Twin trading is a trading strategy where you reduce risk by dividing one large trade into several smaller trades with same stop loss level and different take profit levels.

Forex trading for beginners can include this strategy so let me explain the whole trading strategy and Forex risk management strategy by several examples in trading with live quotes.

Contents

- 1 Twin Trading Meaning

- 2 Twin Trading in Forex

- 3 Why to Use Twin Trading

- 4 Twin Trading Strategy

- 4.1 Risk Management

- 4.2 Risk Management Example

- 4.3 Twin Trading Single Trade Scenario

- 4.4 Multiple Trade Scenarios With Twin Trading

- 5 Single Trade Risk and Multiple Trade Risk

- 6 Profit Locking

- 7 Second Twin Trading Technique

Twin Trading Meaning

Twin trading means opening double trade or more trades instead one trade with a large lot size.

Twin means double trade, but with double smaller lot size than initially planned one trade. If you have planned to open one trade with one lot size, 1.00 lot size, then you would open a twin trade where one trade would be 0.5 lots and second trade 0.5 lots.

This is a minimum this trading strategy should use. You can use more than two trades, but two trades are minimum. If you want to you can divide one lot, 1.00, to three trades. Each trade with 0.33 lots.

At the end you will have two trades open at the same price, with same lot size, but with different take profit levels.

Twin Trading in Forex

If you want you can use Twin Trading in Forex by dividing a trade you want to open in the Forex trading platform.

Forex market or any other market that requires to open different sizes of the trade you can use a twin trading strategy. Whether it’s the stock market or cryptocurrency market it does not matter.

Let’s say you want to open one trade with 1 lot. That means you will divide that trade into two separate trades with 0.5 lots.

If you want to open buy order with 1 lot then you would open one 0.5 lot trade and second 0.5 lot trade. Have in mind that you can open more trades and not only two. You can open 3 or 4 trades, but the lot size will be different for each trade.

Let’s put this into a formula.

You have three variables:

- x = Lot size you want to open

- n = Number of trades you want to open

- F = lot size per each trade

Formula says that you need to divide the lot size you want to use with the number of trades.

F = x / n

If we put numbers into the formula we will have the following.

I want to open four trades with a lot size total equal to 2 lots with 10 pips stop loss and 10 pips take profit.

F = x / n = 2 / 4 = 0.5

This means each of four trades I will open will have 0.5 lot size.

1st trade = 0.5 lot

2nd trade = 0.5 lot

3rd trade = 0.5 lot

4th trade = 0.5 lot

When you open each trade you will take the profit level of each trade on a different level.

If you open buy order your:

- First trade will have take profit level 10 pips from open price

- Second trade will have take profit level 20 pips from open price

- Third trade will have take profit level 30 pips from open price

- Fourth trade will have take profit level 40 pips from open price

Why to Use Twin Trading

Up to now you have seen that the idea is to open more trades with smaller lot sizes instead of one trade with a large lot size.

Why would you do this? Why split one trade into several smaller trades when you can simply open trade.

Each trade you open will have a different take profit level with the same stop loss level. This means you will have the same risk per each trade, but the profit will be higher on second and following trades.

First trade will have the smallest profit and the last trade will have the highest profit.

The reason is behind the market uncertainty where you do not know where the price will move.

Will the price:

- move in the direction you have predicted

- move in the direction you have predicted and after few pips turn around

- move in the direction you have predicted and after few pips turn around and then again continue to move in the direction you have predicted

- move immediately in the wrong direction

You see, there are many combinations the price can move and you cannot predict all the time 100% the right direction.

Check the following so you understand this more clearly.

Twin Trading Strategy

Twin trading strategy offers you price locking and risk management in one.

These two things are the main things in each trade. With each trade you want to make money, and if you predict the wrong direction you want to lose as little as possible.

But, that is not so easy. To maximize profits and to minimize the loss. Would not that be the best stuff if you just know how to do it?

Let me explain how this works.

Risk Management

When you use twin trading techniques you will use the profit of each trade to lower the risk on the following trade after that trade.

If the first trade ends up with profit you will take that profit to lower the loss on the second trade. That is if the second trade closes with loss.

If the first two trades are positive you will use that profit to lower the loss if the third and fourth trade ends as losing trades.

If we put this analogy into examples with numbers you would get this.

Open buy order with 1.00 lot size and with 20 pips profit. Stop loss is 20 pips. This buy order we will divide into four trades with 20 pips loss each.

Stop loss = 1 lot x 20 pips

Stop loss = $10.00/pip x 20 pips

Stop loss = $200

I will open four trades with 4 equal lot size. And that is:

F = x / n

F = 1.00 / 4 = 0.25 lot

Each trade will have 0.25 lot size with 20 pips stop loss.

Stop loss = 0.25 x 20 pips

Stop loss = $2.5 x 20 pips

Stop loss = $50

Take profit will be equal to:

Take profit = 1.00 x 20 pips

Take profit = $10 x 20 pips

Take profit = $200

Total profit with 1.00 lot should be $200.

We will divide four trades into four equal pieces so each trade will have take profit of 20 pips.

One thing to note here. There is a Twin trading strategy where you divide 20 pips take profit with the number of trades. If that is 4 trades you will have

20 pips / 4 trades = 5 pips per trade

- first trade will have 5 pips profit

- second trade will have 5 pips more that is 10 pips

- third trade will have 15 pips take profit and

- fourth trade will have 20 pips take profit

First let me show you an example where 1st trade will have 20 pips take profit.

Risk Management Example

Now, let me explain how each trade will look. Below is a table with four trades and the first trade has a 20 pips target.

Second trade has 20 pips larger take profit and that is 40 pips.

Third trade has 60 pips profit target.

And the fourth trade has an 80 pips target.

And at the end you will make 200 pips and $500.

You can see that you have four trades with equal risk included and that is $50.00.

If the market turns against you immediately when you open trades you will lose $200. And if that happens in any risk management strategy you cannot avoid that.

But, if the market starts to move in your direction using a twin trading strategy you will minimize the risk.

Let me show you several scenarios.

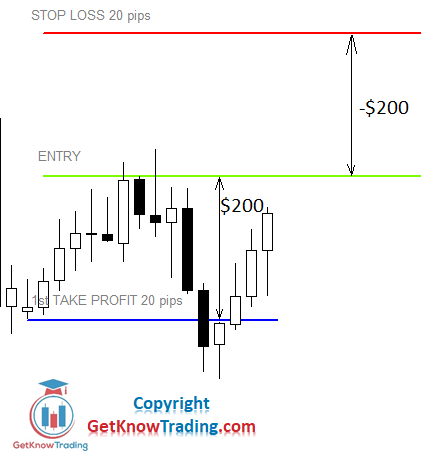

Twin Trading Single Trade Scenario

If you do not use Twin Trading technique you would have open one trade with 20 pips stop loss and 20 pips take profit.

If the trade closes with loss you would have -$200 on your account.

If the trade closes with profit you would end up with $200 profit.

It is a simple scenario which usually most traders use in trading.

Multiple Trade Scenarios With Twin Trading

There is a second option you can use and that is Twin Trading with multiple orders where you split one order into several.

How many orders you want to have depends on you. But at least two trades should be used.

I will show you one example how Twin Trading will increase the profits you can make from the trade you want to open. And after the first trade is closed you will see how you can minimize the risk and increase profits by modifying the rest of trades that are open.

Example will be with four trades where each trade have 20 pips stop loss.

Twin Trading Scenario 1 – First Trade in Profit, Other Trades in Loss

Lets imagine first trade closes with profit. And that is 20 pips with 0.25 lot gives you $50 of profit.

0.25 x 20 pips = $50

Now, you have $50 of profit on your account and three trades open that can close in loss if the market turns around and goes against you.

Lets say that happens.

Other Trades in Loss

Market turns around and closes all other three trades you have open.

0.75 x 20 pips = -$150

Now, you have $150 of loss on your account and one trade that has closed with $50 of profit.

When you sum all results you get this:

+$50 – $150 = -$100

You have ended up with a $100 loss. That is 50% less compared with the scenario where you would open one trade with 1.00 lot with 20 pips of profit and 20 pips of loss.

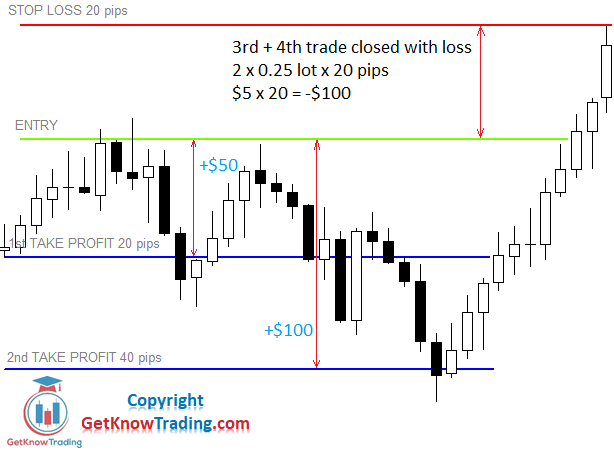

Twin Trading Scenario 2 – First Two Trades in Profit, Other Trades in Loss

Let’s imagine the first two trades close with profit. And that is 20 pips from the first trade and 40 pips from the second trade with 0.25 lot each trade.

That gives you $150 of profit.

1st trade – 0.25 x 20 pips = $50

2nd trade – 0.25 x 40 = $100

Now, you have $150 of profit on your account and two trades open that can close in loss if the market turns around and goes against you.

Let’s say that happens.

Other Trades in Loss

Market turns around and closes the other two trades you have open.

0.50 x 20 pips = -$100

Now, you have $100 of loss on your account and two trades that have closed with $150 of profit.

When you sum all results you get this:

+$150 – $100 = +$50

You have ended up with $50 profit. That is great because compared with the scenario where you would open one trade with 1.00 lot with 20 pips loss and lose all $200.

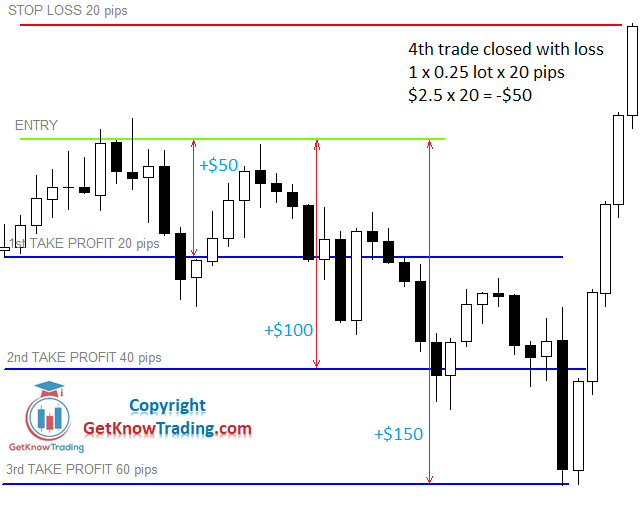

Twin Trading Scenario 3 – First Three Trades in Profit, Other Trades in Loss

Let’s imagine the first three trades close with profit. And that is 20 pips from the first trade and 40 pips from the second trade and 60 pips from the third trade with 0.25 lot each trade.

That gives you $300 of profit.

1st trade – 0.25 x 20 pips = $50

2nd trade – 0.25 x 40 = $100

3rd trade – 0.25 x 60 = $150

Now, you have $300 of profit on your account and one trade open that can close in loss if the market turns around and goes against you.

Let’s say that happens.

Other Trades in Loss

Market turns around and closes one trade you have open.

0.25 x 20 pips = -$50

Now, you have $50 of loss on your account and three trades that have closed with $300 of profit.

When you sum all results you get this:

+$300 – $50 = +$250

You have ended up with $250 profit. That is great because compared with the scenario where you would open one trade with 1.00 lot with 20 pips loss and lose all $200 or if it turns into profit you would end up with $200 profit.

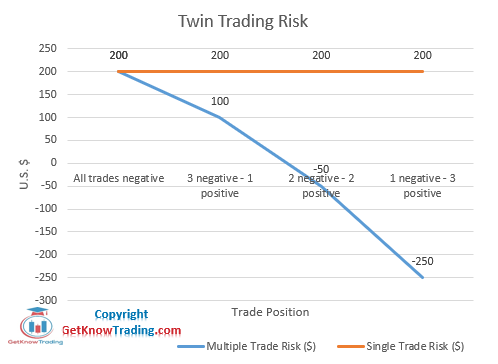

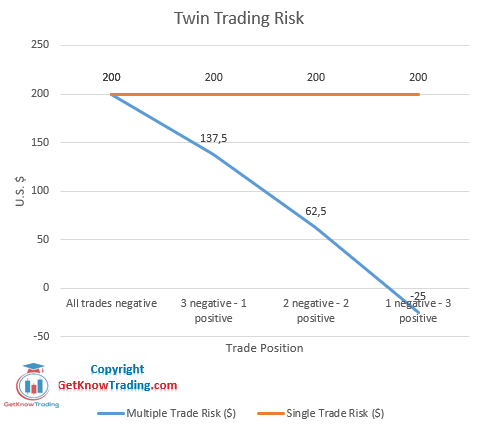

Single Trade Risk and Multiple Trade Risk

Now look how the risk difference is visible when you use single trade risk and multiple trade risk.

You compare risk on each trade and if you have profit on one trade you minimize total risk.

- Positive number means the loss on your account.

- Negative number means profit on your account.

You can see that with all negative or one negative trade you would end up with loss.

With one positive trade you would minimize the loss on the other three trades. You would take $50 of profit from one positive trade and add it to three negative trades.

Three negative trades gives you -$150, but with $50 of profit from first trade you end up with:

-$150 + $50 = -$100

If you have two positive trades you add that profit to the negative result from two negative trades.

-$100 + $150 = +$50

Two positive trades give you $150, one gives you +$50 and second one gives you +$100.

In the table you can see what happens when you have 3 positive trades and one negative.

Profit Locking

You remember the first scenario when the first order was closed with profit?

That is when the first order has closed with $50 of profit and three trades were still open.

By locking profits technique in Twin Trading you will move stop loss of three trades that are open above or below entry point depending if you have open buy or sell order.

The goal here is to prevent making three orders being closed with stop loss.

After the first trade is closed and the market turns around moving to the entry point where you have three orders open you will prevent price closing three trades with loss.

When you move stop loss above or below entry point you will make three orders being in profit instead of closing with loss.

This is the same as trailing stop function which you have in a trading platform.

Second Twin Trading Technique

In the second way of trading with Twin Trading technique you can divide the profit level on four equal pieces.

So, if you have 20 pips as take profit you would have:

20 pips / 4 trades = 5 pips per trade

Now, the first trade will have 5 pips take profit.

Second trade will have 5 pips more and that would be 10 pips take profit.

Third trade would have 15 pips and fourth trade would have 20 pips.

If you check the table below you will see that in this case you would not have profit

1.00 x 20 pips = $200

But, you would have $125.00. Which is less than in the previous way of trading.

But, here you can move your take profit and stop loss each time when price reaches higher levels. That means when price comes close to second trade take profit you will increase take profit and move stop loss to be in small profit.

When you reach third take profit you would increase third take profit to the next level close to fourth take profit and move your stop loss to be in higher profit.

When the trade reverses and comes back to your stop loss you will end up in profit. That profit can be higher than initially planned take profit where you can make more than $125.

Second thing that is important here is risk management. With this way you lower risk on second, third and fourth trade when the first trade is closed with profit.

Let me explain how I got the second and third row so you understand the table.

2nd row I got with 1st trade in profit:

0.25 lot x 5 pips profit = $2.5 x 5 = $12.5

3rd row I got 1st + 2nd trade in profit. First trade profit is $12.5 and second trade is:

0.25 lot x 10 pips profit = 0.25 x 10 = $25

When I sum these two positive trades I get:

$12.5 + $25 = $37.5

Now you understand how the table is filled.

————————————————————–

In this case you would end up in profit only if you have three trades positive and only one negative. You would have $25 profit.

So, you can see how each time loss is decreasing as 1st, 2nd and 3rd trade is positive instead of having $200 loss on each trade.

We can see from the table that while the risk remains constant for a single order, there is a constant decline in risk for multiple order trading with each position closed.

0 Comments