Why Should You trade on Forex?

Should you trade and what are the benefits that Forex market gives you that no other market has? Here are few answers on these trading questions you should know about.

1. No Commissions

When you open account which is mostly free on all brokers, demo or real, you get trading platform. Afterwards you login on you real account, deposit money on that account and connect on trading platform with login data.

Afterwards you are already on the market and you can make a trade and start earning money.

To this point you do not need to pay any commission to anyone. If you open a trade only then you need to pay commission to your broker who gives you access to Forex market. Commission that broker charges you is the bid-ask spread that varies depending which trading pair you have traded.

Fee you will pay is one that bank charges when depositing or withdrawing money from and to your Forex account. These costs depends on the bank or credit card house with which you do business.

There are brokers that can charge some fee for withdrawing your money from you account but try to avoid those brokers. Luckily for you there are many brokers who do not charge it.

2. There is no Third Party

Who would not be happy to have chance to earn money on a market without additional paying middleman.

Forex market is the market without third party that could charge you for their services just for providing access to Forex market. Here does not exist some one who could wrong interpret your information and later on to end badly for you.

In Forex market you trade directly with the market and there are no other barriers that could appear in your way between you and the market.

3. You Decide Lot Size

If you remember about contract sizes on the futures market then you know that they are defined by the exchanges. For Euro it was 125,000.

In the Forex spot market you choose your own lot or position size. There is several lot sizes available:

- Standard – 100,00 units

- Mini – 10,000 units

- Micro – 1,000 units

- Nano – 100 units

To use advantage of the lot size you pick larger lot size if you would like to earn more money on small movement. Pay attention that movement in wrong direction can bring higher loss to you account.

4. Low Transaction Costs

Transaction cost that you pay is bid-ask spread which can be less then one pip up to several pips.

Spread can be fixed for some trading pair and that depends on the broker. If it is not fixed then it varies and several events can have impact on it.

If news is published and those news are about interest rate or macroeconomics movements in the country then you can expect that spread will change its value.

5. 24/5 Hour Market

Market is open 24/5 for traders like us from Monday to Friday. You do not need to be on the floor in some room to participate in the market like on some other markets.

You can participate on the Forex market when Forex market opens in Australia and up to New York. So, if you can be awake for 24h then you can say that you are trader on the all big market center, Tokyo, Sidney, London and New York.

This market allows you to participate whenever you want, during whole day, only few hours , at night.

It is up to you when suits you best.

6. No One Controls the Market

Due to it size Forex market is not possible to control by one person or a bank.

If the central bank or several institutions decide to have impact on the market then they could make some impact on short term basis.

To control whole market movement you would need a large amount of participants with high amount of money. While this is not easily possible then market cannot be manipulated.

What can be done to try to control market is that someone who have large impact on the market could decide to make a move in a moment when on the market is been forming some of the technical patterns. While many traders base their trading style on the technical analysis and patterns then this move could trigger their decision to trade in that direction.

I think that is not, easily, possible but I cannot say it is not possible at all. Everything is possible.

7. Different Leverage

With small amount money deposited on your account broker can offer you to control larger amount on the Forex market. This is done with leverage that gives you the ability to make more money.

One of the examples of leverage is when broker offers you leverage 1:500. This means that you with $100 invested money can buy or sell $50,000 worth of currencies on the market.

When you see this data I believe that your mouth opens widely and your eyes open like you have won the lottery.

You have to be aware that leverage is double-edged sword that can heart you if the market momentum start moving against you. Large gains and losses are possible with leverage and you need to protect yourself with proper money management.

8. High Liquidity

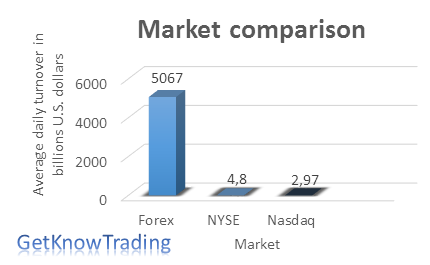

The size of the Forex market have volume and high liquidity due to large number of traders. Forex market have advantage that no any other market has.

Using trading platform you can open a trade with simple click, buy or sell. Many participants willing to trade will provide you possibility to close your trade by accepting other side of the trade.

Because of high liquidity you will not stay in the trade forever and it will not happen that you stuck in the trade. It will not happen that currency pair is not attractive or it is expensive to trade.

On the stock market this can happen often because stock market can have stocks that do not have many traders willing to trade that stock. In this case you cannot sell stock because no one is willing to buy it. Reason for that could be that maybe stock is not attractive or it is to expensive. At the end you end up with stock that no one wants to buy from you and your money get stuck.

9. Low Obstacles to Enter Into Forex Market

Here is a list of the obstacles you will encounter as a beginner in Forex:

- Smartphone, Tablet or desktop computer

- Internet access

- Mail address

- 25 – 50 U.S. dollars or other equivalent amount of another currency accepted by broker

As you can see if you are reading this text it means that you already have first 2 points covered. For other two I hope it will not be to hard to get, so you can start trading on the Forex market.

If you have all the above listed points then you need to make a move and find good broker and start trading.

FREE WORKSHOP

For beginners who does not know how and where to start with trading

In the workshop I will tell you

what steps to do in order

to transform yourself into a trader

0 Comments