Updated version – first version was published on 26.12.2019.

Whoever trades on the Forex market he knows that the Lot size in Forex have high impact on the trading result.

Many traders have the problem using Lot size in the Forex because it is not easily explained in Metatrader 4 trading platform. It is shown as a Volume with drop down menu and with numbers, like 0.01 – 8.00.

This is a major problem for the traders that are just starting as a beginners in Forex trading because they need to learn Forex trading basics and the lot size is the basic Forex term.

If you change the Lot size in Forex you will change the outcome of the trade you open in Metatrader 4 trading plaform.

If you use small lot size, something like 0.01, you will make small amount of money per each pip. In case if you use larger lot size, something like 1.00, you will make a lot of money by each pip.

How the lot size impacts on the outcome is the open question.

Through this post I will explain all about the lot size in Forex trading.

First, I will explain to you what is the lot size in Forex, and finally how the lot size impacts on your trading results.

Contents

At the End

After you read the post you can download the FREE pdf file about lot I have prepared for you with examples. In PDF file you will see on the live example how the lot size impacts on the trading result.

If you do not understand the lot in Forex by reading the post or by reading the PDF file with examples you can always contact me or leave a comment. That way I can explain in more details anything that is unclear.

You will know how to adjust the lot so it sticks to your trading strategy and risk management. If you plan to risk 1% or 2% per trade you will know how to calculate the correct lot and how to set correct stop loss.

You should leave this blog post with the knowledge about the lot, about volume in Metatrader 4 trading platform. You should know how to use the lot in your favor.

What is Lot in Forex

Lot in Forex or “Volume” in Metatrader 4 trading platform is the same thing but it is slightly written differently.

The Lot in Forex or Volume represent how much of something you will use after the trade is open in Metatrader 4 trading platform.

Amount of Volume defines how much the pip will be worth. Will the pip worth $0.1, $1 or $10 or even more.

The Lot gives you choice to define how much you want that the pip is worth.

When you open the order, each pip move up or down, will bring you profit or loss.

Profit or loss depends on which Forex order type you have open and does the price of the Forex currency pair is moving in the direction you have predicted.

When the price move by 1 pip, you see on the trading platform that your profit changes. The change will be in the amount you have defined by the Volume.

How Much is Lot in Forex

How much is lot in Forex is defined by the contract size.

The contract size in the Forex is defined like this:

| Lot | Units of base currency |

Volume | Pip value in USD |

|---|---|---|---|

| 1 standard lot | 100,000 | 1.00 | 1 pip=$10 |

| 1 mini lot | 10,000 | 0.10 | 1 pip=$1.00 |

| 1 micro lot | 1,000 | 0.01 | 1 pip=$0.10 |

| 1 nano lot | 100 | 0.001 | 1 pip=$0.01 |

First three are mostly used while the fourth is not so much and only few brokers offer nano lot for trading.

You can open lot in Forex that is between these values, 0.01 <-> 0.1 <-> 1.00 and so on. The Metatrader 4 trading platform gives you opportunity to open lot as 0.02 or 2.00.

Different values than 0.01, 0.1 or 1.00 is called lot size. Lot size specifies different values where you can use values between mini, micro or standard lot.

It is not mandatory that you use only standardized values for micro lot (0.01), for mini lot (0.1) and for standard lot (1.00).

Remember this – 1 pip will have the values as explained in the table only if

- the USD is on the second place(quote) in the trading pair and

- your trading account is in USD

If one of the two conditions are not fulfilled the value of 1 pip will not be as described. The 1 pip will not worth $1.00 for mini lot or $10.00 for standard lot. It will be different.

In that case you need to make calculation to get value of 1 pip. Here is FREE PDF for pip calculation with example how to calculate the pip value.

If you do not want to bother calculating, Metatrader 4 will do that for you anyway. But it is good to know how the calculation of pip is done.

1 pip value will be different for 1 standard lot and for 1 mini lot in a way like it is described in the table. Difference is 10x times more in case of standard lot.

If you want to make more money when the price of the trading pair changes you need to increase the lot.

Will the increase be from 1.00 to 2.00, it depends on you and your trading strategy.

Strategy should define how much you can lose on each trade you open. So, the lot should follow that strategy.

Standard Lot

Standard lot contains 100,000 units of the base currency.

If you are trading NZD/USD trading pair, the base currency is NZD and therefore, 1 Lot or 100,00 units worth 100,000 NZD.

Even if you are experienced trader and you have a lot of money on your trading account, you should be careful when using large lots.

Large lot, like standard lot, can wipe your trading account in few seconds.

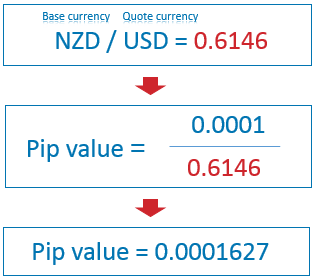

Imagine that you have open order with standard lot. Like NZD/USD trading pair as on the image above where 1 pip is worth $16.27.

By the research I have done on NZD/USD trading pair analysis, average daily pip range is 50 pips.

If you have open order and leave it through the day and if the price moves in wrong direction you can end with:

50 pips x $16.27 = $813.50

$813.50 loss is high amount on any trading account.

Mini Lot

If you want to trade smaller Lot, the mini lot is for you.

If you trade NZD/USD trading pair and open order with 0.1 Lot or 10,000 base units, this means you are trading 10,000 New Zealand dollars.

On the same example like in the case of standard lot, NZD/USD trading pair, we will have:

50 pips x $1.62 = $81.35

10x smaller loss is more acceptable if you do not have large account size.

Micro Lot

For beginners in the Forex trading this is the main lot they will use. The account they fund with the money, at the beginning is small, from $10 – $500, and they want to practice on real account.

To protect the account from large losses they open order with 0.01 lots which means 1,000 units of base currency or 1,000 New Zealand dollars.

Now, the example with 50 pips move will give us:

50 pips x $0.16 = $8.13

Not so much if you have trading account with $100 on it.

This is the reason why beginners with small account should start with micro lot, 0.01.

Even you lose few trades you will be able to continue trading with your account.

What is Lot Size in Forex – Example in Metatrader 4

It is always easier to explain something on the live example so I have prepared one example of Lot in Forex from the Metatrader 4 trading platform.

I have selected NZD/USD trading pair as an example.

I have open three orders at the same price but with different lot size shown in the column “Volume”.

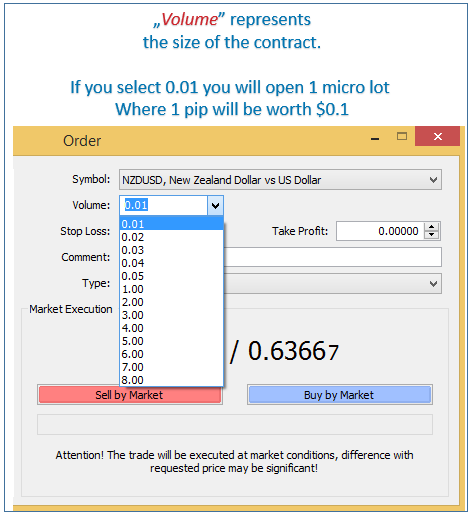

The image below shows how the window looks like in Metatrader 4 trading platform when you want to open new order.

On the image above I have selected drop down menu next to “Volume:“.

In the drop down menu I select which lot size I want.

The lot size can be different and you should select which one you want. The minimum I can use is 0.01 lots and the maximum is 8.00 lots.

In mine example I have used three different lot sizes, 0.01, 0.10 and 1.00.

The image below shows three buy orders with three different lot sizes. Lot size is shown in the column “Volume”.

Each row have the order open at the price 0.64340 so it is easier to follow the explanation.

The current price is 0.64329 an the difference between open price and current price is:

0.64340 – 0.64329 = 0.00011

0.00011 is equal to 1.1 pip

In the first row I have order with 0.01 lot and the profit in the last column shows me loss, -0.11$.

Second row have 10x larger lot size, 0.10 lot, compared to the first row and shows the loss 10x larger than in the first row, -1.10$.

The third row have 100x larger lot size, 1.00 lot, compared to the first row and shows the loss 100x larger than in the first row, -11.00$.

You see that the lot size in Forex defines how much a pip will be worth.

If you change the lot size at the beginning when you open order and increase it to the 2 lots, the last row in the table would have -22.00$ of profit.

By selecting the lot size you define how much each pip will be worth.

What is Lot Denomination Currency

Furthermore, the size of lots are usually denominated in the base currency, the currency that appears first in the quoting convention for a currency pair.

That currency is called the lot denomination currency.

For example, the lot denomination currency would be Euros for the EUR/USD trading pair or U.S. Dollars for the USD/JPY trading pair.

When calculating the pip value it is important to know which currency is base and quote currency and which currency is on the trading account.

The result of the pip value will vary between two cases:

- When the quote currency in the trading pair is not currency on the trading account

- EUR/USD trading pair and trading account currency is EUR

- When the quote currency is the currency on the trading account

- EUR/USD trading pair and trading account currency is USD

How to calculate the pip value for different cases you can check here: What is a Pip in Forex

Typical Lot Size in Forex Trading Available at Online Forex Brokers

The typical lot in Forex is between 0.01 and 1.00. This means between micro and standard lot.

Let’s repeat again what are standard lot in Forex. First three are mostly used while the fourth not so much and few brokers offer nano lot for trading.

| Lot | Units of base currency |

Volume |

|---|---|---|

| 1 standard lot | 100,000 | 1.00 |

| 1 mini lot | 10,000 | 0.10 |

| 1 micro lot | 1,000 | 0.01 |

| 1 nano lot | 100 | 0.001 |

The micro lot is very much used at the beginning of the traders life. It is because you can invest $100 and open order where you will not make a lot of money but also not lose too much.

The value of 1 pip at micro lot size in Forex is $0.10. When the price changes 100 pips you will win or lose $10 which is not to much.

Brokers knows that they have different types of traders. They tend to fulfill all possible demands that trader could have.

With small lot, micro lot, they give a chance to a beginner trader so they can try how trading looks like with real money.

On the other side they offer larger lot, 1.00 or more, to experienced traders who have more money to invest. Large investors have more money and they have possibility to open large lot where 1 pip is worth $10 or even $100.

Conclusion

Lot size is slightly different from lot. The only difference is is the amount you are using.

If you use standardized lot size, 1.00 which is standard lot size, 0.10 which is mini lot size and 0.01 which is micro lot size, you can say that you are using standard, mini or micro lot.

Lot or lot size are almost the same thing, but lot size defines the values that are between standardized lot sizes. The value can be changed by 0.01 size, which means you can change the lot size from 1.00 to 0.09 or to 1.01.

0.01 in lot size is for micro account, but if you have nano lot size then you will have 0.001 lot size as a step.

Lot size in Forex will define how much each pip will be worth so it is good to know to control lot size in order to be inline with the trading and risk strategy.

I hope this was useful and you will start practicing using the lot in your favor. Also use lot in Forex by the trading strategy because that is the correct way to be profitable.

The Lot is a powerful tool to maximize your profits but it can be very sharp weapon against you if the market does not go into your direction.

I have gathered most asked question that any trader ask himself and answered them with the example for easier understanding. Below is the link for downloading and I know it will be helpful.

0 Comments