Contents

Compound ROI Calculator or Compound Growth Rate

Compound ROI Calculator or compound growth rate is the rate of return or Return On Investment at the end of the time period used in compounding calculation.

Simply said, Compound ROI, Compound annual growth rate is the compounding percentage used in Forex compound calculator to get an ending balance.

ROI(CAGR) = ((Ev / Bv)1/n – 1)*100

Ev – ending value

Bv – beginning value

n – number of time periods

CAGR is also called compound annual growth rate which represents annual return on Forex compounding plan.

That means CAGR watch the annual return, but if you want to check other time periods return you can do that.

Here is how to do it.

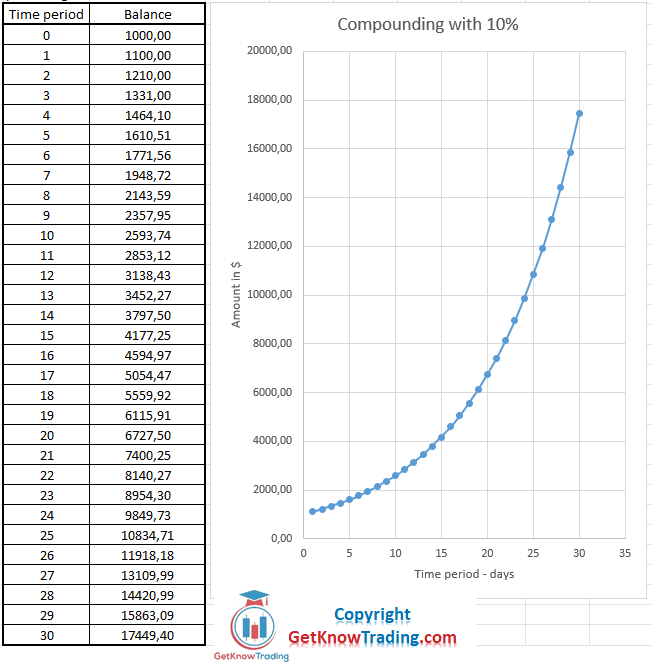

If we use an example from above where we have $1000 invested and compounded 10% on each day through 10 days.

The result from the graph is below. You could make

10% return – $17.449,40

But when you calculate ROI or CAGR you get this:

ROI(CAGR) = (Ev / Bv)1/n – 1*100

Ev = $17.449,40

Bv = $1000

n = 30

ROI(CAGR) = (17.449,40 / $1000)1/30 – 1*100

ROI(CAGR) = (17,4494)0,033 – 1*100

ROI(CAGR) = (17,4494)0,033 – 1*100

ROI(CAGR) = (1,099 – 1)*100

ROI(CAGR) = 9,99%

You see, the CAGR or compounding ROI is the percentage used at the start in compounding calculation to get the result.

CAGR is the reverse compounding process which gives you insight how the Forex trading investment has grown over a time period.

CAGR Formula in Excel

If you want to use CAGR in excel then the formula for CAGR in excel is equal to:

CAGR = ((End_balance / Start_Balance)^(1/time period) – 1)*100

Maybe this is not easy to understand if you are beginner in Forex trading, but here is an example in Excel directly so it is easier to understand the formula.

I will use the same example as above where I have:

Initial investment or start balance = $1000

End balance = $17.449,40

Time period = 30

How to Use CAGR Formula in Excel

There are two ways you can get CAGR in excel and that by using excel RRI function or directly entering CAGR formula in the excel.

Let me show the first way and that is to use the RRI function.

RRI function in excel looks like this:

=RRI(nper; pv; fv)

nper = time period

pv = start balance

fv = end balance

Here you would get the result in decimal point and to get the result in percentage % you would need to multiply the result with 100.

Here is the result in the excel when you type the RRI formula to get the CAGR in excel.

When I select all three variables for the RRI function you would get this in the excel.

When you confirm all the data in the RRI formula to get a CAGR in the excel you would get 10% as a result.

10% is the percentage I have used in the compounding calculation to get the 30 day result.

Here is what you get in excel.

Example of CAGR Formula in Excel

Now I will show you the real CAGR formula in the excel which same formula I have used above when I have calculated the CAGR for the 30 day time period.

I will enter all the data from the CAGR formula:

CAGR = ((End_balance / Start_Balance)^(1/time period) – 1)*100

I have added column letters so it is easier to understand the formula used in excel to get CAGR.

You see that the CAGR formula in excel is the same as the formula here. The data used from the table in the excel gives us final CAGR = 10% which was the percentage used in the compounding calculation on $1000 starting balance.

0 Comments