Here I will discuss trading pair EUR/USD analysis through several charts I have extracted from period of one year and from 1997 for monthly analysis.

You will see how trading pair is behaving through:

- hours in a day

- days in a week

- months in a year

You will be able to see what period of the day, week and year is the best time to trade EUR/USD pair. When pair have highest volatility to extract pips as much as possible from the market and to get profit from that pips.

As every trader knows in order to be successful trader you need to have good strategy. Every strategy involves good planing which trading pair to trade and at which time. This post will give you good overview about EUR/USD volatility so you can make good strategy around this pair.

I want to give more insight with EUR/USD analysis through following topics:

- EUR/USD Name Analysis

- EUR/USD Analysis Popularity

- How to Trade EUR/USD

- Trading Session Pip Range

- What is EUR/USD Daily Range

- EUR/USD Weekly Range

- Monthly Range and Pip Range History

- What Impacts EUR/USD Volatility

- Connection Between Volatility and News

- EUR/USD Analysis – What to Take From Here

Before starting you should read what is Pip Range to understand how the analysis of this Forex currency pair is done:

Read more: What is Pip Range in Forex

Contents

- 1 EUR/USD Name Analysis

- 2 EUR/USD Analysis Popularity

- 3 How to Trade EUR/USD

- 4 EUR/USD Analysis – Trading Session Pip Range

- 5 EUR/USD Analysis – Daily Hour Pip Range

- 6 EUR/USD Analysis – Weekly Range

- 7 EUR/USD Analysis – Monthly Range and Pip Range History

- 8 What Impacts EUR/USD Volatility

- 9 Connection Between Volatility and News

- 10 EUR/USD Analysis – What to Take From Here

EUR/USD Name Analysis

There is three opinions and I could not find which one is correct that gave name „Fiber“ to this trading pair.

- First opinion is that the Euro zone has the best optical fiber

- Second is because GBP/USD is called „Cable“ and close connection between EUR and GBP

- Third one is that name was taken from the paper used to print European banknotes where cotton polymer fiber blend is used in each banknote to make it more durable

EUR/USD Analysis Popularity

Is the EUR/USD trading pair popular?

Yes it is. One of the most popular trading pair on the Forex market.

Why is this so?

Well, if you have traded EUR/USD than you know why. If you did not trade it up to now then you will find out. Trading pair have the best spreads only if pair have enough liquidity, volatility.

While it is major trading pair many traders lowes to trade the pair and this give EUR/USD volatility and liquidity. Also trading pair have 2 major currencies from all currencies in the world and from countries where the majority of traders lives.

So, when you combine all these characteristics it is not strange that EUR/USD is one of or the best trading pair to trade.

Many trading strategies are used on this pair because those trading strategies works and gives good result. You should have in mind that when traders use same trading strategy/patterns it is very much possible that the pattern will work because they all look for same key levels.

How to Trade EUR/USD

EUR/USD pair is very popular among traders because of its volatility. Large volatility is a result of many corporations in U.S. and Europe which have their subsidiaries and which use two currencies for their business. They participate every day in Forex market to exchange currencies and to hedge their exposure to the risk of currency movement.

Hedging means they want to protect their money if any of the currencies start to move against their position so they buy another currency that will bring them profit in that move.

While this pair attract so many investors and traders, pair is known by its huge volatility. This also gives broker opportunity to lower spread on trading pair which attracts more traders to trade. EUR/USD as major currency trading pair have one of the lowest spreads on Forex market and thus have large traders trading it.

How to Trade EUR/USD – Volatility

Volatility and low spread are two characteristics, one of the crucial ones for traders when choosing which pair to trade. For beginners this pair is one of the favorite ones because low spread and high volatility and liquidity gives them low cost and most opportunities to trade.

When pair have small volatility it leaves less opportunity for traders because it is much easier to grab some pips in over 100 daily pip range instead trading on 50 daily pip range. So, in these times you can expect that you will have lower average pip income compared to previous years. I will explain this later in this post.

This directly impact on the trading results because smaller pip movement can be hard to trade when spread or commission is to large. Sometimes opening a trade is not worth of the costs you will pay just to enter into the trade.

Smaller volatility can trick you in a way you think there is a trend but momentum slows down and you get stuck in a trade. You have less trades available or signals from your trading strategy and your strategy begins to give you less profitable trades.

Another way to trade EUR/USD is to follow price action where you can catch pair movement in a way to open a trade when pair have made price action pattern. This combination of trading price action you should take a look on DailyPriceAction blog where Justin Bennett shows very good example.

EUR/USD Analysis – Trading Session Pip Range

Lets dive into EUR/USD trading pair analysis to see how pair behaves in different hour, day and month. I want to emphasize that time of candle price is taken out from platform which is on GMT+1. Values are average pip range from period of one year, 12/2017-12/2018.

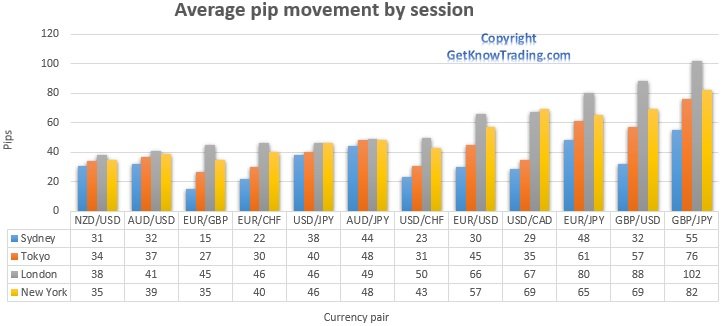

First chart shows how pair is doing on trading sessions compared to others trading pairs. I have ordered pairs on the chart to easily see which pair has lowest and which have highest volatility.

EUR/USD analysis shows it has relatively medium volatility compared to other trading pairs. Compared to GBP/JPY who has the best volatility EUR/USD is not so good.

Starting from Asian trading sessions pair does not have pip range above 50 pips which in some cases is not enough for good trading. But some trading techniques requires 10-20 pips in order to trade successfully.

As time passes from Asian to European trading session volatility increases and almost double. When London opens large number of traders and volume increases because EUR is European currency.

When New York opens and two major trading sessions overlap, London and New York, we get more volatility. This overlap you will see further in this post on the next chart.

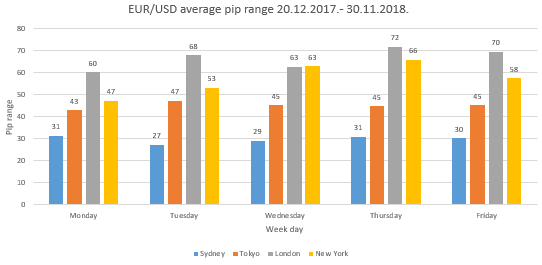

Next chart shows EUR/USD analysis how pair is doing through week by each day on each trading session. Comparing it with chart above where is average pip range for each trading session we see that there is no big difference looking trading pair by each day in a week.

Asian session is around 30 pips on Sydney and around 45 on Tokyo trading session. Pair is not traded to much when Europe and U.S. is sleeping which makes sense. During Asian session AUD/NZD/JPY is traded at most which average pip range is visible on the chart above.

If you take a closer look in the chart “EUR/USD analysis – trading session pip range” you will see that EUR/USD average pip range is increasing from Monday up to Thursday on London and New York session. On the Friday is declining. This kind of behavior is not visible on Asian session which confirms that pair is interested so much to those traders during those trading sessions.

From these charts you should take information that EUR/USD analysis shows you that:

- pair have highest volatility on London trading session

- during overlap with New York session pair have increased volatility

- starting from Monday volatility increases

- volatility peak is in the middle of the week, Wednesday and Thursday

- volatility decline on Friday

EUR/USD Analysis – Daily Hour Pip Range

By looking on the chart above you see average pip range which in a period of one year. Pip range through a day measured on which hours has high and low pip range.

EUR/USD analysis tells us that EUR/USD volatility is known to traders because it is major trading pair and it is liquid. It means that a lot of traders buys and sells EUR/USD pair.

Looking from the left side on the chart you can see pip value starts to rise. This is time when Sydney market is open and there are no so many traders who trade this pair. During this period AUD and NZD currencies are traded in more quantity.

When two trading sessions overlap, Sydney and Tokyo, you can see that pip range increases which means traders buy and sell this pair more than on Sydney session. This happens due to Tokyo traders who jumps on the market and increase volatility on this pair.

As time passes pip value decline because traders have open their positions and volatility is on hold until London trading session starts.

Read more: Forex Market Hour

EUR/USD Analysis – London Trading Session

London session is known as the largest one and while EUR is Europe currency traders like to trade that pair. We see increase in pip range from 09:00h up to 11:00/12:00h.

Around noon we see drop in pip range on London session. Mostly this is due to lunch brake in Europe, positions are set and traders relax in next 2 hours waiting for New York session.

EUR/USD Analysis – New York Trading Session

Around 14:00h we see rise on the pip range and reason for this is that U.S. traders together with European traders are active on the market. EUR/USD volatility increases due to large amount of trades.

Traders form their positions and mostly around that time news from U.S. are published. News have high impact on this pair because USD currency is widely connected to all other currencies. So, when USD currency moves all other currencies also move.

Going to the end of the day you see that pip range starts to decline, especially when London trading session finishes(17:00h). Large amount of traders close their position, EUR/USD volatility declines and pair is traded less.

By the end of the day pip range is at same level as it was on the start of the day. Sydney and Tokyo trading session takes over and another day comes.

Conclusion

What can you take from this chart as conclusion is that EUR/USD volatility is high when two main trading session overlaps. Those are London and New York where Europe and U.S. traders trade EUR and USD currency.

Less EUR/USD volatility is on Sydney and Tokyo session because there is no much traders active on this pair. They are focused on AUD and NZD which is more closer to their area from economic aspect.

EUR/USD Analysis – Weekly Range

Going to weekly chart of EUR/USD volatility by trading session we can have better overview how trading pair is behaving during each day of the working week. Of course it is not possible to trade every day during week, like weekend, but from Monday to Friday we will see how pair is doing.

EUR/USD Analysis – Starting the Week

Looking from Monday we see that pair is starting to increase pip volatility towards middle of the week. This is similar as on daily chart where traders start to open trades and form their trading strategy which is based on the weekly trading plan.

At the start of the week we also see some trends forming which will last until end of the week. This is also one of the reason why pip range increases from Monday to middle of the week.

Each trading session have its own behavior during the week but something that can be concluded is that Sydney and Tokyo trading session on EUR/USD volatility does not change a lot during week.

On the other side London and New York session have relatively significant change and rise from Monday to Friday. Reason for this is that EUR/USD volatility is subject to European and U.S. trading session where most traders trade this pair.

EUR/USD Analysis – Middle of the Week

In middle of the week EUR/USD volatility is at peek and most traders are active. Traders are already in the trend making their decision to open or close trade. Many traders are speculative and they day trade which gives trading pair more volatility in middle of the week.

What traders have planned on the beginning of the week now in the middle of the week they implement it into market.

EUR/USD Analysis – End of the Week

Comparing to daily behavior of the trading pair EUR/USD volatility at the end of the week gives decline in pip range.

Chart shows information that traders reduce their activity on Friday. Many traders close their position and calculate their results. Some of them does not want to have open position over weekend so they can enjoy weekend without thinking what will happen when market on Sunday evening open(GMT time).

Over weekend some news can pop up which can have huge impact on some currencies. Those news can make a large gap at the opening which could cause large losses to traders account if he is on the wrong side of the market.

Stop loss will not help reducing your loss if gap happens. When market opens trading terminal will close open position at the price when market opens.

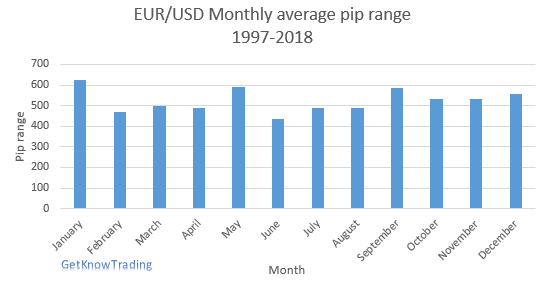

EUR/USD Analysis – Monthly Range and Pip Range History

Something new for EUR/USD volatility is shown on the chart above. It shows what is average pip range on monthly base. Which month in the year is most volatile and which is less volatile. For some traders this information will be helpful so they can improve their trading strategy.

Comparing this chart with two previously charts we see that months does not behave similar as day or a week at the beginning. In monthly chart there is a lot data that cannot be filtered to have some greater meaning as day or hour has.

Start of the year for EUR/USD pair means that average pip range is at the highest level. Middle of the year is holding level a little less than begin of the year and end of the year is also holding some level, slightly increasing.

End of the year we can attribute to closing position for traders who wants to see their results. Similar as traders do on stock market they want to close position and calculate their work through year. Some of them wants to close position and show that they had positive results and get bonus on their trading if they trade for bonus.

As the year start they open again their position and do the same cycle again. This is one of the reason why start of the year is at the top of pair volatility.

In the next part of the blog post I will show you 12, twelve, charts which shows EUR/USD analysis over few decades in order to give you the best pair volatility overview.

January

The only month in which average monthly pip range is over 600 pips if you take a look on the chart above “EUR/USD analysis – monthly pip range“.

Looking into the past you can see that average pip range did not change a lot. Only significant change was in 2009 when major financial crisis hit the market where volatility has increased.

2015 had large impact on the market by news from EU where ECB decided to unleash QE(quantitative-easing).

February

One of the months that has lower pip range, under 500 pips, but enough to trade this pair. Average line from the past did not change which tell us that there is no major change in pip range volatility in this month.

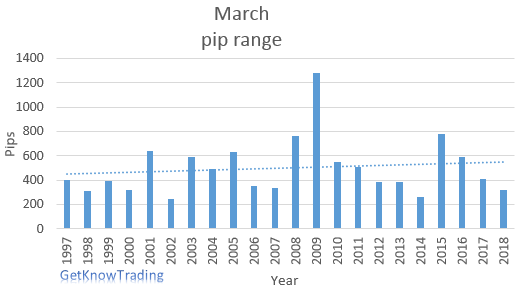

March

March is one of three months that have increase in monthly average pip range from the past up to now. But anyway if you take a closer look even this month does not have increase in pip range volatility in the last three years. It declines like most of the months.

April

April is month with decreasing monthly average pip range. Nothing special had happen in this month which could be interesting to show you.

May

Second month by monthly average pip range with almost 600 pip range by chart “EUR/USD analysis – monthly pip range“.

May is one of the months that have increase in monthly average pip range. But, also as most of others months have decline in last few years. Only 2018 year was exception where we have increase in pip range.

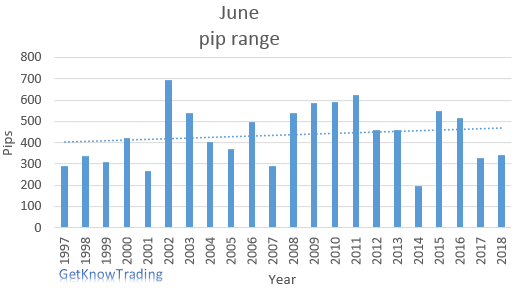

June

June as the last month with monthly average pip range rise. It would be good that other months follow this one in average pip range rise.

July

July have decline in monthly average pip range. Event that made large pip range in 2010 was Greek debt crisis. Years after that average pip range declined.

August

Major financial crisis in 2007-2008 had large impact on price movement on every currency so this pair had also some change in pip range.

Average monthly pip range is declining as most of the others months.

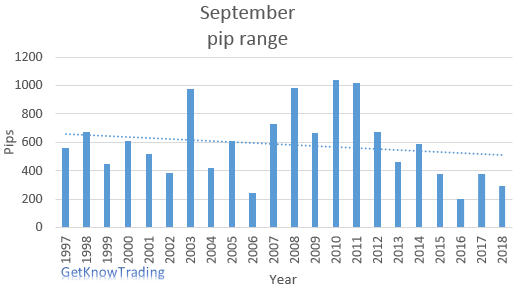

September

September is a month with close to 600 average monthly pip range. Its average monthly pip range is declining looking from the past up to now.

October

Read here for more information about global financial crisis in October 2008. This event caused spike which is shown on the chart under this text.

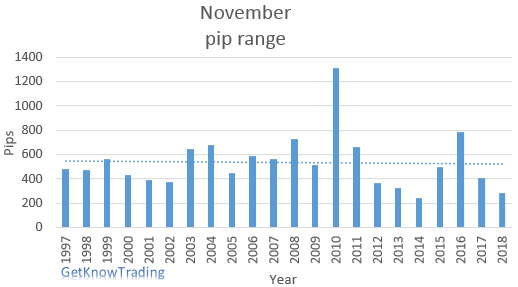

November

Again, European sovereign debt crisis caused spike on monthly pip range.

December

In 2008 major crisis had another impact on this pair and in December there were more bad news which caused spike on the monthly pip range.

EUR/USD Analysis – Monthly Conclusion

What we see generally is that average pip range is declining from 2009 and we do not have such volatility as before. This gives us less opportunities to catch higher number of pips but still pair has large volatility that allows us to trade it and to earn money.

What Impacts EUR/USD Volatility

What influence these two currencies is primary their economy. One of the highest indicator that have large impact on the currency is interest rate in each country.

Mostly when interest rates are increasing price of the currency is increasing. This is called International Fisher effect.When interest rate is higher in U.S. it means that USD will rise comparing to EUR. When EUR interest rates is higher than U.S. EUR will rise comparing to U.S. dollar.

Higher interest rates means currency will attract more investors in that country where they can earn more money and currency becomes more desirable.

Central banks – Institutions that affect the pair are the central banks, ECB and FED. They regulate interest rates, the monetary policy which as a result have currency movement.

Political factor have impact on EUR where several countries are in eurozone and when there is instability between them currency gets hit and value starts to decline. This political factor is one of the main issues they are facing because to many countries use same currency and each country have their one opinion on some topics. When you see this kind of behavior in eurozone you can plan to trade against EUR.

Connection Between Volatility and News

As any currency in a world EUR and USD is affected by news. Here is a list of news which have impact on the currency and which impacts your trading strategy:

- Monetary policy

- Price Inflation

- Confidence and sentiment

- Economic growth, GDP

- Balance of payments

Countries with high level of inflation depreciate more compared to other currencies. Inflation causes the central bank to intervene in a way as adjusting interest rate to control undesired effects.

PPI, CPI, PMI and GDP

Indicators:

- PPI as Producer’s Price Index

- shows trends within sale markets, manufacturing industries and commodities markets

- CPI as Consumer Price Index

- Consumer Price Index measures inflation that is most important indicator of the economic health of that country

- PMI as Purchasing Managers Index

- Purchasing manager index – shows us are purchasing managers optimistic or pessimistic about the economy

- GDP Gross Domestic Product

- tells us how much the economy is strong, how does it advance and is it healthy or not

These indicators have impact on the price of any currency and they are ones which you should watch. Price index is telling how the price of consumer goods and manufacturing material is doing. These prices have impact on inflation and consequently on interest rates.

GDP is overall information how country is doing and thus information will have large impact on the price of currency.

I will not go more into details about these indicators but you can check for more information on the links I have gave.

EUR/USD Analysis – What to Take From Here

As I have give a lot of information in EUR/USD analysis there is useful information you can use in your trading.

- Pair have large volatility and low spreads

- Best time to trade during day is middle of the day(GMT)

- Use overlap in trading sessions, Tokyo-London, London-New York, to extract as much pips is possible because then you will have the highest movement

- During a week choose to trade on middle of the week, Wednesday and Thursday because then you have best volatility and chance to grab pips from the market

- Watch for Friday – lock the profits you have to avoid impact from weekend news if there is any

- Any month in a year is good to trade. There is no big difference between them

- Watch out on published news and indicators that have large impact on the currency

Read more:

- GBP/JPY Pip Range Analysis – Account Widow Maker

- GBP/USD Pip Range Analysis – Cable Connection

- EUR/GBP Pip Range Analysis – Forex Under the See Level

- EUR/JPY Pip Range Analysis – Euro Japan Samurai

- EUR/CHF Analysis-The Biggest Crash in the Forex History

- USD/CAD Pip Range Analysis – Oil UP Pair DOWN

- USD/JPY Pip Range Analysis – Ninja Pair

- USD/CHF Pip Range Analysis – Swissie

- AUD/USD Pip Range Analysis

- AUD/JPY Pip Range Analysis

- NZD/USD Pip Range Analysis

- What is Meaning of XAU in Forex

- What is Meaning of CFD in Forex

- What is GU in Forex

- What is GJ in Forex

0 Comments