Contents

- 1 Forex Compounding Plan

- 2 Compounding Plan Strategy

- 3 Currency Pair for Compounding Strategy Plan

- 4 Volume or Lot Size in Compounding Trading Plan

- 5 Define Stop Loss and Take Profit

- 6 Risk:Reward In Compounding Plan Strategy

- 7 Time Period in Forex Compounding Plan

- 8 10 Pips a Day Compounding Strategy

Forex Compounding Plan

Forex compounding plan represents steps to use compounding techniques by reinvesting fixed percentage of profit on initial investment and increasing the profits exponentially.

Steps of Forex compounding plan include these points:

Step #1 – define initial investment as account balance

Step #2 – define percentage growth per time period

Step #3 – define time period which you will use in compounding plan

Step #4 – define Forex compounding trading strategy

Forex Compounding Plan Investment

Forex compounding plan includes investment you will bring to Forex trading which you will grow. Growing that investment will be by the compounding calculation which you can check in the Forex compounding calculator.

The investment in a compounding plan can start from $1000 or $10 000. That depends on your ability to invest money.

If you do not have money then you can try a compounding plan with a demo account. You can open demo trading account and test compounding plans with virtual money.

Below is a graph where I have put $1000 investment through 30 time periods.

The return on $1000 is calculated with compounding calculator and I have used a 10% return.

Forex Compounding Plan Percentage Return

When you have defined the initial investment it is time to define which percentage you will try to reach on each time period.

In the graph below I have put three different percentage return so you can see what you would get if you decide to have:

- 1% return – grey line

- 5% return – brown line

- 10% return – blue line

You can see that 10% has exponential growth after 30 time periods.

1% and 5% have small growth which is not so attractive. But it is conservative return which some traders like to see.

If you imagine that you invest $1000 000 and put 5% return you would get 4x times after 30 time periods.

Here are the results from the graph below:

1% return – $1.437,85

5% return – $4.321,94

10% return – $17.449,40

You can see that 10% return has exponential growth with a return of 1744%.

5% return has growth of 432%.

1% return has growth of 143%

Forex Compounding Plan Time Period

This is one of the most important parts you will need to decide what to use. The compounding time period defines how long you need to wait to get the desired outcome.

I have used a time period of 30 something. Something here can be trades, days, weeks, months or years.

Lets check what would mean if I use 30 trades as a time period for compounding plan.

Trades as a Time Period in Compounding Plan

30 trades means you would open 30 trades with profit and at the end you would end up with money on your account. Those 30 trades can be in a day, or a week. That depends on you how fast you can achieve 30 trades in a row.

Here is the condition to have 30 trades in a row profitable, not one losing. Which is less likely to achieve because if you can do 30 trades in row with profit with 10% return you would not be here reading this.

So, with 30 trades in row without losing trade you would end up with $17.449,40 on your account if you use 10% profit on each trade and with $1000 initial investment.

30 trades x 10% profit = $17.449,40

Days as a Time Period in Compounding Plan

If you use days as a time period in your compounding plan then you would try to achieve results in 30 day time. That means each day you would need to have 10% of profit.

In one day you could have more trades open, 1, 2, 3 or more, but at the end of the day you would need to have 10% of profit.

If you do not have 10% of profit each day you would not be able to achieve results from the graph.

Day as a time period gives you more freedom because you can open more trades per day and make a strategy to reach those 10%.

Check this – if you have 10 trades per day and each trade you open has a risk of 2%. But on each trade you try to get 4% of profit or more.

That is Risk:Reward = 1:2.

Let’s say you use 4% of profit and 2% of risk. That means if you open a trade and that trade becomes bad trade you would end up with 2% loss.

2% risk on bad trade = 2% of $10 000 = $200

Then you open a second trade and that trade becomes profitable. You end up with 4% of profit.

4% profit = 4% of $10 000 = $400

Lets say you have 5 bad trades and 5 good trades. You would end a day with:

5 x 2% risk = 10% loss

5 x 4% profit = 20% profit

TOTAL = 20% profit – 10% loss = 10% profit

You see, with Risk:Reward = 1:2 you would need 5 good trades with 5 bad trades to reach daily target of 10% of profit.

This gives you a lot of space to make errors in trading. Compared to 30 good trades in a row this time period makes much more sense and makes it more reachable.

Week as a Time Period in Compounding Plan

If you have a week as a time period then you would have more freedom to make more bad trades because you could open more trades per week.

The goal is to reach 10% of profit per week. And then you would need 30 weeks to reach the target from the graph.

30 weeks is equal to 7 and half months where you would make $17.449,40.

Now it is up to you to decide which time period you would use.

NOTE – I will not cover the monthly and yearly time period. The analogy is the same as described for a week time period.

If you use a monthly time period you would need 30 months to reach the target. If you use a yearly time period you would need 30 years to reach the target.

I assume that would be too long to wait, but it is up to you to decide.

Compounding Plan Strategy

As a final step you need to decide how to use all steps explained before to start trading by using a Forex compounding plan.

Strategy should include these steps:

Step #1 – define currency pair for trading

Step #2 – define lot size you will use

Step #3 – define stop loss and take profit levels

Step #4 – define risk per each trade, Risk:Reward

Step #5 – define time period you will use in Forex compounding plan

Lets now check each step so you know how to use this compounding strategy in Forex trading. You can use this strategy if you want, but first test it on a demo account before trying on a live account.

Currency Pair for Compounding Strategy Plan

If you are beginner in Forex trading then you should learn how to choose currency pair for trading.

Each currency pair has its own characteristics and you need to select those that are good for your trading strategy.

In this article I am not showing which trading strategy to use. You can use technical analysis, fundamental analysis, price action analysis or any other.

But, one of the currency pairs that are good to trade at the beginning is the EUR/USD currency pair. It has moderate volatility and you can see trends which are good to follow to make money and to make less mistakes.

When you have a currency pair for trading you can move to the next step and that is to define the volume or lot size you will use in each trade.

Volume or Lot Size in Compounding Trading Plan

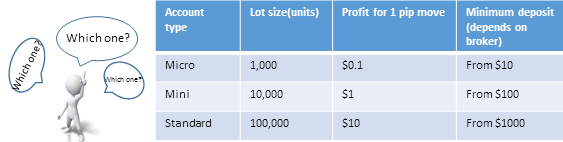

Volume or Lot size defines how much each pip will be worth. Is one pip equal to $0.1, $1 or $10 or more.

If you want, you can learn what pip is, and how to calculate the pip on this website.

If you use EUR/USD currency pairs then you do not have problems understanding the lot size for each pip.

If you use micro lot size you will have 1 pip equal to $0.1.

1 micro lot for 1 pip = $0.1

Remember that lot size should be defined with the risk you will use on each trade and how many pips you will go for in each trade.

I will explain this later with an example.

Define Stop Loss and Take Profit

To define stop loss and take profit you need to have a trading strategy. Strategy defines entry and exit levels for each trade you open.

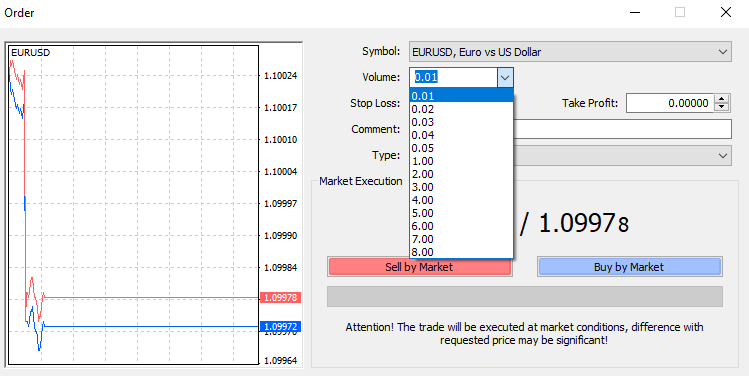

In the Forex trading platform you have two fields where stop loss and take profit are defined. Check the image below.

Risk:Reward In Compounding Plan Strategy

Now you have come to one of the most important steps in compounding plan strategy. And that is to define Risk:Reward ratio.

Risk to reward ratio defines how much you accept to lose per each trade and how much you will make per each trade. In percentage.

If you define Risk:Reward as 1:2 with 1% risk that means you plan to lose 1% on that trade if the trade is a bad trade.

1% loss as a risk per each trade

If that trade is positive trade then you would make 2% of profit on that trade.

2% profit per each trade

You should plan to have at least R:R = 1:2 as a minimum.

If you put R:R = 1:3 that is even better. Because each positive trade will give you 3% of profit.

Lets see two examples where one trade is bad trade and one is positive trade with R:R = 1:3.

First trade on $10 000 account:

1% loss = $100 loss

Second trade is positive with 3% profit:

3% profit = $300 profit

After two trade with one bad and positive you end up with $200 profit.

TOTAL = $300 – $100 = $200 profit

That means you can lose two more trades in a row to be equal. To have $10 000 on your account just like when you have started.

Time Period in Forex Compounding Plan

Now it is time to define the time period. Will you watch each trade as a time period or you will set a time period to daily.

Daily time period means you need to have a return at the end of the day defined by percentage. If you have set 10% as a target per day then you need to finish the trading day with 10% of profit to follow Forex compounding plan.

You can have several trades per day and they can be bad trades and there can be good trades. Final result should be to have 10% of profit.

If you select a weekly time period, which is also ok, you would need to finish the week with 10% of profit. This gives you more room to open more trades.

You have five days to get 10% of profit.

You can reach 10% in one trade and wait the rest of the week because you have reached your weekly target. That way you can rest and prepare for the next week. It is important not to be greedy and trade just to trade to avoid becoming bored.

I would use a weekly time period because it gives more freedom and the pressure is not too strong. Pressure can lead to overtrading which at the end gives you account wipeout.

With a weekly time period you can open one trade and let it run for the whole week.

Now it is time to show you an example with all steps explained now. So you can see how that looks.

10 Pips a Day Compounding Strategy

So, in this example I want to show you how it looks when you use a 10 pips a day compounding strategy where you define lot size, risk:reward ratio and then open the trade.

You will see how much you can make after a certain number of days by using a 10 pips a day target.

The profit each day you make with 10 pips you will add to the initial balance and then calculate next day return.

I will use 1% of profit per day as a target.

So, here is summary what I will have:

Step #1 – Currency pair EUR/USD

Step #2 – Lot size – I will show this below

Step #3 – stop loss and take profit – check below

Step #4 – Risk per each trade – 1%

Step #5 – time period is daily time period

While I have a currency pair and that is EUR/USD I know how much is micro lot per each pip.

1 pip on micro lot = $0.1

Account balance is $1000. So I am targeting 1% which is:

1% of $1000 = $10

Now I will calculate the lot size I will use to have 1% risk on each trade. Because Risk:Reward is set to 1:3 I will target 3% of profit on each trade.

1% risk of $1000 = $10

If I am targeting 10 pips on each trade I will need only one trade positive. To get $10 target which is 1% of $1000 I will need to have:

10 pips = $10

1 pip = $1

That is equal to one mini lot size. That means I need to open an order with 0.1 lot size in the Forex trading platform.

Day 1 – 10 Pips a Day Compounding Trading Plan

When I open a new order with one mini lot size with stop loss of 10 pips I will risk $10 per trade.

But, I have put the Risk:Reward ratio to 1:3 which means I am targeting 30 pips with each trade.

So, If I open three trades per day I can have 2 bad trades and one positive trades to reach the daily target of 10 pips.

1st trade – 10 pips loss

2nd trade – 10 pips loss

3rd trade – 30 pips profit

TOTAL = -10 -10 + 30 = 10 pips

With 10 pips of profit I have earned

10 pips x $1 = $10

When I add profit to account balance I will have $1010. This amount will be used to open new trades the next day.

Day 2 – 10 Pips a Day Compounding Trading Plan

Now I will use the same strategy to open new trades. The goal is to reach 10 pips of profit which will give me 1% of profit.

1% profit of $1010 = $10,1

Calculate the Lot Size

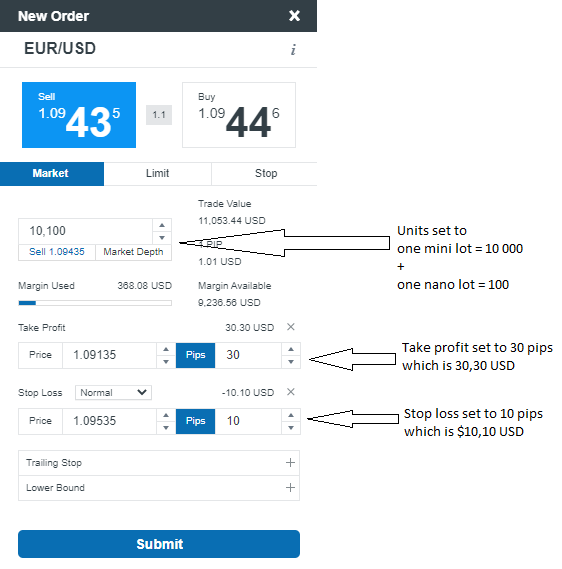

Now I will need to calculate the lot size to get $10,10 of profit. This time I will not use 1 mini lot size which is equal to 0.1.

Lets calculate the lot size.

10,10 / 10 pips = 1,010 per pip

1,010 per pip = 0,1010 lot size

This is one mini lot(0,1) + one nano lot(0,01). If you are using the Metatrader 4 trading platform then you will not be able to use 0,1010 because MT4 accepts only micro lot size as the smallest unit size.

If you use an Oanda broker then you can use nano lot size 0,001.

Oanda uses terminology of units instead of lot size. So, 1 lot is 100 000 units.

1 mini lot which is 0.1 is equal to 10 000 units.

1 nano lot which is 0.001 is equal to 100 units.

1st trade – 10 pips loss

2nd trade – 10 pips loss

3rd trade – 30 pips profit

TOTAL = -10 -10 + 30 = 10 pips

With 10 pips of profit I have earned

10 pips x $1,01 = $10,10

Now, when I add this amount to the account balance from day before which was $1010 I will get new account balance:

$1010 + $10,10 = $1020,10

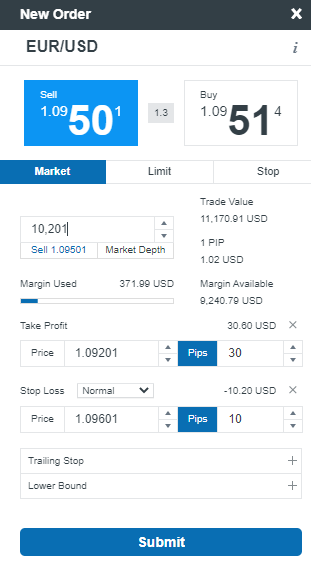

Day 3 – 10 Pips a Day Compounding Trading Plan

Now I will use the same strategy to open new trades. The goal is to reach 10 pips of profit which will give me 1% of profit.

1% profit of $1020,10 = $10,201

Calculate the Lot Size

Now I will need to calculate the lot size to get $10,201 of profit.

Lets calculate the lot size.

10,201 / 10 pips = 1,0201 per pip

1,0201 per pip = 0,10201 lot size

This is one mini lot(0,1) + two nano lots(0,002).

1st trade – 10 pips loss

2nd trade – 10 pips loss

3rd trade – 30 pips profit

TOTAL = -10 -10 + 30 = 10 pips

With 10 pips of profit I have earned

10 pips x $1,0201 = $10,201

Now, when I add this amount to the account balance from day before which was $1020,10 I will get new account balance:

$1020,10 + $10,201 = $1030,301

Day 10 – 10 Pips a Day Compounding Trading Plan

When I trade like this for 10 days you would get these results.

After 10 days with 10 pips compounding with 1% risk on each trade you would end up with a 10% large account.

In two weeks you would make 10% which is quite a good result. And those 10% were with three trades per day where you can have 2 bad trades and only one positive trade.

Day 10 – 10 Pips a Day Compounding Trading Plan with 50% Profit

Imagine increasing percentage of profit each day from 1% to 50%.

In 10 days you would end up with $57.665,04 on your account.

Check the graph below.

0 Comments