Trading pair GBP/JPY is called a widow-maker and I want to give more insight with GBP/JPY Forex currency pair analysis through following topics:

- GBP/JPY Name Analysis

- GBP/JPY Analysis Popularity

- How to Trade GBP/JPY

- Trading Session Pip Range

- What is GBP/JPY Daily Range

- GBP/JPY Weekly Range

- Monthly Range and Pip Range History

- What Impacts GBP/JPY Volatility

- Connection Between Volatility and News

- GBP/JPY Analysis – What to Take From Here

This post will clarify why GBP/JPY is known under catchy name where volatility have huge impact on the trading result.

You will see what is daily, weekly volatility and how pair behave through past years until today. You will get chart information which you can implement into your trading strategy which will help you trade better on this pair by knowing when pair have largest movement and when it slows down.

Contents

- 1 GBP/JPY Name Analysis

- 2 GBP/JPY Analysis Popularity

- 3 How to Trade GBP/JPY

- 4 GBP/JPY Analysis – Trading Session Pip Range

- 5 GBP/JPY Analysis – Daily Range

- 6 GBP/JPY Analysis – Weekly Range

- 7 GBP/JPY Analysis – Monthly Range and Pip Range History

- 8 What Impacts GBP/JPY Volatility

- 9 Connection Between Volatility and News

- 10 GBP/JPY Analysis – What to Take From Here

GBP/JPY Name Analysis

By its movement, volatility and results trader have give this pair a various names. Some names are made from combination of GBP and JPY currency and some from results traders had in their trading.

- Beast

- Geppy

- Dragon

- Widow Maker

- Guppy

- Gopher

Why would someone call trading pair a Beast? I think you have encountered people who calls their friends or someone they know as a Beast for some reason. Sometimes it is because that person is a strong one, huge, or very strong.

Beast or Dragon, is a name taken out of currency pair movement and behavior. If you take a look on the internet you will find traders result s where they show pip collection in one or two moves that gave them huge earnings. Also, on the other side large losses.

I also have earned in few days 1000 eur starting from 100 eur in few trades on this pair. This was time back in 2012 when Japan prime minister Shinzō Abe have conducted QE(quantitative-easing).

But I had very huge losses going from 1200 eur account balance to margin call and destroyed account in one night. This was all on GBP/JPY pair and this is the reason why traders call this pair “Widow maker”.

If you had open BUY order with enough wide margin you could not loose trade. Pair was running to the sky, like riding on the Dragon or Beast that do not slows down.

Name “Widow Maker” is giving a good picture of this pair. So, traders give names to trading pair just to emphasize pair strength, value, to easy remember trading pair or give extra meaning.

GBP/JPY Analysis Popularity

GBP/JPY in Forex is known by description, strong and huge, but in terms of volatility. Pair is strongly volatile and I will show you charts that proves these statements. When pair starts to move, it moves very fast with high volatility.

Pair is very attractive because it gives you opportunity to earn a lot by trading it. Sadly said, when it moves in wrong direction it makes a huge loss to your account if you do not play correctly with stop loss. On this pair you cannot, easily, use tight stop loss or have poor money management because pair does not give second chance.

I have traded this pair just because it has high daily pip range and it is extremely volatile. I had time in trading when I have invested several 100 euro and get 1000 euro or more in 2 days. But those cases are really rare and if you are not experienced trader you should avoid trading in aggressive way as I did because you can easily lose your account balance in few hours.

How to Trade GBP/JPY

While it makes large moves during day it can make more than 100 pips, or sometimes over 200 pip. You have to put Stop Loss wide and lot size should be small enough to sustain your wide Stop Loss and to avoid margin call.

GBP/JPY analysis gives you opportunity to aim high R:R(Risk:Reward) ratio because it makes large moves and you can reach that R:R without problem.

Scalping this pair is not easy but if you are experienced trader you will know how to deal with high volatility.

Best strategy is to have high enough account balance. You can open several trades with smaller lot size and put wide stop loss. During day you will have large pip range, above 100 pips, and you can look for daily pivot line.

Around daily pivot line set trade to open or sell, depending on the daily trend line. Set trade to close when it hits 20 pip profit. You can be sure that you will get those 20 pip in a day when pip range is between 100-200 pips.

If that day does not close trade you can have it open for next day because you have wide stop loss and account large enough to sustain wrong trade direction.

How to Trade GBP/JPY – Volatility

Small volatility leaves smaller opportunity for traders because it is much easier to grab some pips in over 100 daily pip range instead trading on 70 daily pip range. So, in these times you can expect that you will have lower average pip income.

This directly impact on the trading results because smaller pip movement can be hard to trade when spread or commission is to large. Sometimes opening a trade is not worth of the costs you will pay just to enter into the trade.

Smaller volatility can trick you in a way you think there is a trend but momentum slows down and you get stuck in a trade. You have less trades available or signals from your trading strategy and your strategy begins to give you less profitable trades.

Another way to trade GBP/JPY is to follow price action where you can catch pair movement in a way to open a trade when pair have made price action pattern. This combination of trading price action you should take a look on DailyPriceAction blog where Justin Bennett shows very good example.

GBP/JPY Analysis – Trading Session Pip Range

Lets dive into GBP/JPY trading pair analysis to see how pair behaves in different hour, day and month. I want to emphasize that time of candle price is taken out from platform which is on GMT+1.

First chart shows how pair is doing on trading sessions compared to others trading pairs. I have ordered pairs on the chart to easily see which pair has lowest and which have highest volatility.

GBP/JPY have highest volatility in all trading sessions which imply that pair is the “Beast” among all other pairs. GBP/JPY analysis shows us that traders love to trade it and thus creates large pip range during each session.

Read more: Forex Market Trading Session

Which Trading Session Should You Trade

If you are not bond to time frame during each day like if you live in Australia and it does not make a problem for you to trade on London or New York then you can extract the best volatility from the market.

On Sydney and Tokyo session you will have some volatility which can be enough for almost every strategy because more then 50 pip range is great. Moving from Asian session to European, London, session we see rise in pair volatility.

London session give us great volatility which is double then Sydney session. Because GBP is European currency, London currency, many traders love to trade this currency and consequently pair have higher volatility.

During London session we have overlap with New York session which gives us more volatility because U.S. traders jumps on the market. During overlap, news on U.S. market are published which impacts all currencies in the world.

You will see how overlap time have impact on the pair volatility during day on the chart further in this post.

From this chart you should take information that GBP/JPY analysis shows you that:

- pair have highest volatility on London trading session

- during overlap with New York session have increased volatility

- starting from Monday volatility increases

- volatility peak is in the middle of the week, Wednesday and Thursday

- Volatility decline on Friday

GBP/JPY Analysis – Daily Range

If you take a look how overlap looks like then you understand why pip range is higher on these time. Trading session chart shows that time between 2 trading session, London and New York, happens between 14:00-18:00h(GMT+1).

How does the time overlap looks on the daily pip range, measured in hours during a day is shown on the next chart. Immediately you can see that time between 14:00-18:00 have rise in pip range which confirms above said.

Time overlap between London and New York trading session, news publishing, large amount of traders on the market have a result as increased pip volatility in that time.

It is not only London and New York trading session overlap that makes a difference in pip volatility. You can see that trading session overlap between London and Tokyo have change on the pair volatility.

GBP/JPY Analysis – London Session

London session is known as the largest one and while GBP is Europe currency traders like to trade that pair. We see increase in pip range from 09:00h up to 11:00/12:00h.

Around noon we see drop in pip range on London session. Mostly this is due to lunch brake in Europe, positions are set and traders relax in next 2 hours waiting for New York session.

GBP/JPY Analysis – New York Trading Session

Around 14:00h we see rise on the pip range and reason for this is that U.S. traders together with Europe traders are active on the market. GBP/JPY volatility increases due to large amount of trades.

Traders form their positions and mostly around that time news from U.S. are published. News have high impact on this pair because USD currency is widely connected to all other currencies. So, when USD currency moves all other currencies also move.

Going to the end of the day you see that pip range starts to decline, especially when London trading session finishes(17:00h). Large amount of traders close their position, GBP/JPY volatility declines and pair is traded less.

By the end of the day pip range is at same level as it was on the start of the day. Sydney and Tokyo trading session takes over and another day comes.

What you should take from these two charts for your trading is this:

- During a day pair have highest volatility on trading session overlap

- Two trading session overlap have increase in pair volatility, Tokyo-London and London-New York session

- Best time to trade is on London-New York trading session overlap where pip volatility is at highest rate

- You should close your positions, if you are a day trader, until London session closes to avoid later “slower” movements

GBP/JPY Analysis – Weekly Range

On the next chart I will show you how pair is doing on the weekly basis but not on the trading sessions. This information you can incorporate into your trading strategy when you plan to trade this pair.

Similar to chart “GBP/JPY analysis – trading session pip range” this chart shows similar data on pair volatility. Starting from Monday pip volatility increases. This increase we can connect with waking of the market after weekend.

From Monday to Wednesday traders makes they trading strategy and enters into trades. Trends on the pair movement start to form. Traders looks what is pair trend, make trading plan when to enter and exit and which news will have impact on trading pair.

These key characteristics are done over weekend before or on start of the week. When all is done traders enters into positions and they day trade or wait several days to exit their positions.

When pair hits Wednesday mostly traders start to plan to exit trades. Pair volatility decline to the end of the week. On Friday there is still volatility, higher comparing to Monday, but lower than Wednesday or Thursday.

On Friday traders tend to close their positions due to weekend on which sometimes can be published news which have high impact on the pair. So, to avoid that kind of possible problem if news are against trader they close their position on Friday.

Friday – Day for Profit Lock

During Friday you could see that price of the pair reverse against weekly trend. Reason for this is also in closing positions of the traders who takes their profit from the market.

What you should take for yourself from this chart is following:

- On Monday prepare yourself for trend forming

- Until Wednesday do not trade or scalp if you are scalper or day trader. Wait until highest volatility hits pair where you can extract most out of this trading pair

- If you are weekly or long term trader wait until Wednesday until trend is formed or confirmed

- On Friday get out from trading pair if you are uncertain will there be any news over the weekend which could impact trading pair volatility

GBP/JPY Analysis – Monthly Range and Pip Range History

In the next part of the blog post I will show you 12, twelve, charts which shows GBP/JPY analysis over few decades in order to give you the best pair volatility overview.

January

January is one of 4 months that have monthly average pip range above 1000 pips. Something useful you can see on the chart that pip volatility from 2009 have declined. Average pip volatility is shown as average line and it is declining looking from start of measuring data, 1997.

February

February is second of the 4 months that have monthly average pip range above 1000 pips.

Average pip range line is declining also looking from start of measuring data. Line shows us small slope where pip range is not changed so much looking to past data. This information gives us conclusion that pip range on February does not change a lot.

March

First month with pip range smaller than 1000 pips.

Average pip range line is also declining and slope is large going down looking from start of measuring data.

April

April is a month with rise on average pip range looking from start of measuring data. It is month with smallest average pip range compared to others moths. This information tells that month does not have so much volatility and there is no big events that had impact on pip range change.

May

May as one of the months with high inclination going down in pip range. Average line shows us that trading activity on the pair slowed down in years before. What will happen in the future it is left for those who would like to guess trend direction.

June

June is a month with average pip range line almost straight like February.

One characteristic point on the chart that sticks out is year 2016. This month is historical because on the 23.06.2016. U.K. had referendum on leaving European union.

Referendum had so much impact that average pip range on that month was over 2700 pips. That same day pip range was around 2700 which was huge movement on the Forex market.

Referendum had so much impact that average pip range on that month was over 2700 pips. That same day pip range was around 2700 which huge movement on Forex market.

Others years did not had any major event that had impact on the GBP/JPY pair price.

July

July as most of the others months have decline in average pip range looking from past to today. Month does not have large price movement but 2016 had increase in pip range volatility due to Brexit referendum from June 2016.

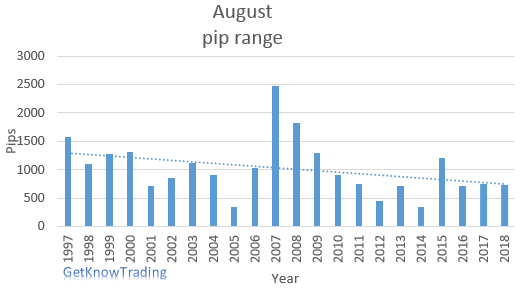

August

Major financial crisis in 2007-2008 had large impact on price movement on every currency so this pair had also some change in pip range.

This event we see as pip range increase in 2007 and decline until 2009. No other events had so much impact on the GBP/JPY price as major financial crisis.

August is one of 4 months that have average monthly pip range above 1000 pips.

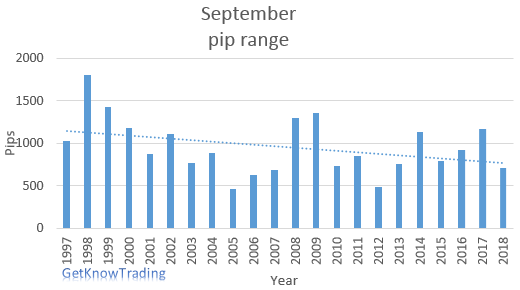

September

September is a month with no big movements or events that had so much impact on the price to make large spikes.

Average pip range is declining looking from start of measuring data.

October

October is last of 4 months with monthly average pip range above 1000 pips. Also, highest pip range of those 4 months with 1090 pip range.

What sticks out on the chart is 2008 year. On 22.10.2008. U.K. said they are in recession. News had so much impact on the price that monthly pip range was above 5000 pips.

Average pip range line is also declining in this month like on the most of other months.

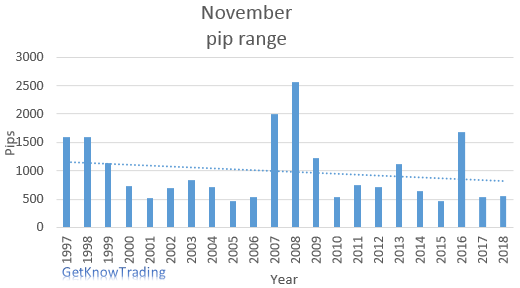

November

Average pip range on this month is declining with slow pace. What sticks out is year 2008 where pip range was high due to October news that U.K. is in recession. This news had impact on the next month but with lower strength.

Other months did not had any big event that had such impact to move price of the pair and to make high pip range.

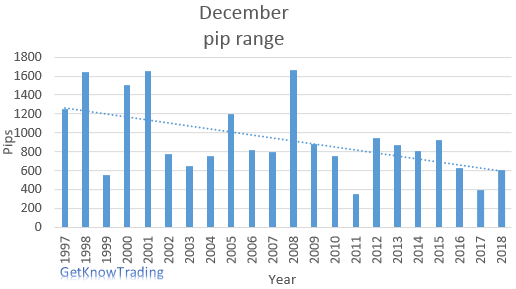

December

December is a month with high decline in average pip range compared to other months during a year.

Like on any other month year 2008 was a year after which average pip range did not pass above 1000 pips.

GBP/JPY Analysis – Monthly Conclusion

You see spike on 2009 or 2016 year. Those spikes have occurred on the big events which had large impact on the pair GBP/JPY volatility.

In year 2007-2009 major financial crisis hit whole world and GBP/JPY was not spared of large movements.

2016 for GBP/JPY pair were influenced by GBP referendum where U.K. nation has decided to leave European Union. You can read here more information. This referendum had so much impact on the currency that several years after that, question about Brexit is still open and uncertain how will end.

Small volatility leaves smaller opportunity for traders because it is much easier to grab some pips in over 100 daily pip range instead trading on 70 daily pip range. So, in these times you can expect that you will have lower average pip income.

This directly impact on the trading results because smaller pip movement can be hard to trade when spread or commission is to large. Sometimes opening a trade is not worth of the costs you will pay just to enter into the trade.

Smaller volatility can trick you in a way you think there is a trend but momentum slows down and you get stuck in a trade. You have less trades available or signals from your trading strategy and your strategy begins to give you less profitable trades.

What we see generally is that average pip range is declining from 2009 and we do not have such volatility as before. This gives us less opportunities to catch higher number of pips but still pair has large volatility that allows us to trade it and to earn money.

What Impacts GBP/JPY Volatility

Japan imports crude oil and natural gas products to satisfy domestic energy requirements. So, price of Yen is close connected with price of the energy commodities.

In addition to price of energy, political situation and domestic monetary policy play a role in defining price of trading pair.

- Energy commodities

- Political situation

- Monetary policy

- Macroeconomic indicators

After 2009 rarely one of the months had greater volatility compared to years before. Less volatile market can be result of geopolitical risks, or declining of global wealth, interest rates policy.

Connection Between Volatility and News

As any currency in a world pound sterling is affected by news. Here is a list of news which have impact on the currency and which impacts your trading strategy:

- Monetary policy

- Price Inflation

- Confidence and sentiment

- Economic growth, GDP

- Balance of payments

Price, Inflation, GDP and Monetary Policy

Countries with high level of inflation depreciate more compared to other currencies. Inflation causes the central bank to intervene in a way as adjusting interest rate to control undesired effects.

GBP interest rates were falling looking back to 1998. as you can see on the chart under. What this means for you as a trader? Well, if you take a closer look on times when interest change is announced you will see how pair behaves.

When interest rates is increasing that is good for currency so you can expect price of GBP will rise. Why does it rise – because when there is high interest rate in country it attracts more investors who can benefit on high rates.

But have in mind that trading pair chart is not only with one currency but with two currencies. This means sometimes if interest rates is increasing for GBP it could happen that trading pair value will not increase. Reason could be that JPY is stronger even interest rate on GBP is rising pair price could remain moving sideways or even falling.

When there is any change on interest rates Monetary Policy Committee (MPC) will make a statement which will have impact on the trading pair volatility. So, when this happens you can use it to trade and get in your advantage.

PPI, CPI, PMI and GDP

Indicators:

- PPI as Producer’s Price Index

- shows trends within sale markets, manufacturing industries and commodities markets

- CPI as Consumer Price Index

- Consumer Price Index measures inflation that is most important indicator of the economic health of that country

- PMI as Purchasing Managers Index

- shows us are purchasing managers optimistic or pessimistic about the economy

- GDP Gross Domestic Product

- tells us how much the economy is strong, hod does it advance and is it healthy or not

These indicators have impact on the price of any currency and they are ones which you should watch. Price index is telling how the price of consumer goods and manufacturing material is doing. These prices have impact on inflation and consequently on interest rates.

GDP is overall information how country is doing and this information will have large impact on the price of currency.

I will not go more into details about these indicators but you can check for more information on the links I have gave.

GBP/JPY Analysis – What to Take From Here

As I have give a lot of information in GBP/JPY analysis there is useful information you can use in your trading.

- Be careful because pair can make you as “Account widow”

- Pair have large volatility and high movements

- Use overlap in trading sessions, London and New York, to extract as much pips is possible because then you will have the highest movement

- During a week choose to trade on middle of the week, Wednesday and Thursday because then you have best volatility and chance to grab pips from the market

- Watch for Friday – lock the profits you have to avoid impact from weekend news if there is any

- Any month in a year is good to trade. There is no big difference between them

- Watch out on published news and indicators that have large impact on the currency

Read more:

- EUR/USD Volatility – Pip Range Analysis

- GBP/USD Pip Range Analysis – Cable Connection

- EUR/GBP Pip Range Analysis – Forex Under the See Level

- EUR/JPY Pip Range Analysis – Euro Japan Samurai

- EUR/CHF Analysis-The Biggest Crash in the Forex History

- USD/CAD Pip Range Analysis – Oil UP Pair DOWN

- USD/JPY Pip Range Analysis – Ninja Pair

- USD/CHF Pip Range Analysis – Swissie

- AUD/USD Pip Range Analysis

- AUD/JPY Pip Range Analysis

- NZD/USD Pip Range Analysis

- What is Meaning of XAU in Forex

- What is Meaning of CFD in Forex

- What is GU in Forex

- What is GJ in Forex

Very interesting and very well written

Hi Pipster,

Thanks.