This post is to show you Forex truth to the Forex trading question why is not smart to invest less than $1,000 and do day trading with $1000. There is something that will lead you to lose all what you have invested.

By something I mean most common thing that happens to all beginners in Forex trading. It is mistake all beginners make which makes them feel disappointed, think that Forex is SCAM, gambling.

But, there is cause of that result which makes you lose all what you invest on your trading account.

Have you experienced the situation like this?

You invest $100 and you try to double it up in a few days or a week. The only way to succeed and earn $100 with $100 trading account is to open lots of trades with smaller lot size or you will open few trades with larger lot size.

You start trading and in a day or few days you lose everything. Or, you start trading and in a day or few days you double the account.

If you lose all what you have, you invest again. If you double account you continue doing it same way and eventually you lose all what you have. Same story ends with investing again $100.

When you lose $100 for several times you stop investing because you do not see the point losing always.

Then you move away from Forex trading because you think that is not for you. After several weeks or months you get back into trading Forex.

Contents

Day Trading with $1000 and Perfect Setup

You see some opportunity on the market with perfect signal, Pin Bar, and you immediately invest $100 on your trading account.

You open new trade with pretty large lot size and you wait for the market to move into your direction. And market moves into your direction which makes you very happy. You have entered into the market and you are earning money.

This was so easy. You think that Forex trading is so easy and you start watching for the next perfect signal.

And, look, again the perfect signal. You open new trade with large lot size and wait for the market to move into your direction.

But the market is not on your side this time and you end up losing all what you have invested. Your investment has lasted for few hours.

Another $100 on your trading account wiped completely.

You feel very disappointed and start thinking why the market did not move into your direction. It was perfect signal like the one before.

This is situation I think you have experienced for some many times you do not count them anymore. But the lesson was learned only after the situation happens. And you forget the lesson after few days.

When same case happens again you repeat the same scenario with the same outcome.

Why is this happening and how to prevent that from happening again?

I will explain to you with examples why is this happening and what you should do to prevent it from happening again.

Over Trading

The first problem that happened in the trading example was opening too much trades in day trading with $1000. You think more trades will give you more money so you can double your account very fast.

That way of thinking is logical and makes sense. If you open more trades and they all are wining then you will make more money compared to opening only one trade.

What was the problem in the example is the approach to trading. There were no stop loss level set on each trade and you can wipe your account with day trading with $1000.

When the price moved against you all your trades acted like your enemy. Losing money just piled up and speed up the losing process.

Over Sizing

Second problem that happened in the trading example was opening the trades with large lot size. You think that large lot size will give you fast results to reach your goal, doubling your trading account.

And that way of thinking is logical and makes sense. If you open trade with large lot size each pip will be worth more and if the trade is wining one you will double your account very quickly.

What was the problem in the example is again the approach. There were no stop loss level set on the trade.

When the price moved against you, your trade acted like your enemy. Large lot size have speed up losing process because pip value was large and it did not take to much time to wipe your trading account.

Only few pips were necessary to take the money from you.

Stop Loss Level on Day Trading With $1000

How to solve those two problem so you do not lose your initial investment for day trading with $1000 in a day or few days? What must be done to prevent that happening. What you need to do to start making money?

Stop loss level is the key that can solve those problems. But only in one way. It will not solve them completely.

Common questions:

- And how does it really work?

- How Stop Loss level will help you not to lose your $1000?

- What should you do to prevent losing again?

Stop Loss Level – Logic Behind

If you do not know how the stop loss level works, here is the short explanation.

When you open the trade you can set level which defines how much money you accept to lose if the trade is losing one.

That means you can say that you will lose 1% of $1000 which is $10.00 on each trade you open. You set stop loss at the price that will close the trade when it reaches that level.

The percentage can be 1% or any other you desire to have. But it is smart move to set it to 1% so you do not lose to much on each trade.

You do not need to watch the trade until reaches the prices. And you do not need to close the trade at the stop loss level with your mouse.

Metatrader 4 trading station closes your trade automatically when the stop loss level is reached. That is very good tool which you should use all the time.

Stop Loss Help

You see how stop loss can help you prevent losing money on each trade. It works very good and it is automatic.

Stop losing money on your trading account should be the primary thing when trading Forex. If you lose all what you have you will not be able to open more trades.

Stop loss is there for you. It helps you reduce the loss on each trade.

Without money you do not have anything to do on the market. Like on the stock market – if you do not have money you cannot buy the stock.

Why do You Lose All $100 or $500 or $1000

To explain this to you I will show you examples because it will clearly show you what is happening.

You will see what happens when you make same mistake all over again and what results you can expect.

Let’s start with the scenario.

When you start day trading with $1000 on the trading account you start looking for the trading signal.

And you find one.

As the next step you open the trade without stop loss. The trade is open with large lot size because you want to earn money fast.

The lot size defines how much each pip will be worth. To calculate the pip value I will use one trading pair as an example.

I am using the combination of the EUR/USD trading pair and account balance currency so my pip will be like this:

| Volume | Contract size | Pip value in USD |

| 0.01 | 1,000 | $0.1 |

| 0.02 | 2 x 1,000 | $0.2 |

| 0.05 | 5 x 1,000 | $0.5 |

| 0.1 | 10,000 | $1 |

| 0.2 | 2 x 10,000 | $2 |

| 1 | 100,000 | $10 |

| 8 | 8 x 100,000 | $80 |

Now, if you use micro, mini or standard lot size the speed of losing money on your trading account will vary.

To completely wipe out your money from trading account you need 10 pips on standard account, 100 pips on mini account and 1000 pips on micro account.

Daily Average Pip Range

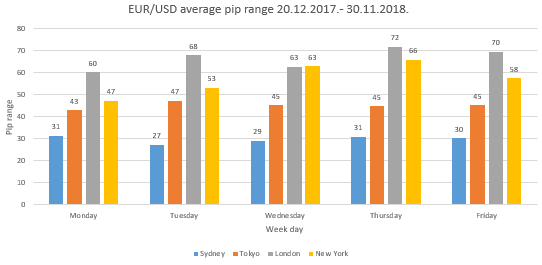

On EUR/USD trading pair you would need around few days to reach that amount of pips because average daily pip range is 30-70 depending on the trading session.

And here is daily pip range so you can see how much pips are traded on each hour throughout the day.

Now see how that looks like on all three lot size levels.

Micro Lot Size Example

When you use micro lot size the pip is equal to $0.10.

If you want to reach 100% loss which is $100, you need to have 1000 pips.

1000 pips x $0.10 = $100.00

That amount of pips is pretty large and you would need few days to reach it with 30-70 pips per day.

Mini Lot Size Example

You decide to open the trade with mini lot size which is 0.10 and each pip is worth $1.00.

When you start trading you need 10 times less pips, 100 pips, compared to micro lot size to reach 100% of loss.

That is possible to reach in a day or two with 30-70 pips daily average.

100 pips x $1.00 = $100.00

Standard Lot Size

If you use standard lot size you need 10 pips to reach the loss of 100% on your account.

EUR/USD trading pair have hourly pip rage around 20-30 pips. That means you would reach that pip amount in less than an hour.

10 pips x $10.00 = $100.00

You probably open mini lot size because standard lot size is not possible do to leverage and margin requirement.

What happens?

Few dozens of pips destroy your account balance and you end up depositing more money on your account. And you repeat same process all the time.

If you did not use large lot size then you have probably open to much trades.

Here is scenario with over trading.

If you open micro lot size you see that you are not earning enough. Each pip is $0.10 which means you need 100 pips just to earn $10.00.

If you want to double your account you need 1,000 pips which means you need days and days with each trade profitable.

To make the plan more realistic you open several trades.

If you open 10 micro lot size trades it is same as you open one mini lot size, 0.10.

Problem appears where 10 trades you have open become losing trade. Your loss is increased by each pip moved against you.

At the end you end up with no money on your account.

You see, you open to much trades with smaller lot size or trade with large lot size.

Both scenario makes you lose the money by trading on Forex.

Stop Loss and Day Trading With $1000

If you define certain percentage you will lose only that amount of money. The percentage you define should be small as much as it is possible.

To stop losing all what you have invested, and that is $100 or $500 or $1000, you need to make a plan. Plan should contain how much you will lose on each trade.

The amount you define should not be more than 1%.

Imagine you start losing 10 trades in a row. That would give you 10% of your starting capital.

If your starting capital is $1000 you will lose $100.00 which is acceptable. You still have large capital to trade and you can return that money with few profitable trades.

If you have 5% on each trade you will lose 50% if you lose 10 trades in a row.

$50.00 on your trading account is pretty small and hard to recover without risking to much on each trade.

The solution is to open trade with smaller lot size and to plan to lose 1% if the trade is losing one.

It will take a lot of time to earn decent money if you start day trading with $1000.

Even though you see that you have the plan how to make money it happens that you lose all the money.

Desire to double the account forces you not to follow the trading plan.

You stop using 1% as a stop loss level. Having the trade without stop loss means you will lose all your money in the next few trades.

The reason is simply that you are looking for quick money where you quickly lose your money.

Micro Lot Size And Day Trading With $1000

If you decide to follow the plan and lose only 1% on each trade you need to have larger account balance. At least $1,000 on your account.

Why?

If you use smallest lot size, and that is micro lot size, you need to find how much pips is 1% of $100.

1% of $100 is $1.00.

To reach that you need 10 pips on micro lot size.

If you take a look into the charts above you can see that the hourly pip range is between 20-30 pips. To reach 10 pips you need less than an hour.

Now imagine you set 1% on each trade you open.

Each trade would close with loss because you did not leave enough space for the price. To avoid being hit you need to set stop loss level with more pips than daily pip range.

And that is more than 70 pips and to be on save side it is best to set i to 100 pips.

If you set 100 pips on micro lot size as a stop loss you would have $10.00 of loss. $10.00 is 10% of your account balance.

With that move you are away from 1% which is crucial if you want to succeed and stay in the market.

$500 Account Balance

With same calculation from above with $100 you would experience loss of 2.0% if you lose 100 pips which are equal to $10.00.

$10.00 of $500 is 2.0% which is double than 1%. Even that is not good enough.

Day Trading With $1,000 Account Balance

To solve this problem and to be in 1% of your account balance you need to do day trading with $1000 on your trading account.

If you lose 100 pips which is equal to $10.00 that will be 1% of your account balance.

This way you are leaving enough space for the price to fluctuate on a daily basis and you are still inside 1% of acceptable stop loss level.

Conclusion

Now you see why is important to day trade with $1000 on your trading account. I did not say $700 or $800 but $1,000 as a minimum because the lowest lot size you can use with most brokers is micro lot size.

Micro lot size have pip value of $0.10 and on average you need to have daily 100 pips stop loss to avoid being hit to prematurely.

If you day trade with less than $1,000 you will not be able to follow trading plan where the risk you are accepting is 1%.

Do not make same mistake and invest $100 for several times. You will just lose your money and quit trading.

Take this example from live experience and learn from it. Using small deposit and opening the trades without stop loss or with large stop loss is the way how to lose the money.

FREE WORKSHOP

For beginners who does not know how and where to start with trading

In the workshop I will tell you

what steps to do in order

to transform yourself into a trader

0 Comments