Contents

- 1 How Much is William O’Neil Net Worth?

- 2 Born and Raised

- 3 William O’Neil Timeline

- 4 William O’Neil IBD

- 5 William O’Neil Companies

- 5.1 O’Neil Capital Management

- 5.2 WJO Foundation William O’Neil Worth

- 5.3 William O’Neil Securities

- 5.4 William O’Neil China – Investment Management Shanghai Ltd.

- 5.5 William O’Neil India

- 5.6 O’Neil Capital Management India Pvt Ltd

- 5.7 O’Neil Digital Solutions, Inc.

- 5.8 MarketSmith, Incorporated

- 5.9 William O’Neil + Co.

- 5.10 O’Neil Global Advisors Inc.

- 5.11 Data Analysis Incorporated (DAI)

- 6 William O’Neil Quotes

- 7 William O’Neil Strategy

- 8 William O’Neil Trading Rules

- 9 William O’Neil On Mistakes

- 10 William O’Neil Books

- 11 Resource:

How Much is William O’Neil Net Worth?

William O’Neil net worth is approximately $100 000 000 ($100 millions) with several companies across the world, from U.S. to China and India.

There is no single place where the William O’Neil net worth can be calculated, but you can check all companies he has and check what is the worth of each company at the time of reading.

William Joseph O’Neil is a legendary entrepreneurial investor and famous trader who developed a unique method of stock picking. He also launched his own company to help investors improve their portfolio results.

Image Source: Investors Business Daily : https://www.youtube.com/watch?v=1T70ZEoAhzw

Born and Raised

William Joseph O’Neil was born in 1933 in the southern plains of Oklahoma.

He was an only child but this was not the reason to get spoiled. He was a hard working kid that wanted to get something in his life.

His childhood was shaped by the economic depression which was in some part one of the pillars of financial discipline and work.

As a young boy he was delivering newspapers to make some money to help his family.

He attended southern methodist university and graduated with a degree in business in 1955.

Later he served in the Airforce. During that time he bought the first stock, five shares of Procter and Gamble. He wanted to become a stockbroker.

Later on he joined Hayden Stone & Co in 1958. He started as a broker where he did not know anyone.

He started without any account he could trade for so it was a hard start. So he started to look for the ones who are successful.

He looked at Dreyfus mutual fund who was performing very well at the time. He started with charting where he used quantitative analysis with computers.

At the beginning he bought Chrysler in 1962, Korvette discount department stores and Syntex Laboratories Inc.

He managed to increase his investment, $5000 into more than $200 000.

In 1964 he became the youngest person that bought the seat on the New York Stock Exchange.

William O’Neil Timeline

Source: https://origin.daicompanies.com/oneil-legacy/

William O’Neil IBD

In 1963 O’Neil started his own company William O’Neil & Co. His company made a computerized daily securities database and sold it to institutional investors.

His first product was a chart with all fundamentals about the company like income and expenses where he provided all what was needed for an investor to make a decision to buy the stock.

In 1972 he launched Daily Graphs which was a precursor of MarketSmith. Ten years later he started Investors Daily which became Investors Business Daily.

IBD provided information that was missing on the market. The information he provided had helped ordinary investors and the business community to pick the right stock.

Investor could find these informations inside:

- market trend

- people in the stock company

- equipment

- software

William O’Neil Companies

Here is the list of O’Neil assets that are available online. You can find more information about each below.

- WJO Foundation for charitable, literary, and educational purposes

- William O’Neil Securities incorporated

- O’Neil Digital Solutions, Inc.

- MarketSmith, Incorporated

- O’Neil Capital Management

- William O’Neil Ventures LLC

- William O’Neil + Co.

- O’Neil Global Advisors Inc.

- William O’Neil China

- William O’Neil Investment Management Shanghai Ltd.

- William O’Neil India

- O’Neil Capital Management India Pvt Ltd

- Data Analysis Incorporated (DAI)

O’Neil Capital Management

O’Neil Capital Management is a company with interest of investing in:

- asset management

- real estate

- printing

- digital media

- brokerage

- investment advisory

- information technology services

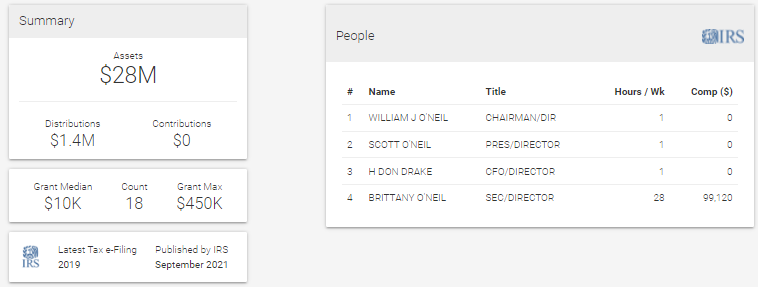

WJO Foundation William O’Neil Worth

William O’Neil WJO Worth Assets – $28 millions.

Image source: https://www.grantmakers.io/profiles/v0/461612598-wjo-foundation

William O’Neil Securities

Independent advisory firm that provides domestic and international equity research, recommendations, and consulting to institutional portfolio managers.

O’Neil Securities provide execution of the best possible trades for their clients.

Headquarters are in Boston with regional offices in New York and San Francisco.

Here you can find more details about William O’Neil Securities.

More details about the company as a brokerage firm here or PDF report.

Here you can find PDF report from 2016 where it is a visible financial report. Inside the financial report you can find that William O’Neil Securities asset worth was $12 millions.

William O’Neil China – Investment Management Shanghai Ltd.

Here is the link of William O’Neil Investment Shanghai company.

William O’Neill China, a subsidiary of William O’Neill, was established in Shanghai in 2016. In China there is also William O’Neill Information Technology (Shanghai) Co., Ltd which is Research and Development (R&D) of William O’Neil Group.

IT R&D team works to bring new products and developments to position O’Neil group as a leading market provider.

William O’Neil India

William O’Neil India is a big subsidiary of O’Neil company in India where you can find MarketSmith platform for Indian stocks and many other tools for traders.

You can find:

- MarketSmith

- tool for analyzing the portfolio

- TraderSmith

- swing trading calls

- AlgoSmith

- AI-powered Smart Investments & Trading Ideas

- Panaray

- visual display

- discover alpha-generating ideas

- analyze stocks efficiently

- easily monitor your watch lists and portfolio

- make your team more productive and efficient

- visual display

- PortfolioSmith

- diagnoses the overall strength of your stock

O’Neil Capital Management India Pvt Ltd

Here is the link of O’Neil Capital Management India Pvt Ltd which is an alternate investment fund of William O’Neil.

The company uses O’Neil Quant Fund investment strategy with Indian equities with technical and fundamental analysis.

O’Neil Digital Solutions, Inc.

O’Neil Digital Solutions specialize in Customer Communication Management (CCM). They provide solutions for Customer Experience Management (CXM) for the Healthcare and Financial Services industries.

They have a CCM platform called OneSuite to digitally transform and improve customer communication.

The company has been live since 1974 which is quite a long time.

MarketSmith, Incorporated

Using MarketSmith platform you can:

- find the best-performing stocks

- use stock charts to conduct in-depth fundamental and technical research

- see—right on the charts—the optimal time to buy and sell

William O’Neil + Co.

William O’Neil + Co. is an investment company for advising clients what to buy and sell. They offer research to their clients to improve the performance of their investment.

Here are few numbers you can find on their website:

- 70,000 Global equities, funds and indices in our proprietary database

- 350 Major institutional clients around the globe

- 150 Employees in Los Angeles, New York, Boston, London, Chicago, and San Francisco

- 70 Countries covered by our international database

- 50 Years serving the institutional investor community

- 25 Research analysts covering international markets

O’Neil Global Advisors Inc.

O’Neil Global Advisors (OGA) is an investment advisor founded in 2019. OGA focuses on building algorithmic strategies based on proprietary quantitative factor research

Data Analysis Incorporated (DAI)

Data Analysis Incorporated (DAI) is the controlling part of the O’Neil family of businesses. Provides strategic direction and guidance to its subsidiaries

William O’Neil Quotes

90% of the people in the stock market, professionals and amateurs alike, simply haven’t done enough homework

The whole secret to winning in the stock market is to lose the least amount possible when you’re not right

I make it a rule to never lose more than 7 percent on any stock I buy. If a stock drops 7 percent below my purchase price, I will automatically sell it at the market – no second-guessing, no hesitation

Some investors have trouble making decisions to buy or sell. In other words, they vacillate and can’t make up their minds. They are unsure because they really don’t know what they are doing. They do not have a plan, a set of principles, or rules to guide them and, therefore, are uncertain of what they should be doing

When a stock pulls back in price, you want to see volume dry up, indicating no significant selling pressure. When it rallies you want to see volume rise, which usually represents institutional buying

The stock market does not go up due to greed, it goes up because of new products, new services and inventions

Don’t be thrown off by the swarm of gloom and doomers. In the long run, they have seldom made anyone any money or provided any real happiness. I have also never met a successful pessimist

Managing a portfolio of stocks is like tending a garden. If you don’t keep at it, those lovely flowers you planted will be overrun by unsightly weeds

William O’Neil Strategy

Working for his own company he analyzed successful companies and through time he developed his own strategy called CAN SLIM.

CAN SLIM represents seven key characteristics of a winning stock before they make huge stock price gains.

Current Earnings

Annual Earnings

New Product

Supply and Demand

Leader

Institutional Investment

Market Direction

He used fundamental and technical analysis in his stock picking. Fundamental analysis gave him insight into how the company was doing, is it healthy. Technical analysis gave him the right timing to get into those stocks.

He had specific entry levels and exit levels so he protected his profits and to control the risk on trading.

O’Neil Investment Strategies

O’Neil capital management strategies are focused to bring the profits to their clients.

So, if you check O’Neil capital investment companies you will find that there are four investment strategies.

O’Neil Quant Fund Strategy

One is located in India under O’Neil Capital Management India Pvt Ltd. The investment strategy is called O’Neil Quant fund, which is hedged aggressive growth equity long/short strategy.

The strategy is implemented by a systematic quantitative algorithm developed based on the proven O’Neil proprietary factors. Main focus is on Indian equities that show potential growth.

O’Neil Chameleon Strategy

U.S. based O’Neil Chameleon Strategy technically, event-driven market timing strategy.

The strategy uses quantitative systematic algorithms through a set of proprietary technical patterns. With technical factors the strategy is intended to predict market trend reversal.

O’Neil Raven Strategy

U.S. based O’Neil Raven Strategy is an edged aggressive growth equity long/short investment strategy with U.S. equities.

O’Neil Timberwolf Strategy

U.S. based O’Neil Timberwolf Strategy is a proprietary Alternative Risk Premia strategy where Timberwolf seeks capital appreciation with lower volatility.

William O’Neil Trading Rules

Here are list of O’Neil trading rules which you can find in his books and in his CANSLIM strategy:

- Cut losses at 8%

- Do not buy cheap stocks, they should be higher than $20

- Buy stocks from top industries

- Stock company should have great product or service that is performing great

- Respect CANSLIM

William O’Neil On Mistakes

When you are investing you will make a lot of mistakes. All traders make mistakes.

Do not just sit and hope that the mistake will pass away. You should cut every single mistake, every loss you have.

If you have an 8% loss simply sell the stock. Do not just sit and wait for it to come back.

Because it can happen that it will fall even further and you could end up losing more than 50% or even more.

Market does not know who you are and does not care about you. You need to protect yourself and your investment.

William O’Neil Books

O’Neil is the author of:

- How To Make Money In Stocks, William J. O’Neil (1988),

- educational aspect of investing how to make in stocks

- 24 Essential Lessons For Investment Success, William J. O’Neil (1999)

- The Successful Investor, William J. O’Neil (2003)

Resource:

https://origin.daicompanies.com/oneil-legacy/

https://www.worldtopinvestors.com/william-oneil-investor-profile/

https://www.prnewswire.com/news-releases/oneil-capital-management-announces-divestiture-of-investors-business-daily-301256069.html

0 Comments