Deriv pip calculator calculates the pip value for certain synthetic indice like:

- Volatility Index

- Step Index

- Boom Index

- Crash Index

- Range Break Index

- Jump Index

You would use deriv pip calculator or synthetic indices calculator to get pip value for each of synthetic indice index. The deriv pip value you can use to calculate profit on volatility index to properly calculate risk and reward on each trade.

Read more: Forex Calculator

To use the deriv pip calculator you need to enter these values:

- Select Symbol

- Enter Volume or Lot size

- Enter Contract Size

- Enter Point Value

With these values entered simply click Calculate button and you will get the Pip value for synthetic indices index.

If you need more help read further on and I will explain all details you need to know.

If you want to download Deriv cheat sheet table with all indices and with details about the contract size, pip value visit the download section.

Contents

- 1 Download PDFs for Trading

- 2 A Beginner’s Guide to Using a Deriv PIP Calculator

- 2.1 Pip Calculator for Synthetic Indices

- 2.2 Pip Calculator for Volatility Index

- 2.3 How to Choose the Best Deriv PIP Calculator for Your Trading Needs

- 2.4 How do You Calculate Pips in Deriv?

- 2.5 How to Interpret the Results from Your Deriv PIP Calculator

- 2.6 Tips and Tricks for Using a Deriv PIP Calculator to Improve Your Trading Results

- 3 Conclusion

Download PDFs for Trading

A download section is a place where you can download PDFs/indicators, MT4 and more, that will help you in trading.

A Beginner’s Guide to Using a Deriv PIP Calculator

If you are beginer in trading then this introduction to deriv pip calculator or also called synthetic pip indices calculator will help you understand the parts of the calculator you can find here.

The tutorial will show you what to enter and in which format to get the result and then how to use that result in trading to calculate pip value you need for further calculation.

And those calculations are profit, stop loss and take profit values, risk to reward ratio to properly manage your trades risk.

Pip Calculator for Synthetic Indices

Syntetic indices calculator is the calculator that calculates the pip value of each of synthetic indices that exists. The syntetic indices that exists are:

- Volatility Index

- Step Index

- Boom Index

- Crash Index

- Range Break Index

- Jump Index

The pip value will be determined by the point value which can be 0.01 or more. That is defined by the broker you use in trading synthetic indices.

Synthetic Indice Broker

Pip Calculator for Volatility Index

Pip calculator for Volatility index uses following values to calculate the pip value:

- Select Symbol

- Enter Volume or Lot size

- Enter Contract Size

- Enter Point Value

When you enter these values you get pip value which you use further on to calculate the profit per trade or stop loss and take profit in the deposit currency.

Which deriv pip calculator to use? Well, you will find several of them, but the one you have here, at the start of this page, is the one that has all what you need.

How to Choose the Best Deriv PIP Calculator for Your Trading Needs

The best deriv pip calculator has these values you will use in trading:

- you can select which synthetic indice you want pip value for

- you can enter volume or lot size

- you can enter contract size

- you can enter point value

When you have flexibility to put different settings then you have all what you need. Because different volatility index and different trading style has different requets.

For example:

- if you are trading Volatility Index then maybe some other trader is trading Jumo Index

- if you are using Volume = 1.00 lot or one standard lot, mabye some other trader would like to use Volume = 1.5

- If you want to calculate pip value with contract size = 1 unit, maybe other trader want to use contract size = 10 units

All these combinations depends on the trader that is using the deriv pip calculator.

That is why it is important to choose the best deriv pip calculator here at GetKnowTrading.com. Because you can combine any of these values to calculate the pip value for synthetic indices.

How do You Calculate Pips in Deriv?

Now, let me show you how to calculate the pip in deriv. To calculate the pip value with deriv calculator you use formula:

Pip value = point value × volume × contract size

You enter these three values and you get the pip value for synthetic indices.

But, if you do not want to manually calculate pip value then you can use deriv pip calculator that will do this for you.

You need to enter the:

- Symbol – pick the symbol you want to use in calculation

- Volume – enter the volume. This is lot size that can be from 0.01 up to some value. Have in mind that minimum and maximum value is defined by the broker

- Contract size – this represents number of units and it can be different for each of symbols you use. This can be from 1 up to some value. This value is defined by the broker

- Point Value – this is the pip on the trading platform you use. The pip can be defined as 0.01 or 1.00. This is also defined by the broker you are using

Now, for example I will use one synthetic index and show you how this looks like on the Metatrader trading platform. I will use Metatrader 5 because my broker has offered me MT5 for trading synthetic indices.

Synthetic Indice Pip Value Calculation Example

In this example I will use Volatility 10 index.

Here are details I will put inside the deriv pip calcultor:

- Symbol – Volatilty 10

- Volume – 1

- Contract size – 1

- Point value – 0.01

Now, I will open Metatrader trading platform and I will select Volatility 10 index and put it on my chart.

Here is image how this looks on the trading platform.

When you have open Volatility 10 on your chart, on the left side you have Market Watch window where the of all symbols is.

Inside that window you need to click right mouse button on the Volatility 10 Index to get the new menu.

Check the image below.

The goal is to get specification for this symbol from your broker. And the specifications are:

- Contract size – what is the contract size from your broker for this symbol on this trading platform

- Point value – or also called Tick size or tick value. It is the value of a price point on the chart. I will explain later this in more detail

- Volume or lot size -what is minimum, maximum volume, and what is the volume step. I will explain later this in more detail

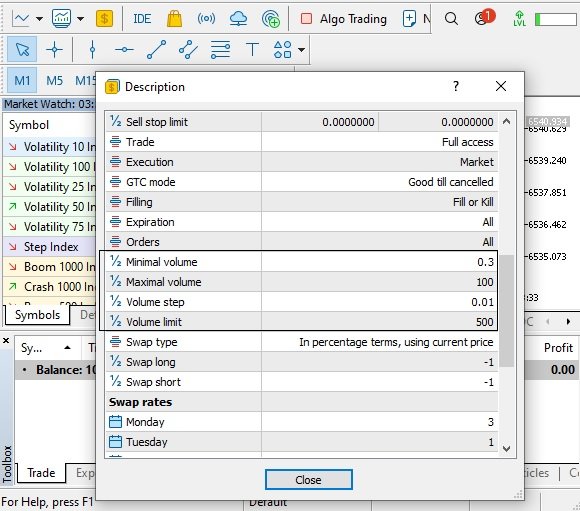

You can see new window where details are shown for the Volatility index.

You can see that the broker has defined that for Volatility 10 index on this trading account for this symbol have these values for:

- Contract size = 1

- this means 1 unit of base currency or simply 1 unit

- Tick value = 0.001

- this means that when the price change from 6543.001 to 6543.002 will have price change of 1 pip.

- this number also represents what is the minimum price change on the chart for this symbol. If the broker put this value to 0.01, then the smallest price change would be like this -> 6543.01 -> 6543.02. You see that we now have 2 decimal places instead of three

- this is also important to know because we need to put this value into the deriv pip calculator

In the next image we have more details we need to read for this symbol.

In this part you can see that the broker has defined these values for:

- Volume = 0.01

- this represents the lot size and the minimum you can select is 0.01.

- The maximum lot size is 100

- and the steps you can use to increase the volume from 0.01(minimum) to 100(maximum) is 0.01.

- that means you can set volume 0.02, then 0.03 and so on, up to 100

Now, you have all details you need for calculation. If you do not have these values clearly stated, and I mean if you are using another trading platform where you cannot find these calues easily, then you should contact your broker to give you specification sheet for the synthetic indices.

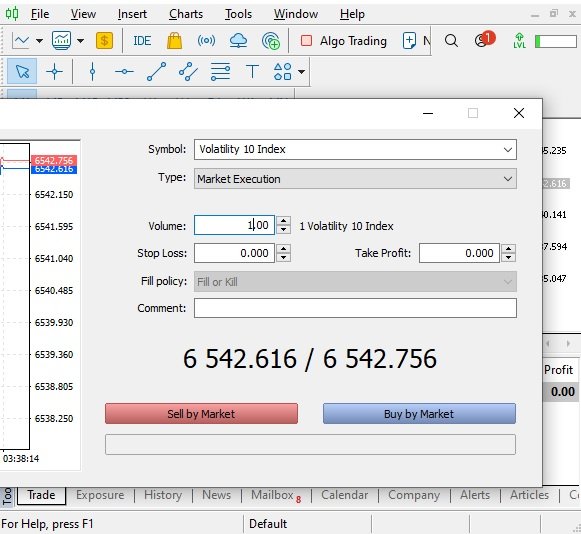

Now I will open new order where I will set the Volume = 1. That means I want to open 1 standard lot.

I will open buy order which means I am expecting the price will rise in value.

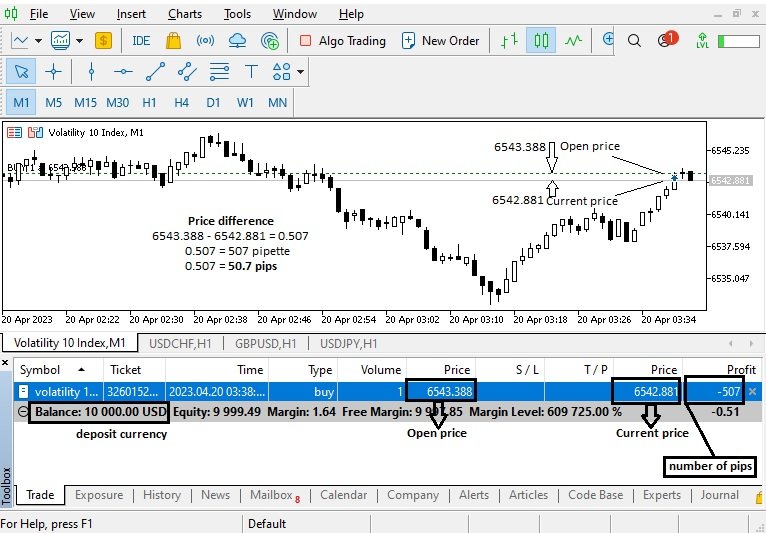

Here you can see new order open with open price, current market price and the current profit/loss.

You can see which is my deposit currency because that is the currency you will calculate the pip value for synthetic indices.

In the image you can see all details for this order. You can see that the current market price is different from the open price.

Now, let’s see this in more details.

Price Difference

You can see that the price difference is:

6543.388 – 6542.881 = 0.507

0.507 = 507 pips

You know that the tick value is set to 0.001. That means we have 3 decimal places in the price. So, the price is changing in pips. If the broker put 2 decimal places then you would see the price on chart like 6543.38.

Profit/Loss

You can see that the current profit/loss is set to -507 which is the number of pips. If you use tick value = 0.001 with three decimal points then you use pips in calculation.

When you calculate profit/loss in deposit currency, and that is U.S $, USD, you get -0.51$.

How do you get this value?

Well, if you use deriv pip formula which is equal to:

Pip value = point value × volume × contract size

you can calculate the pip value and the profit/loss.

Let’s calculate manually.

Pip value = point value × volume × contract size

Pip value = 0.001 × 1 × 1

Pip value = $0.001

With a pip value we now use number of pips which is -507 pips and calculate it. We use 507 and not 50.7 because tick value is set to three decimal points, 0.001.

Pip profit/loss = pip value x number of pips

Pip profit/loss = $0.001 x (-507)

Pip profit/loss = -$0.507

When you round the result to 2 decimal points you get -$0.51 which is the same like in the trading platform.

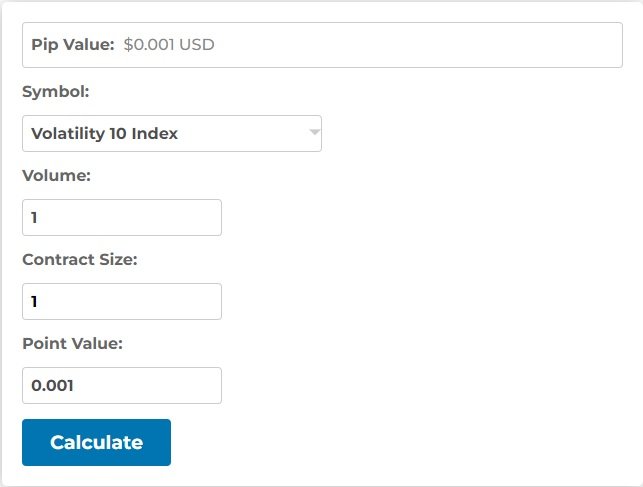

When you use the same data and put them into the deriv pip calculator you get the same result for the pip value.

The value of a pip with deriv pip calculator is $0.001 for this example.

When you put the values from this example where the price change is 0.507 then you put that value into the calculator.

When you put that value you get the same result as we have got with manual calculation.

How to Interpret the Results from Your Deriv PIP Calculator

To interpret correctly the result from the deriv pip calculator you need to understand what you have got as a result. The result represents the pip value so each time the price change on the chart it represents the change in the profit or loss.

The pip value from the synthetic pip calculator is the value of a price change. And it is important to know how much is to properly calculte all the values, like profit or loss, to set risk and reward ratio properly.

If you do not interpret the pip value correctly for the syntetic indices you will get wrong results which could affect the risk management.

And that means if you put wrong 0.01 as a tick value instead 0.001 you will get 10 times higher values then you should.

That is why is important to know details from your broker for certain synthetic indice symbol.

Tips and Tricks for Using a Deriv PIP Calculator to Improve Your Trading Results

Here are some tips you could use while using deriv pip calculator:

- almost all synthetic symbols have 0.001 or 0.01 tick value. There are almost none that have third tick value like 0.1

- deriv pip calculator can be used for other pip calculations like Forex pairs. To do that simply change contract size and tick value. If you use forex pairs then set contract size to 100,000

Conclusion

The deriv pip calculator for synthetic indices is a tool that helps you define the pip value for certain symbol

You should use it to get right values of a tick change to properly calculate the profit/loss for certain symbol.

If you are beginner in trading and you would like to understand trading basics then this calculation can help you learn that.

Use Metatrader trading platform for practicing with a demo account and learn how to use proper risk management by calculating profit and loss.

The products offered on the Deriv.com website include digital options, contracts for difference (“CFDs”), and other complex derivatives. Trading digital options may not be suitable for everyone. Trading CFDs carries a high level of risk since leverage can work both to your advantage and disadvantage. As a result, the products offered on the website may not be suitable for all investors because of the risk of losing all of your invested capital. You should never invest money that you cannot afford to lose, and never trade with borrowed money. Before trading in the complex products offered, please be sure to understand the risks involved.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

0 Comments