Contents

What is 1.00 in Forex

1.00 in Forex is the lot size you will use to open the trade. Lot size or Volume is the same but some traders are using different words.

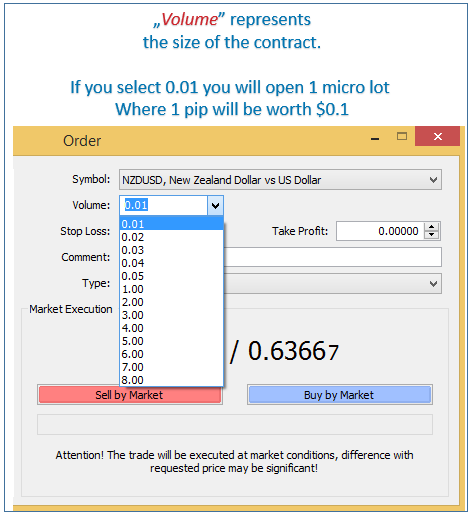

In the Metatrader 4 you will see Volume in the window when you want to open new trade.

Volume or lot size defines value of one pip. The value of a pip can be $0.1 or it can be $10.00.

On the image below you can see how does the window for new trade looks like in Metatrader 4 trading platform.

It is shown as a Volume starting from the 0.01 up to 8.00. Each value means something and gives you different result in your trading.

You need to select which Volume or lot size you want to use. By selecting one of the values you will determine will your pip be worth $1.00 or $80.00.

Standard Lot Size, 1.00 in Forex

To explain you a little bit more about lot size here is a table with the information of standard lot sizes:

| Lot | Units of base currency |

Volume | Pip value in USD |

|---|---|---|---|

| 1 standard lot | 100,000 | 1.00 | 1 pip=$10.00 |

| 1 mini lot | 10,000 | 0.10 | 1 pip=$1.00 |

| 1 micro lot | 1,000 | 0.01 | 1 pip=$0.10 |

| 1 nano lot | 100 | 0.001 | 1 pip=$0.01 |

These are four standard lot sizes which you will encounter in Forex trading. First three are usual ones and the fourth is the one that you will not see too often.

Nano lot is rarely seen because few brokers offer nano accounts. The value of a pip is $0.01 which is not too much so brokers rarely offers them.

The standard lot size, 1.00, is the lot that is mostly used. For accounts starting from the $1,000 is normal to see lot 1.00 to be used because each pip is worth $10.00. That is 1% of $1,000 account which is acceptable for trading, but more acceptable is to use it on the $10,000 account.

Large account balance will allow you to have wider stop loss. That way you can have trade open for larger moves and when there is larger draw down.

Lot Size 1.00 in Forex Meaning

1.00 in Forex means 100,000 units of base currency. In EUR/USD currency pair the base currency is Euro.

One standard lot or 1.00 in Forex means 100,000 units of Euro. When you open buy order on EUR/USD with 1.00 in Forex, that means you are buying 100,000 units of Euro for specified price.

If the current price EUR/USD = 1.1234 that means you are buying 100,000 units of Euro.

What is 0.01 in Forex?

As you can see in the table above there are three main lot sizes in Forex. Smallest of them is micro lot size.

Micro lot size means 0.01 which is 1,000 units of base currency. In case of EUR/USD currency pair that is 1,000 units of Euro.

When you buy EUR/USD at 1.1234 that means you are buying 1,000 units of Euro.

The value of a pip when you open order with 0.01 in Forex means you will make or lose $0.10. Make or lose $0.10 with each pip is not too much.

Many beginners in Forex trading tends to use micro lot size 0.01 in Forex because that means they will lose less if the trade becomes losing trade.

But, it also means 0.01 in Forex will give them $0.10 by each pip. Many traders are not satisfied with that small profit so they increase the lot size or volume.

What is 0.10 in Forex?

Middle lot size in Forex is mini lot size. Mini lot size means 0.10 which is 10,000 of base currency in Forex currency pair.

If you use EUR/USD currency pair and buy the pair at the price 1.1234 you will buy 10,000 of Euro.

0.10 in Forex means you will make $1.00 with each pip that you make by trading. While there are currency pairs that moves daily 20-100 pips, trader can make $100 if he predicts correct direction.

Mini Lot size or 0.10 in Forex is one of usual lot sizes traders use. It is acceptable lot size on trading accounts with $1,000 or more where trader can make profit of few $100 with just few trades.

What is 0.01, 0.10 and 1.00 in Forex – Example in Metatrader 4

It is always easier to explain something on the live example so I have prepared one example of Lot in Forex from the Metatrader 4 trading platform.

I have selected NZD/USD trading pair as an example.

I have open three orders at the same price but with different lot size shown in the column “Volume”.

Each row have the order open at the price 0.64340 so it is easier to follow the explanation.

The current price is 0.64329 an the difference between open price and current price is:

0.64340 – 0.64329 = 0.00011

0.00011 is equal to 1.1 pip

In the first row I have order with 0.01 lot and the profit in the last column shows me loss, -0.11$.

Second row have 10x larger lot size, 0.10 lot, compared to the first row and shows the loss 10x larger than in the first row, -1.10$.

The third row have 100x larger lot size, 1.00 lot, compared to the first row and shows the loss 100x larger than in the first row , -11.00$.

You see that the lot size 0.01, 0.10 and 1.00 in Forex defines how much a pip will be worth.

If you change the lot size at the beginning when you open order and increase it to the 2 lots, the last row in the table would have -22.00$ of profit. That means you would open 2 x 1.00 standard lot. You can increase that volume as you wish.

By selecting 0.01, 0.10 or 1.00 you define how much each pip will be worth.

Conclusion

In Forex trading basics there are three main lot sizes in and those are 0.01, 0.10 and 1.00. Each lot size will give different pip value.

If you use standardized lot size, 1.00 which is standard lot size, 0.10 which is mini lot size and 0.01 which is micro lot size, you can say that you are using standard, mini or micro lot.

The value can be changed by 0.01 size, which means you can change the lot size from 1.00 to 0.09 or to 1.01.

I have gathered most asked question that any trader ask himself and answered them with the example for easier understanding. Below is the link for downloading and I know it will be helpful.

0 Comments