S. dollar.

That bring us to the conclusion that in a case of U.S. dollar, the 1 cent = 100 pips.

What is Pipette in Forex

Many Forex brokers today show the trading pair price with 5 decimal places instead 4 decimal places.

Take a look into the image below.

That means that they have added one more 0 at the end in 0.0001 value and now it is 0.00010.

The 5th decimal point is one tenth, 1/10, of a pip.

That means if you have a price of 1 Euro = 1.1000$, now it is written as 1 Euro = 1.10000$.

If the price change for 1 pip it will be 1.10010.

Now you see that 1 pip is shown as 10 and not 1. The fifth decimal point is called pipette. Like U.S. dollar consist of 100 cents, the 1 pip consists of 10 pipettes.

Do not be afraid or confused with the pipettes because the analogy of 1 pip is the same. The only difference is that you will see the price of the trading pair on the Metatrader 4 or any other trading platform like 1.10000 (5 decimal places) instead old pricing which was 1.1000(4 decimal places).

And the amount of the:

- 1 pip will be shown as 10

- 10 pips will be shown as 100

- 100 pips will be shown as 1000

Pipette example

In the image below I have put an example how the pip in Forex looks like on the Metatrader 4 trading platform.

First image shows open buy position where the current result is -20 which means, -2 pips and 0 pipette. The total amount is 20 but do not let that to confuse you.

While the price of a trading pair is shown with 5 decimal places or 3 decimal places in case of Japanese YEN, the total amount you get as a result you need to divide with 10 to get the pip amount.

When you divide -20 with 10 -> (-20 / 10) -> you get 2 pip as a result.

On the second image below it is the same example but after few minutes when the price changed. The price changed and the price have increased by 0.6 pipette.

The result is -14 which tells us that we have -1 pip and 4 pipette.

Now, to make the pip change much simplified I have made an article to show you what means 20 Pips in Forex. There you can see how does it look when the price change by 10 pips, or 20 or 30 pips.

Now take a look how does the list of trading pairs look like in Metatrader 4.

The list contains available trading pairs with the current Bid and Ask price. Standard pairs have 5 decimal places and the pairs with Yen currency have 3 decimal places.

Pip in Forex and Japanese Pairs

Pairs with two decimal places are the pairs with Japanese Yen currency. If the broker is using pipettes to show the trading pair price then the pair will have 3 decimal places.

In the example below the trading pair price shows 139.504 which means that the last number, number 4 in 139.504, is pipette.

In order to change for 1 pip the price must change UP to 139.514 or DOWN to 139.494. If the price move UP to the 139.509 price, it means that the price has changed for 0.5 pips or 5 pipettes.

Pipette as a Spread

Pipette is introduced in the trading pair price in 2004 by the Oanda Forex broker so the broker can offer better spread to the potential trader. Without pipette broker could offer spread as low as 1 pip.

If the broker would like to offer better spread, lower than 1 pip, he would need to offer 0 spread which means he will not earn anything.

With the pipette the broker can offer spread lower than 1 pip, like 0.5 pips, and with that offer, which is really good offer, he can attract more traders.

The spread of 0.5 pips is equal to 5 pipette spread.

How Much is a Pip in Forex

Whenever a price of the trading pair moves UP or DOWN you will earn or lose money. The amount of money you lose/win depends on several things.

The first thing is the pip.

How much pips you gain or lose matters, because you need to use the pip amount to calculate the amount of money that you have won or lost .

Without knowing how much is a pip you cannot calculate the risk and profit you are planning to have in your next trade. And calculating the risk and reward is one of the most important thing you need to do as a Forex trader.

A pip value depends on the:

- Lot size you have used when you open the trade

- Currency you are trading

- The current price of a trading pair on the Forex market

The lot size depends on which contract you are trading right now.

There are three or four main contract sizes in Forex and it depends on the broker what he can offer.

Standard are the first three in the table below. The fourth is rarely used and few brokers offers them.

| Lot size | Units of base currency |

Volume | Pip value in USD |

| 1 standard lot | 100,000 | 1.0 | 1 pip=$10 |

| 1 mini lot | 10,000 | 0.1 | 1 pip=$1 |

| 1 micro lot | 1,000 | 0.01 | 1 pip=$0.1 |

| 1 nano lot | 100 | 0.001 | 1 pip=$0.01 |

Looking into the table above it can be strange if you are not in Forex trading already for a long period of time. The reason is, because most traders do not understand what contract size means and what is a lot size.

That is why I will explain it in more familiar way, through an example on the Metatrader 4 trading platform.

Metatrader 4 Example

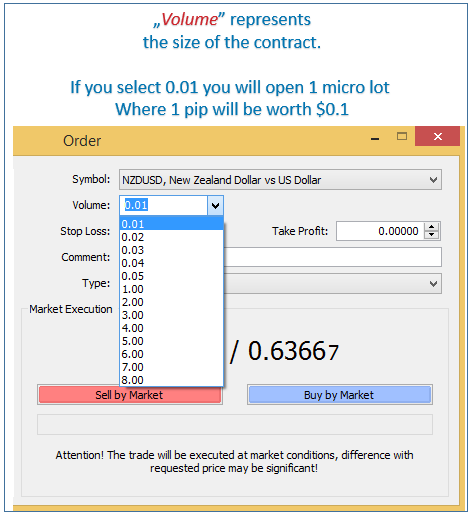

When you open the trading platform and you want to open an order in Metatrader 4 you need to decide which order type and which lot size.

On the image I have selected NZD/USD trading pair as a pair which I will trade.

What if you select other lot size, like 0.02 or 0.1?

Here is the table that shows how much a pip will be worth depending on the selected lot size(Volume).

|

Volume |

Contract size |

Pip value in USD |

|

0.01 |

1,000 |

$0.1 |

|

0.02 |

2 x 1,000 |

$0.2 |

|

0.05 |

5 x 1,000 |

$0.5 |

|

0.1 |

10,000 |

$1 |

|

0.2 |

2 x 10,000 |

$2 |

|

1 |

100,000 |

$10 |

|

8 |

8 x 100,000 |

$80 |

How to Calculate a Pip in Forex

It is really important to know the next part of this post where I will show you how to calculate a pip value.

The reason why it is important is because if you do not know the value of a pip you cannot

- calculate how much lots you will open on each trade

- know where you should set stop loss if you have defined stop loss amount

- know where you should set take profit if you have defined profit amount

- manage your reward : risk ratio

What I have just listed is one part of the trading rules you should follow in your trading career and without knowing the pip value you cannot be professional trader.

How to Calculate a Pip Value in Your Account Denomination

First important thing you need to know if you want to know how to calculate a pip value is which currency you have deposited on your account – for example U.S. dollar(USD).

Second important thing is that the currency that you have on your account is on the second place in the trading pair – example is the U.S. dollar(USD).

Now take a look into the the main rules for how to calculate a pip – example is the U.S. dollar(USD) :

- Trading account in USD

- USD is the quote currency in the trading pair – currency on the second place

Pip Value = Contract Size x One Pip

Pip Value = 100,000 x 0.0001

Pip Value = $10

The image shows how pip value looks like in Metatrader 4 trading platform.

I have open three orders at the same price but with different lot size.

The change in the price is 0.64340 – 0.64329 = -0.00011, which is -1.1 pip.

In the last column “Profit” you can see that for a change of 1.1 pip I have three different profit level.

For the standard lot which is in the last row with the size shown in the column “Volume = 1.00”, I have profit of -11$.

For the mini lot which is in the second row with the size shown in the column “Volume = 0.10”, I have profit of -1.10$.

For the micro lot which is in the first row with the size shown in the column “Volume = 0.01”, I have profit of -0.11$.

How to Calculate a Pip for USD Trading Pairs

How to calculate a pip for USD trading pairs will be the same if the trading account is in USD and the USD is listed on the second place:

- EUR/USD trading pair

- AUD/USD trading pair

- GBP/USD trading pair

- all other pairs that have XXX/USD combination

How to calculate a pip for another account currency?

Just use the above calculations.

For example, if you have AUD as your currency on the trading account, and if the AUD is on the second place in the trading pair then:

| Lot size | Units of base currency |

Volume | Pip value in AUD |

| 1 standard lot | 100,000 | 1.0 | 1 pip = $10 |

| 1 mini lot | 10,000 | 0.1 | 1 pip = $1 |

| 1 micro lot | 1,000 | 0.01 | 1 pip = $0.1 |

| 1 nano lot | 100 | 0.001 | 1 pip = $0.01 |

Here is the list of the trading pairs that have AUD as a second currency:

- EUR/AUD trading pair

- GBP/AUD trading pair

How to Calculate a Pip when Your Account Currency is Quoted as a Base Currency

There is small calculation needed if your account currency is in the first place in trading pair.

I have used USD as an example currency.

If you have USD as your account currency and you want to calculate the pip value for USD/CAD trading pair where USD is in the first place, then do the following.

I have open new order at the price 1.31575.

I have used 1.00 lot size(Column – “Volume”) which represents standard contract, 100,000 units.

Take a look into the table in the image above to see which contracts exist.

The pip value for USD/CAD trading pair is calculated like this:

Pip value for standard lots = 10 / (USD/CAD price)

Pip value for standard lots = 10 / (1.31575)

Pip value for standard lots = 7.60

The image above shows that the difference between open price and current price is

1.31575 – 1.31525 = 50

I have difference of 5 pips and 0 pipette. That is equal to 5.0 pips. Total amount I have with this open trade is when I multiply pip amount with the pip value of 7.60.

5.0 * 7.60 = $38.00

In the image you see I have total earning of -$38.02.

Do not get confused because of 0.02 difference between the value I have calculated and the Metatrader 4 have calculated. It is a small difference between mine and Metatrader 4 calculation of the pip value.

How Much is a Pip in NZD Account

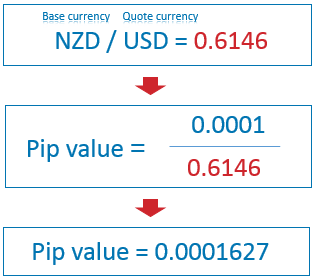

Use Metatrader to see what is the current price of NZD/USD trading pair.

The image below shows the price I have extracted from the Metatrader 4.

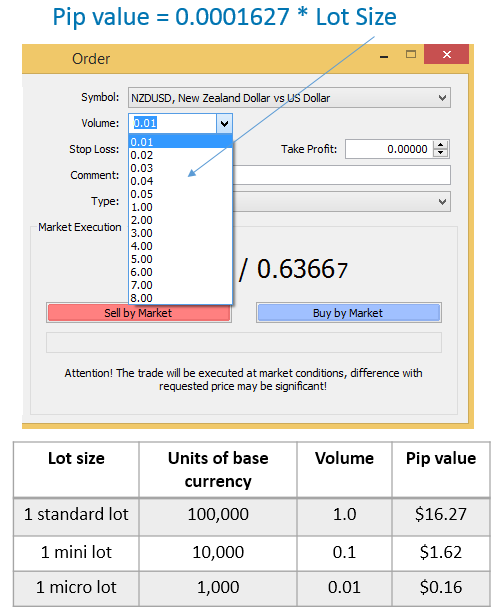

Now you need to select the lot size which will define your pip value.

Remember that there are several contracts(standard, mini, micro) which defines the value of one pip.

The image below shows the table of the pip value when multiplied with the lot size in the Metatrader 4.

When you select different lot size you define how much you earn when the price of the trading pair changes by 1 pip.

If you hunt for more pips then you can calculate how much you will earn or lose in each trade.

How Much is a Pip in EUR Account

Lets take a look what is the pip value for the EUR/USD trading pair.

|

Pip / Rate |

Contract size |

Lot size |

(Pip/Rate)*Contract |

Pip value (EUR) |

|

0.0001 /1.1164 |

100,000 |

1.00 |

(0.0001 / 1.1164) * 100,000 |

8.95 |

|

0.0001 / 1.1164 |

10,000 |

0.10 |

(0.0001 / 1.1164) * 10,000 |

0.895 |

|

0.0001 / |

1,000 |

0.01 |

(0.0001 / 1.1164) * 1,000 |

0.0895 |

How to Calculate a Pip Value That is Not in Your Account Denomination

Common situation will happen when you have your trading account in USD currency but you are trading EUR/CHF trading pair.

And how to calculate a pip in that case?

First you need to find pip value in USD currency. And to do that you need to make calculation.

I have used lot size of 1.00, standard contract of 100,000 units.

Pip value = 0.0001 * 100,000 * pair with USD as a quote currency / (EUR/USD)

While we have EUR/CHF trading pair, combination of CHF/USD does not exist so we need to divide value of USD/CHF in a way like this, 1 / (USD/CHF), to get the value in CHF/USD where USD is quote currency.

If the current value of USD/CHF trading pair is 0.9855, we get:

1 / 0.9855 = 1.014

Pip value = 10 * 1.014

Pip value = 10 * 1.014 = $10.14

Now we need to divide the pip value in USD with EUR/USD = 1.1164 quote.

Pip value = 10.14 / (EUR/USD)

Pip value = 10.14 / 1.1164

Pip value = 9.08 eur

Conclusion

Remember that the pip is a change in the price of the trading pair. With the pip all starts in Forex trading.

Pip is used:

- to show the change in the trading pair price

- for calculation of the amount you will lose or win in each trade

- to decide what is R : R ratio for each trade

Most of the calculation will be done by Metatrader or some other trading platform. You need to know the basic calculation in order to define entry/exit of each trade, and to calculate win/loss amount on each trade.

You can download the Pip and Pipette post in PDF file together with the cheat sheet in which I have made test examples for you so you can test more and practice on real examples.

I have made lots of images with explanation where you will see the difference between lot size and pip value on several trading pairs.

Real example how to calculate value of a pip on:

- EUR/USD trading pair

- USD/CAD trading pair

- USD/JPY trading pair

- EUR/CHF trading pair

Visit download section and download PDFs.

0 Comments