I want to give more insight with EUR/JPY Forex currency pair analysis through following topics:

- EUR/JPY Name Analysis

- EUR/JPY Analysis Popularity

- How to Trade EUR/JPY

- Trading Session Pip Range

- What is EUR/JPY Daily Range

- EUR/JPY Weekly Range

- Monthly Range and Pip Range History

- What Impacts EUR/JPY Volatility

- Connection Between Volatility and News

- EUR/JPY Analysis – What to Take From Here

One of most known cross trading pairs in the Forex market.

Contents

- 1 EUR/JPY Name Analysis

- 2 EUR/JPY Analysis Popularity

- 3 How to Trade EUR/JPY

- 4 EUR/JPY Analysis – Trading Session Pip Range

- 5 EUR/JPY Analysis – Daily Range

- 6 EUR/JPY Analysis – Weekly Range

- 7 EUR/JPY Analysis – Monthly Range and Pip Range History

- 8 What Impacts EUR/JPY Volatility

- 9 Connection Between Volatility and News

- 10 EUR/JPY Analysis – What to Take From Here

EUR/JPY Name Analysis

Name that is given to this major pair is known under phrase “Euppy” or “Yuppy” which is pronounced same. Name consists of two words where first word is starting letter of European currency and last two letters of Japanese currency.

European Euro, EUR, and Japanese Yen, JPY. When you combine these two words you get EUPY. To this combination it is added additional P to get EUPPY. Because EUPPY is read as YUPPY you will see this word often.

EUR/JPY Analysis Popularity

The European EUR and Japanese Yen are two of three or four most traded currencies on the Forex market. Euro have around 39% total volume on the Forex market and Yen around 19% of total volume.

European Euro is well known currency and Japanese Yen is currency which have great volatility. Due to great volatility of these two pairs they are traded a lot during Tokyo and European session.

Pair also have low spread which gives traders better opportunity to enter into traders without losing to much money at the start. Any trading pair that have low spread is very attractive specially for day trader or scalpers who need lowest spread to reduce entering costs.

Yen is know as safe heaven currency in critical periods. During financial crisis, 2007-2009, EUR/JPY pair has fallen from 169.78(07/2008) to a low of 115.00(02/2009). This is 30% drop which gives us explanation why JPY is called save heaven during turbulent times on the market. Investors run into safe currencies, like JYP, where they try to protect their money thinking that JPY currency will not lose its value.

How to Trade EUR/JPY

When USD/JPY broke resistance or support level you can expect that other Japanese pairs will do the same. USD and JPY are one of three most traded currencies in the world. When they make a move you can plan to make a move on other pairs because what traders do on this major pair with Yen currency will have effect on other pairs.

If you trade based on the price patterns this pair is respecting major support/resistance and trend lines with price action patterns.

How to Trade EUR/JPY – Volatility

Volatility on this pair comes with news when something new is released in European Union. Euro is bond to economic data, policy decisions and trend market sentiment. Japanese Yes is bond with importing of crude oil and natural gas because Japan is one of the largest consumers an importers for their industry.

Trading session have impact on pair volatility so it is smart to pay attention to them to use the best volatility in trading. Which trading session has the best trading volatility I will show you further in this post.

EUR/JPY Analysis – Trading Session Pip Range

Lets dive into EUR/JPY trading pair analysis to see how pair behaves in different hour, day and month. I want to emphasize that time of candle price is taken out from platform which is on GMT+1.

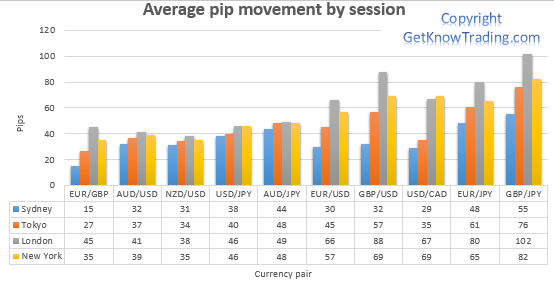

First chart shows how pair is doing on trading sessions compared to others trading pairs. I have ordered pairs on the chart to easily see which pair has lowest and which have highest volatility.

EUR/JPY is second trading pair with highest volatility in all trading sessions which imply that pair is the one of the best among all other pairs. EUR/JPY analysis shows us that traders love to trade it and thus creates large pip range during each session.

Read more: Forex Market Trading Session

Which Trading Session Should You Trade

If you are not bond to time frame during each day like if you live in Australia and it does not make a problem for you to trade on London or New York then you can extract the best volatility from the market.

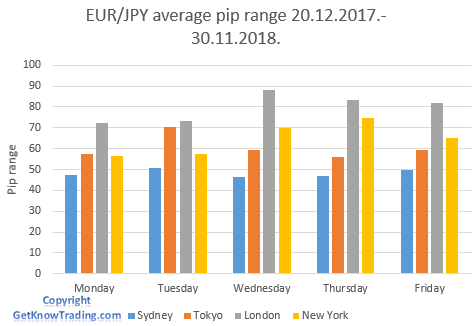

On Sydney and Tokyo session you will have some volatility which can be enough for almost every strategy because more than 50 pip range is great. Moving from Asian session to European, London, session we see rise in pair volatility.

London session give us great volatility which is double than Sydney session on soe days in a week. Because EUR is European currency, many traders love to trade this currency and consequently pair have higher volatility.

During London session we have overlap with New York session which gives us more volatility because U.S. traders jumps on the market. During overlap, news on U.S. market are published which impacts all currencies in the world.

You will see how overlap time have impact on the pair volatility during day on the chart further in this post.

From this chart you should take information that EUR/JPY analysis shows you that:

- pair have highest volatility on London trading session

- during overlap with New York session have increased volatility

- starting from Monday volatility increases

- volatility peak is in the middle of the week, Wednesday and Thursday

- Volatility decline, a little bit, on Friday

EUR/JPY Analysis – Daily Range

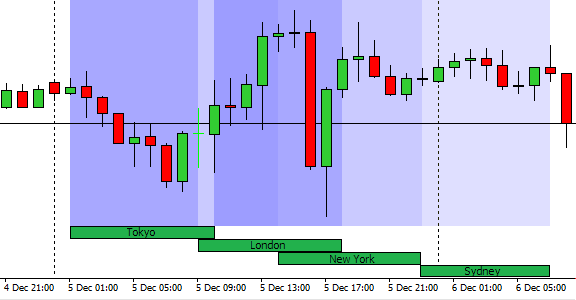

If you take a look how overlap looks like then you understand why pip range is higher on these time. Trading session chart shows that time between 2 trading session, London and New York, happens between 14:00-18:00h(GMT+1).

How does the time overlap looks on the daily pip range, measured in hours during a day is shown on the next chart. Immediately you can see that time between 14:00-18:00 have rise in pip range which confirms above said.

Time overlap between London and New York trading session, news publishing, large amount of traders on the market have a result as increased pip volatility in that time.

It is not only London and New York trading session overlap that makes a difference in pip volatility. You can see that trading session overlap between London and Tokyo have change on the pair volatility.

EUR/JPY Analysis – London Session

London session is known as the largest one and while EUR is Europe currency traders like to trade that pair. We see increase in pip range from 09:00h up to 11:00/12:00h.

Around noon we see drop in pip range on London session. Mostly this is due to lunch brake in Europe, positions are set and traders relax in next 2 hours waiting for New York session.

EUR/JPY Analysis – New York Trading Session

Around 14:00h we see rise on the pip range and reason for this is that U.S. traders together with Europe traders are active on the market. EUR/JPY volatility increases due to large amount of trades.

Traders form their positions and mostly around that time news from U.S. are published. News have high impact on this pair because USD currency is widely connected to all other currencies. So, when USD currency moves all other currencies also move.

Going to the end of the day you see that pip range starts to decline, especially when London trading session finishes(17:00h). Large amount of traders close their position, EUR/JPY volatility declines and pair is traded less.

By the end of the day pip range is at same level as it was on the start of the day. Sydney and Tokyo trading session takes over and another day comes.

What you should take from these two charts for your trading is this:

- During a day pair have highest volatility on trading session overlap

- Two trading session overlap have increase in pair volatility, Tokyo-London and London-New York session

- Best time to trade is on London-New York trading session overlap where pip volatility is at highest rate

- You should close your positions, if you are a day trader, until London session closes to avoid later “slower” movements

EUR/JPY Analysis – Weekly Range

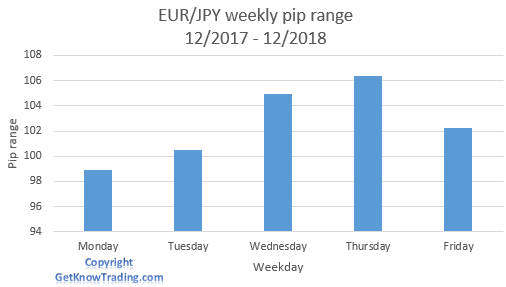

On the next chart I will show you how pair is doing on the weekly basis but not on the trading sessions. This information you can incorporate into your trading strategy when you plan to trade this pair.

Similar to chart “EUR/JPY analysis – trading session pip range” this chart shows similar data on pair volatility. Starting from Monday pip volatility increases. This increase we can connect with waking of the market after weekend.

From Monday to Wednesday traders makes they trading strategy and enters into trades. Trends on the pair movement start to form. Traders looks what is pair trend, make trading plan when to enter and exit and which news will have impact on trading pair.

These key characteristics are done over weekend before or on start of the week. When all is done traders enters into positions and they day trade or wait several days to exit their positions.

When pair hits Wednesday mostly traders start to plan to exit trades. Pair volatility decline to the end of the week. On Friday there is still volatility, higher comparing to Monday, but lower than Wednesday or Thursday.

On Friday traders tend to close their positions due to weekend on which sometimes can be published news which have high impact on the pair. So, to avoid that kind of possible problem if news are against trader they close their position on Friday.

Friday – Day for Profit Lock

During Friday you could see that price of the pair reverse against weekly trend. Reason for this is also in closing positions of the traders who takes their profit from the market.

What you should take for yourself from this chart is following:

- On Monday prepare yourself for trend forming

- Until Wednesday do not trade or scalp if you are scalper or day trader Wait until highest volatility hits pair where you can extract most out of this trading pair

- If you are weekly or long term trader wait until Wednesday until trend is formed or confirmed

- On Friday get out from trading pair if you are uncertain will there be any news over the weekend which could impact trading pair volatility

EUR/JPY Analysis – Monthly Range and Pip Range History

In the next part of the blog post I will show you 12, twelve, charts which shows EUR/JPY analysis over few decades in order to give you the best pair volatility overview.

Chart shows that only 3 month in a year have pip range more than 700 pips. But comparing it to other pairs, like EUR/GBP, who have around 300 pip range we can say this pair is good one to trade.

Read more: EUR/GBP Pip Range Analysis – Forex Under the See Level

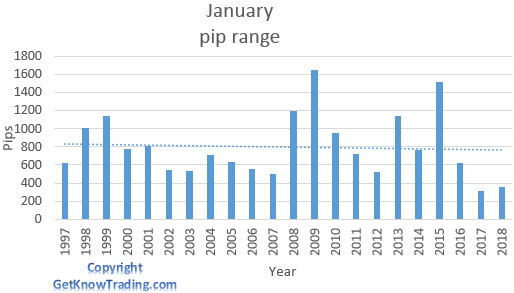

January

Only spike appeared on 2009 when Major financial crisis hit whole market and large volatility caused high movements.

February

February did not had any huge events that moved market in one or another way. Year 2009 is the year of financial crisis and large spike on the monthly pip range is visible on the chart below.

Monthly average is declining with low slope but we can say that there is no big difference on monthly pip range looking from history.

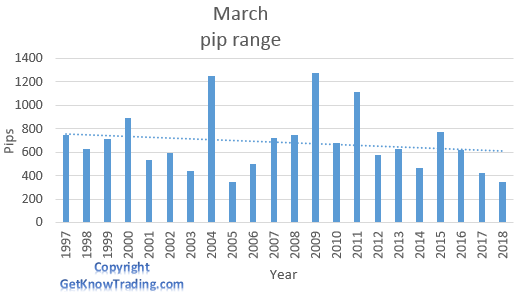

March

March had one special year when financial crisis hit the market and spike above 1200 pips appeared on that month. After that year nothing had so much impact on the market to move volatility on higher level.

April

April is the only month with rising monthly pip range and that rise is really huge. That is average but if you take a look on the last year pip range is declining. Decline in last few years is visible on all trading pairs and this one did not avoid bad decline.

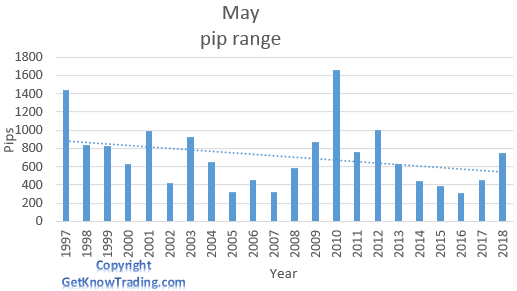

May

Really high decline in monthly pip range did not pass May. Looking on the chart we see steady decline where only few years had spike due to financial crisis, 2008-2010.

June

June was able to sustain stable pip range volatility during all years I have researched. Monthly average almost have straight line but bad volatility at the last year did not pass this month.

July

July had several months with spikes and low volatility where he gathered bad monthly average pip range with decline to this year. Last year was one the worst years in pip range comparing to the past.

July is month with the lowest pip range when compared to other months. It is the only month with monthly pip range under 600 pips.

August

Very strong decline in monthly average pip range we can see on the chart below for month August. Only spike in 2007 when financial crisis started was have moved monthly pip range above 1600 pips.

September

Same as August this month have strong decline in monthly average pip range. Few spikes appeared in years before but nothing so special that could drove pip range in the sky. Few last years are steady in pip range counting around 500 pips in average.

October

These events caused spike in this month which is shown on the chart under this text.

- Read here for more information about global financial crisis in October 2008.

This we call large spike where event made three or four times larger monthly pip range compared to “standard” monthly pip range.

November

September is month with average pip range around 600 pips. There was no big events in this month and something worth of mentioning is that last two year, 2017 and 2018, had the worst monthly average pip range.

December

In 2008 major crisis had another impact on this pair and in December there were more bad news which caused spike on the monthly pip range.

EUR/JPY Analysis – Monthly Conclusion

You see spike on 2008/2009 or 2016 year. Those spikes have occurred on the big events which had large impact on the pair EUR/JPY volatility.

In year 2007-2009 major financial crisis hit whole world and EUR/JPY was not spared of large movements.

Small volatility leaves smaller opportunity for traders because it is much easier to grab some pips in over 100 daily pip range instead trading on 70 daily pip range. So, in these times you can expect that you will have lower average pip income.

This directly impact on the trading results because smaller pip movement can be hard to trade when spread or commission is to large. Sometimes opening a trade is not worth of the costs you will pay just to enter into the trade.

Smaller volatility can trick you in a way you think there is a trend but momentum slows down and you get stuck in a trade. You have less trades available or signals from your trading strategy and your strategy begins to give you less profitable trades.

What we see generally by average line on each month is that average pip range is declining from 2009 and we do not have such volatility as before. Only April have average line climbing. This gives us less opportunities to catch higher number of pips but still pair has large volatility that allows us to trade it and to earn money.

What Impacts EUR/JPY Volatility

Japan imports crude oil and natural gas products to satisfy domestic energy requirements. So, price of Yen is close connected with price of the energy commodities.

In addition to price of energy, political situation and domestic monetary policy play a role in defining price of trading pair.

- Energy commodities

- Political situation

- Monetary policy

- Macroeconomic indicators

After 2009 rarely one of the months had greater volatility compared to years before. Less volatile market can be result of geopolitical risks, or declining of global wealth, interest rates policy.

Connection Between Volatility and News

As any currency in a world pound sterling is affected by news. Here is a list of news which have impact on the currency and which impacts your trading strategy:

- Monetary policy

- Price Inflation

- Confidence and sentiment

- Economic growth, GDP

- Balance of payments

Price, Inflation, GDP and Monetary Policy

Countries with high level of inflation depreciate more compared to other currencies. Inflation causes the central bank to intervene in a way as adjusting interest rate to control undesired effects.

When interest rates is increasing that is good for currency so you can expect price of EUR will rise. Why does it rise – because when there is high interest rate in country it attracts more investors who can benefit on high rates.

But have in mind that trading pair chart is not only with one currency but with two currencies. This means sometimes if interest rates is increasing for EUR it could happen that trading pair value will not increase. Reason could be that JPY is stronger even interest rate on EUR is rising pair price could remain moving sideways or even falling.

PPI, CPI, PMI and GDP

Indicators:

- PPI as Producer’s Price Index

- shows trends within sale markets, manufacturing industries and commodities markets

- CPI as Consumer Price Index

- Consumer Price Index measures inflation that is most important indicator of the economic health of that country

- PMI as Purchasing Managers Index

- shows us are purchasing managers optimistic or pessimistic about the economy

- GDP Gross Domestic Product

- tells us how much the economy is strong, hod does it advance and is it healthy or not

These indicators have impact on the price of any currency and they are ones which you should watch. Price index is telling how the price of consumer goods and manufacturing material is doing. These prices have impact on inflation and consequently on interest rates.

GDP is overall information how country is doing and this information will have large impact on the price of currency.

I will not go more into details about these indicators but you can check for more information on the links I have gave.

EUR/JPY Analysis – What to Take From Here

As I have give a lot of information in EUR/JPY analysis there is useful information you can use in your trading.

- Pair have large volatility and high movements

- Use overlap in trading sessions, London and New York, to extract as much pips is possible because then you will have the highest movement

- During a week choose to trade on middle of the week, Wednesday and Thursday because then you have best volatility and chance to grab pips from the market

- Watch for Friday – lock the profits you have to avoid impact from weekend news if there is any

- Any month in a year is good to trade. There is no big difference between them

- Watch out on published news and indicators that have large impact on the currency

Read more:

- EUR/USD Volatility – Pip Range Analysis

- GBP/JPY Pip Range Analysis – Account Widow Maker

- GBP/USD Pip Range Analysis – Cable Connection

- EUR/GBP Pip Range Analysis – Forex Under the See Level

- EUR/CHF Analysis-The Biggest Crash in the Forex History

- USD/CAD Pip Range Analysis – Oil UP Pair DOWN

- USD/JPY Pip Range Analysis – Ninja Pair

- USD/CHF Pip Range Analysis – Swissie

- AUD/USD Pip Range Analysis

- AUD/JPY Pip Range Analysis

- NZD/USD Pip Range Analysis

- What is Meaning of XAU in Forex

- What is Meaning of CFD in Forex

- What is GU in Forex

- What is GJ in Forex

0 Comments