Choose a Forex currency pair by following these steps:

- Step one: find all major currency pairs

- Step two: choose a currency pair that is traded when you are available

- Step three: choose a currency pair with moderate volatility

- Step four: choose low cost currency pair

- Step five: check does the pair respects support and resistance level

- Step six: check does the pair respects trend lines

These are necessary steps to do in order to choose a currency pair for trading.

If you do not know which pairs are good then read the article about the best currency pairs for trading in Forex for beginners.

Contents

Precisely Define How to Choose a Currency Pair

You have a list of necessary steps to choose a currency pair for trading, but the list is not completely finished.

So, I will give you more details about each step and you will see that there are some more small steps you need to pay attention to.

Step one: Choose a Major Currency Pair

I will not get too much into details about major currency pairs, but just as a reminder you need to know that a major currency pair is the pair with USD included.

USD can be base or quote currency in a currency pair. If there is not USD in a pair then it is not a major currency pair.

Here is a list of major currency pairs:

Now, with the list you have narrowed down possible choices to choose a currency pair for trading.

Next step is to narrow down even more. Because you need to choose a pair which will fit your trading strategy. The strategy should have some of the filters you need to apply to this list.

For example, you can have a filter that says you do not want to have Japanese Yen in the list. So you would select currency pairs without Yen.

Now, if you do not have a strategy then you can follow these general steps to select the currency pair for trading.

One of the issues you can have is the time for trading. You are not available 24h per day so you need time for trading.

And when you are available you want to have the best that the Forex market can give you.

One more thing you can do to select the best currency for trading is to use currency strength meter that will show you which currency is strong.

Step two: Time of Activity for a Chosen Currency Pair

If you live in Europe then you can trade EUR and USD during the day. That is the time when you are available and when the EUR and USD currency are traded the most.

By knowing which pair is active more you can also plan the day accordingly.

The image above shows you local working hours for the Forex market. You can use these trading hours as general information because the correct time of each market depends on the time zone you are living in.

So, for example, let’s say you are living in the U.S. That means you are available when the London and New York trading session is active.

That means you can choose all currency pairs from the list of major currency pairs.

But, to filter it more you should use only those that are mostly active during Europe and New York trading sessions.

Those are:

- EUR/USD

- USD/CAD

- USD/CHF

- GBP/USD

Now, the next step is to select a currency pair that is volatile. And by volatile I mean you will have price change per hour by several pips.

That means around 10-20 pips.

With 10-20 pips per hour means you will have prices that change in time. The price that does not stay all the time on one price.

For you that means you can make money.

Remember – you make money on the Forex market when the price moves from price to another price. If the price stays all the time on one price you will not make money.

Step three: Volatility of a Selected Currency Pair

Up to now, you have a list of four currency pairs. The next step is to see which pair has a nice volatility.

Here is a graph of each currency pair from the list so you can make a decision which has the best volatility.

EUR/USD

This pair has a pip range around 20-25 which makes the pair good for trading.

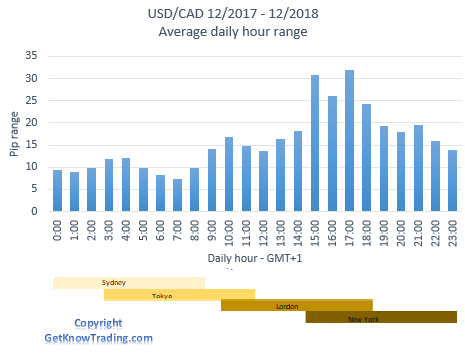

USD/CAD

This pair has highest volatility on the London and New York overlap and it is around 20 pips on average.

USD/CHF

This pair has 15 pips on average per hour.

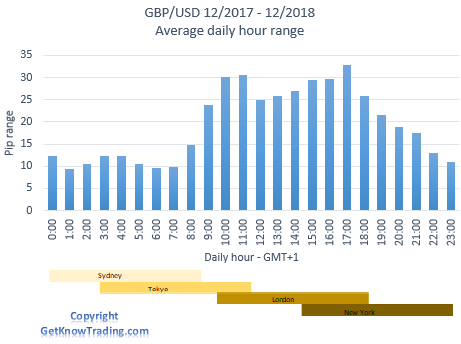

GBP/USD

This one has around 25 pips on average.

What you can see from the above graphs is that:

- EUR/USD – 15-25 pips

- USD/CAD – 20 pips

- USD/CHF – 15 pips

- GBP/USD – 25 pips

If you filter the best ones you will be left with the:

- EUR/USD

- USD/CAD

- GBP/USD

If you are a beginner in Forex trading then it is best to have only one pair for trading.

To help you decide which one would that be you can choose the currency pair that has the lowest spread.

Spread is the cost you pay to your broker for trading that currency pair. So, you want to pay as low as possible.

Step four: Choose Cheap Currency Pair

The lowest spread, meaning the lowest cost for trading, have major pairs in Forex.

On our list we have all major pairs so the first condition you have fulfilled.

The next step you can do to filter currency pairs with lowest spread are the ones that are the most liquid. And that means that they are traded very often.

Have in mind that the broker will give you low spread on the currency pair if you trade it often.

Why?

Because if you trade often that means they will make money often so they can lower the spread for you and to bring more customers.

When they have more customers and when you have low cost for trading that means you and all other customers will trade more. And at the end that means they will make more money.

So, the most liquid pairs from the list are:

- EUR/USD

- GBP/USD

You can see it in the image below. Image shows you that the most traded currency pair is EUR/USD and then GBP/USD. And that is only for the pairs from the list we have filtered.

That means EUR/USD will have, probably, the lowest spread.

Image source: Bank for international settlements

You have come to an end, but if you want to choose a currency pair that respects support and resistance and trend line then read further.

I will use the last three pairs and analyze them to show you which one respects the support/resistance and trend lines.

Step five: Support and Resistance Levels

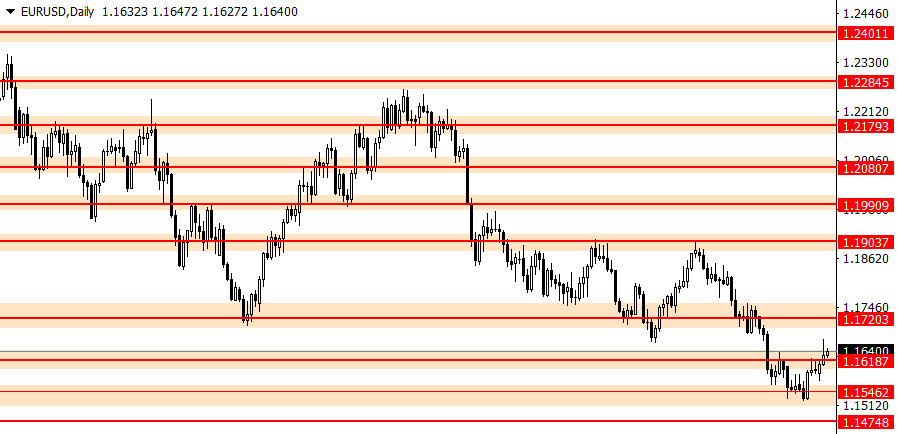

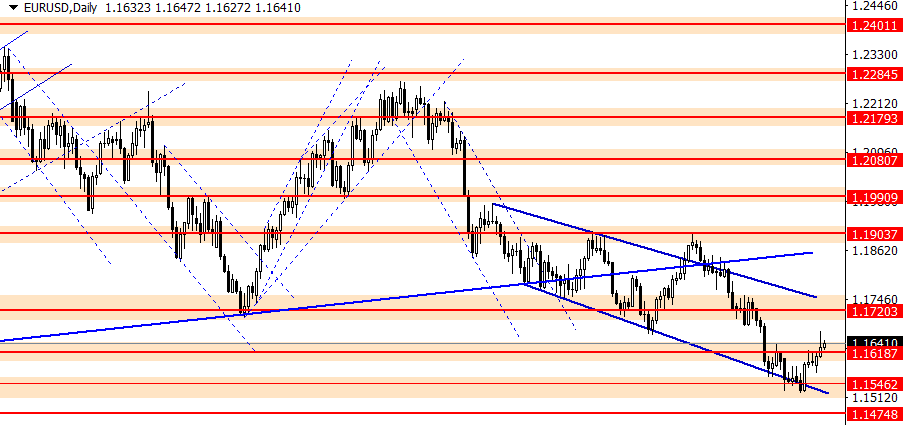

First currency pair is EURUSD with drawn support and resistance lines on the chart.

What you can see is that the pair is respecting the support and resistance lines. There are small breakouts from the support and resistance lines, but in general EUR/USD is moving in between these lines.

This makes the EUR/USD pair which can be predicted where it will move in the future.

You can see that the price is reaching red lines when it is going up and going down.

It changes direction when it comes close to the support and resistance. The area close to support and resistance which is marked with an orange rectangle around support and resistance lines is called supply and demand zone.

GBP/USD

GBP/USD is the next pair with support and resistance lines. As you can see this pair is respecting the support and resistance lines. If the support and resistance lines are drawn correctly then it is visible it respects them.

So, this pair is also good to trade by analyzing it with support and resistance. That means you can make the analysis and predict future price movement.

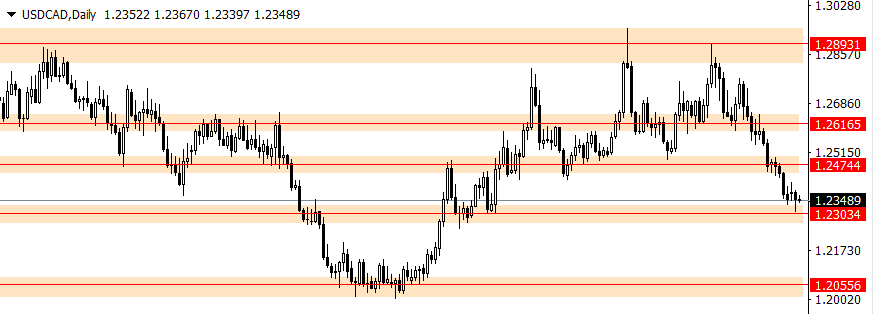

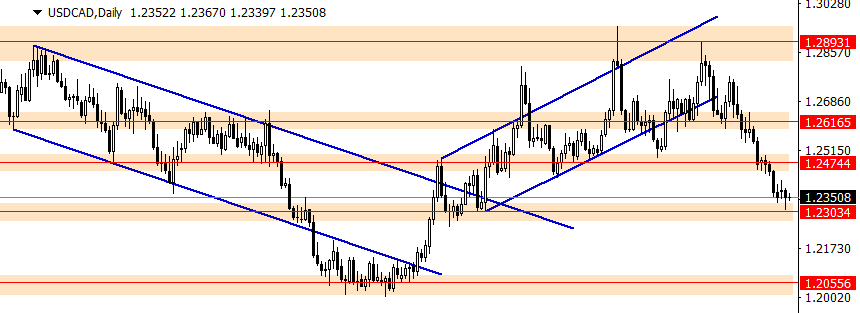

USD/CAD

The USD/CAD pair with support and resistance levels on the chart shows that price is respecting them.

This pair is also good for trading by analyzing it with support and resistance lines.

When you put the supply and demand zone you will have a better overview where the price tends to change direction.

You can make the conclusion that all three pairs respect support and resistance lines which makes them good for trading.

That means also that many traders are using support and resistance lines to analyze the pair and trade the pair.

Lets see how they respect trend lines which adds more arsenal to the trading analysis of the pairs.

Step six: Trend Lines

Trend lines with support and resistance are good tools to analyse where the price will move in the future.

Trend lines are dynamic support and resistance lines where the price will bounce from them or break them.

Drawing trend lines on the chart is not so hard after you practice. But in time you learn what works and what not.

EUR/USD

You can see many trend lines on the chart below where the price follows the lines.

The price stays inside trend lines, but when it breaks out then it changes the direction.

Because the price tends to stay inside trend lines you can easily see where the price is heading.

And when you have support and resistance with trend lines combined you can easily see when the price will have a hard time to pass support or resistance lines.

GBP/USD

GBP/USD with trend lines on the chart shows that it respects trend lines, but not so precisely as EUR/USD. When the price forms a trend line it does not follow the trend for too long.

When it breaks out of the trend line it respects them as a support and resistance.

It would be good that the price respects the trend line many times which would give significance to the trend lines.

As you can see the trend lines do not get touched several times which makes them unstable and less precise tool to trade with support and resistance.

USD/CAD

USD/CAD as the third pair have trend lines on the chart. You can see that it follows the trend lines, but it also does not respect them that often.

In general you can draw trend lines, but do not expect to use them very often.

When the price comes to the horizontal support and resistance lines the price respects them, and combined with trend lines sometimes you have a confluence of support or resistance which makes the pressure on the price.

Supply and demand zones are giving you more confirmation to the analysis which you can use to your advantage.

Conclusion

Now, at the end you can make a conclusion that in six steps you have chosen a currency pair for trading.

You have applied filters that will give you the best pair for trading.

With this way of filtering you can find more pairs for trading, but have at least first, third, five and six steps included.

Those are the most important steps you should have when choosing the currency pair in Forex.

If you are trading crypto or stock market you can use the same steps to filter the best pairs for trading.

0 Comments